Tesla reported 435,059 deliveries for Q3 2023, while NIO reported 16,074 deliveries in October 2023.

Tesla’s Q3 deliveries were up 36% year-over-year, while NIO’s October deliveries were up 59.8% year-over-year. Both companies are seeing strong demand for their electric vehicles, but Tesla remains the dominant player in the global EV market.

Here is a table comparing Tesla and NIO’s deliveries in Q3 2023 and October 2023:

It’s worth noting that Tesla does not report monthly deliveries, so we can’t directly compare Tesla’s October deliveries to NIO’s. However, we can estimate that Tesla delivered around 145,000 vehicles in October, based on its Q3 delivery total and its historical delivery patterns.

Overall, both Tesla and NIO are seeing strong growth in their deliveries. However, Tesla remains the dominant player in the global EV market, with deliveries that are more than three times higher than NIO’s.

* Is an estimation from 435,059 deliveries for Q3 2023.

NIO Cuts 10% of Jobs

NIO, a Chinese electric vehicle maker, announced on November 3, 2023 that it would be cutting 10% of its workforce. The job cuts will be completed by November and will affect employees across all levels and functions.

NIO CEO William Li said in an internal letter to employees that the job cuts were necessary to improve efficiency and reduce costs in the face of growing competition. He also said that the company would be focusing on its core businesses and projects in the coming years.

The job cuts come at a time when NIO is facing a number of challenges. The company has been hit by weak consumer sentiment in China, stiff competition from other EV startups, and a price war kicked off by Elon Musk’s Tesla.

NIO has also been struggling to meet its sales targets. In the first three quarters of 2023, the company delivered 126,067 vehicles, falling short of its target of 150,000 deliveries.

The job cuts are a sign that NIO is serious about turning around its business. The company is now focused on improving its profitability and becoming more competitive in the global EV market.

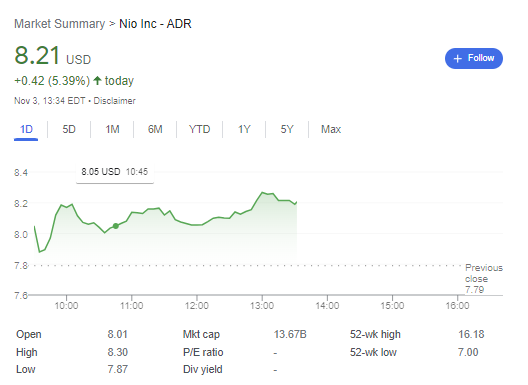

NIO Stock Increasing +5.33%

NIO stock is $8.21 on November 3, 2023, up 5.33% from the previous day. The stock has been volatile in recent months, trading between $7 and $16 per share.

The job cuts announced by NIO on November 3 are likely to weigh on the stock market price in the short term. However, investors are still optimistic about the company’s long-term prospects. NIO is one of the leading EV makers in China, and it has a strong brand reputation. The company is also investing heavily in research and development, which could lead to new and innovative products in the future.

Overall, NIO stock is a risky investment, but it could also be a potentially rewarding one. Investors should carefully consider their own risk tolerance and investment goals before making a decision.

Here are some factors that could affect NIO stock in the coming months:

- Demand for electric vehicles in China: If demand for electric vehicles in China remains strong, NIO could benefit from this.

- Competition from other EV makers: NIO faces stiff competition from other EV makers in China, such as Tesla and Xpeng. The company needs to continue to innovate and differentiate itself from its competitors in order to maintain its market share.

- Cost reductions: NIO needs to continue to reduce its costs in order to become more profitable. The job cuts announced on November 3 are a step in the right direction, but the company needs to make more progress in this area.

- New product launches: NIO is planning to launch a number of new products in the coming years. If these products are successful, they could help to boost the company’s sales and profitability.

Investors should carefully monitor these factors and make adjustments to their investment strategies accordingly.

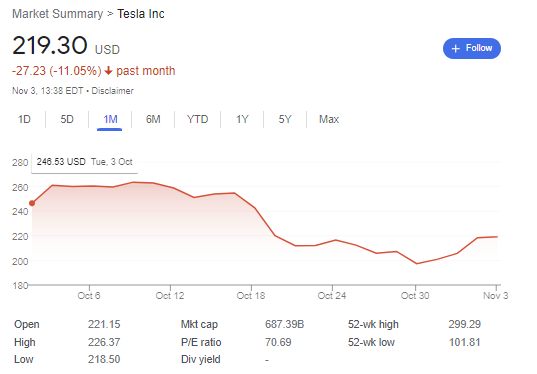

Tesla stock is currently trading at $219.26 per share, up 0.29% from the previous day

The Tesla stock has been on an upward trend in recent days, however in past month losing over 10% since October 3, 2023.

There are a few factors that are likely contributing to Tesla’s stock price increase. First, the company is reporting strong delivery numbers. Tesla delivered 435,059 vehicles in Q3 2023, up 36% year-over-year. This shows that demand for Tesla’s vehicles remains high, even in the face of rising inflation and economic uncertainty.

Second, Tesla is expanding its production capacity. The company is building new factories in Texas and Germany, which will allow it to produce more vehicles and meet growing demand.

Third, Tesla is investing heavily in new technologies, such as self-driving cars and battery technology. This investment is seen by investors as a sign that Tesla is committed to long-term growth.

Overall, Tesla’s stock price increase is a reflection of the company’s strong fundamentals and its bright future prospects. Tesla is a leader in the electric vehicle market, and it is well-positioned to benefit from the continued growth of this market.

Here are some additional factors that could affect Tesla’s stock price in the coming months:

- Interest rates: Rising interest rates could make it more expensive for Tesla to borrow money to finance its expansion plans. This could weigh on the stock price.

- Economic slowdown: A slowdown in the global economy could hurt demand for Tesla’s vehicles. This could also weigh on the stock price.

- Regulatory changes: Changes in government regulations could affect Tesla’s business. For example, if governments impose new taxes on electric vehicles, this could hurt demand and weigh on the stock price.

Investors should carefully monitor these factors and make adjustments to their investment strategies accordingly.