An exchange-traded fund, or ETF, is a type of investment. It’s an index fund that can track the performance of a particular market segment or basket of stocks. Because they can be traded like a stock and offer the ability to buy small amounts of many different stocks at once, ETFs are often preferred by investors over mutual funds that are listed on a stock exchange and have similar characteristics. There are several primary differences between ETFs and mutual funds which we explain in this article.

An ETF (Exchange Traded Funds) is essentially a basket of stocks that you can buy as one unit. Similarly, a mutual fund is a collection of assets (like stocks) that you can invest in as one unit. The main difference between these two investment types is how ETFs trade, the liquidity of their shares, the tracking ability and management structure.

What is an Exchange-Traded Fund?

The term “exchange-traded fund” refers to a particular type of fund that invests in a pool of assets, such as stocks or commodities, and then issues shares that investors can buy and sell throughout the day just like stocks. As opposed to other types of funds, ETFs are open-ended, which means that they keep issuing new shares if demand for the fund is high. This makes ETFs different from other types of funds, such as closed-end funds, where a set amount of shares is created at the outset and cannot change. The proliferation of ETFs in recent years owes to the fact that they are a relatively inexpensive way for investors to gain broad exposure to an entire market or sector. Since ETFs are traded like stocks, they have lower fees than mutual funds, which are priced once a day at the end of the trading day. There are now ETFs that track every imaginable index, region, sector, or asset type.

Read Gold ETF: Pros and Cons of Investing in Gold.

What is an ETF Stock?

An ETF is essentially a basket of stocks that you can buy as one unit. It sounds very similar to a mutual fund, but there are a few key differences. First, the stocks in an ETF are listed and traded on a stock exchange, while mutual funds are listed on an exchange but not traded. The second key difference between an ETF and a mutual fund is that ETFs are bought and sold throughout the trading day. Mutual funds are only traded at the end of the day and only if there is enough demand for them. Another key difference is that ETFs typically have lower expense ratios than mutual funds. This makes them a better option for investors who are seeking long-term growth or who are trying to keep costs low. Mutual funds also have a minimum requirement for when you can invest. But ETFs allow you to invest any amount, which gives more individuals access to investing in the stock market.

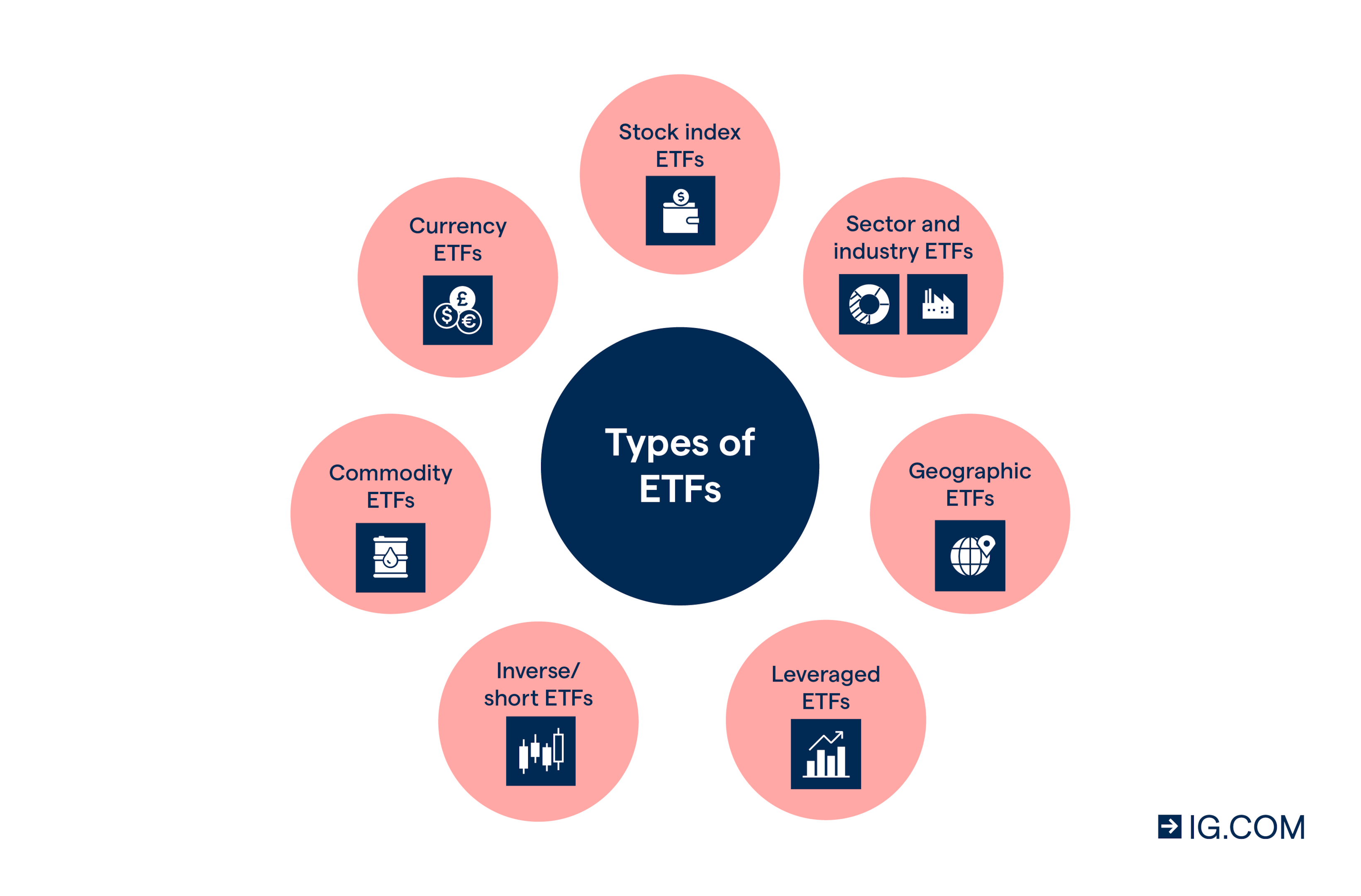

Types of ETFs

Commodity ETFs

Commodity ETFs track the price and total return of a commodity or commodity basket such as gold, silver, oil, and other precious metals. A typical commodity ETF invests in stocks of companies that mine gold, oil, and other commodities. Commodity ETFs are a type of passive fund that’s designed to track the performance of a commodity or commodity index. The value of commodity ETFs rise and fall based on the price of their commodities with no consideration for the performance of the companies that produce these commodities. There are a couple of different types of commodity ETFs. The most common type is a diversified commodity ETF that tracks an index that holds a basket of commodities at a certain weighting. Another type is a single commodity ETF that tracks the price of just one commodity such as gold or oil.

Equity ETFs

Equity ETFs track the price and total return of a specific company or a basket of companies in the same industry vertical such as technology, healthcare, retail, transportation, etc. It holds shares of the company as a large shareholder and you can view its portfolio on the fund’s website. In terms of risk, equity ETFs are similar to mutual funds. However, the difference lies in the fact that ETFs have lower fees and trade on a stock exchange like stocks. Unlike mutual funds, the ETF’s portfolio is transparent and you can see the stocks that it holds. With mutual funds, you don’t know what stocks the fund holds until you get the fund’s annual report. The only catch is that you’ll want to be careful of actively managed equity funds that track a certain index. These funds manage their portfolios in the same way as a typical actively managed fund.

Bond ETFs

Bond ETFs track the price and total return of a specific type of bond such as government, corporate, and high yield bonds. The price of the ETF rises and falls based on the price of the bond that it holds. Like equity ETFs, bond ETFs are very similar to mutual funds. There are, however, a couple major differences. One, the price of bond ETFs rise and fall with interest rates. Two, the price of bond ETFs are influenced by supply and demand whereas the price of a mutual fund is not. With interest rates, when interest rates (especially government interest rates) fall, the price of existing government bonds increase and the price of existing corporate bonds decrease. When interest rates rise, the opposite happens and existing government bonds decrease in price while corporate bonds increase in price.

Mutual Fund-based ETFs

Mutual fund-based ETFs track the price and total return of a specific type of mutual fund. Also, they are very similar to equity ETFs only with a couple of subtle differences. Like equity ETFs, mutual fund-based ETFs are passively managed funds. However, the difference is that mutual funds have their portfolio holdings published in their monthly statement while an ETF’s portfolio is published on its website.

Exchange Traded Funds that Hold Bitcoin and Other Cryptocurrencies

With the introduction of cryptocurrency, many financial experts predict that it will become a future source of value. While cryptocurrency may not be accepted everywhere as a legal tender, many investors are investing in them for their future potential. This has led to the creation of Exchange Traded Funds that are based on Bitcoin and other cryptocurrencies. These include ETFs like the Bitcoin Investment Trust, which is an open-ended trust that is traded on the open market. These are similar to mutual funds in the sense that they are pooled investments. So, if you invest in such ETFs, you are actually investing in Bitcoin and other cryptocurrencies. There’s one key difference though; these ETFs can be bought and sold like stocks. Mutual funds, on the other hand, are bought like an investment in a company that trades on the stock exchange.

Fixed Income ETFs

A fixed income ETF is a type of investment fund that pools money from multiple investors to purchase a diversified portfolio of bonds or other fixed-income securities. These ETFs are traded on stock exchanges, providing investors with an easily accessible and liquid way to invest in fixed-income assets. They offer a convenient way to gain exposure to a variety of fixed-income instruments, such as government bonds, corporate bonds, or municipal bonds, while also enjoying the flexibility and transparency of stock market trading. One of the key benefits of choosing a fixed income ETF is that it offers both diversification and liquidity, allowing investors to spread their risk across various bonds while also providing the ability to buy or sell shares throughout the trading day, offering flexibility that traditional bonds may not provide.

ETFs Are Traded Throughout the Day

When you buy a mutual fund, you are essentially buying a stake in a company. The fund managers make the investment decisions, and you are just a passive investor. With ETFs, however, the fund managers take the list of stocks they are tracking and sell shares to whoever wants to buy them. This means ETF investors are an active part of the trading process and have more control over their investments. In other words, while mutual funds are listed on an exchange, they are not actively traded. In fact, mutual funds are only traded at the end of the day if there is enough demand for them. ETFs, on the other hand, are traded throughout the day. This means investors can make changes to their positions throughout the day if they find out about new information or are trying to better manage their portfolios.

ETFs Have High Trading Liquidity

Investors are always looking for ways to diversify their portfolios and make smart investments. Mutual funds can help you do that, but they can also be difficult to trade. You may have to wait for investors to purchase them and then sell them before you can make any changes to your investment. ETFs have high trading liquidity, so you can make changes to your investment whenever you want. The liquidity of ETFs is usually much higher than a mutual fund. This means you can easily buy or sell ETFs at any point throughout the day. Mutual funds might have trading periods, which are meant to give investors time to buy and sell shares at certain times. But they often have higher trading liquidity, so you can make changes whenever you want.

ETFs Track Their Investments Well

Growing your portfolio is all about investment selection. You need to find the right stocks and funds to put your money into so you can achieve your financial goals. If you pick poorly, your investments won’t pay off the way you want them to. When you pick a mutual fund, you are essentially picking a fund manager. They are the ones who research the stocks and make the investment decisions. You’re just an investor, and you have no control over their decisions. A good ETF fund manager will track the investments in their portfolio. They will track their performance and know when to make changes to improve their portfolio’s performance.

Mutual Fund Investment Basics

When you buy shares in a mutual fund, you are essentially buying a stake in a basket of stocks. But the fund managers make the investment decisions, and you are just sitting back and collecting a return from your investment. You don’t get to decide which stocks are in the basket, and there’s no guarantee that the fund managers will make the right decisions for the fund. On top of that, the fund managers are constantly making changes to the fund. They could be buying and selling stocks in the fund at any time, which can cause the fund’s performance to be unstable.

Why Are Investors Flocking to ETFs?

We’ve already covered a few reasons why ETFs are more attractive than mutual funds. But there are many other factors that make them a more appealing option. The first reason is that ETFs have lower expense ratios than mutual funds. This makes them a good option for investors who are looking to keep their costs low. They are also easier to access than mutual funds, which can sometimes be difficult to invest in. Another reason that more and more investors are turning to ETFs is because of their diversification. Mutual funds can offer some diversification, but it isn’t nearly as much as what you get with ETFs. ETFs can track an index like the S&P 500 or the NASDAQ 100. Mutual funds can track indexes too, but they aren’t as accurate.

How to Start Investing in ETFs?

If you’re interested in starting to invest in ETFs, there are a few things that you should know. First, you’ll want to decide where you want to invest. You can choose from online brokerages, robo-advisors or investing apps. Each of these has their own pros and cons, and you should pick the one that best fits your needs. Then, you’ll need to pick ETFs that match your investment goals. You can look through ETF listings and find ones that are right for you. It’s important to remember that you should always diversify your portfolio. You should have a variety of different ETFs so that your money is spread out and protected from risk.

What are the top 5 bond ETFs?

There are a lot of bond ETFs out there, but which ones are the best? Here are the top 5 bond ETFs, based on performance:

1. iShares Core U.S. Aggregate Bond ETF (AGG)

2. Vanguard Total Bond Market ETF (BND)

3. iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

4. SPDR Bloomberg Barclays High Yield Bond ETF (JNK)

5. iShares 20+ Year Treasury Bond ETF (TLT)

These ETFs offer a great way to diversify your portfolio and get exposure to different types of bonds. Each ETF has its own strengths and weaknesses, so be sure to do your own research before investing. But if you’re looking for a place to start, these are the top 5 bond ETFs.

How do ETFs and mutual funds compare?

When it comes to investing in ETFs or mutual funds, it’s important to understand the difference between the two. ETFs are passively managed, meaning that they track an index or a basket of assets. Mutual funds, on the other hand, are actively managed. This means that a team of professionals makes decisions about which stocks or bonds to buy or sell.

So, what’s the difference between these two investment strategies? ETFs tend to be more cheaply managed than mutual funds. They also provide instant diversification, since they track an index or a basket of assets. Mutual funds, on the other hand, may provide higher returns if the team of professionals making investment decisions is successful.

Which investment strategy is right for you? That depends on your investment goals. If you’re looking for a low-cost way to invest, ETFs may be a good option. If you’re looking for the potential for higher returns, mutual funds may be a better choice.

What types of ETFs are there?

There are two main types of ETFs: actively managed and traditional. Traditional ETFs track a specific index, such as the S&P 500, and are not actively managed. This means that the fund managers do not buy or sell stocks in an attempt to outperform the market. Actively managed ETFs, on the other hand, are managed by fund managers who buy and sell stocks in an attempt to generate returns that outperform the market. There are also a variety of specialized ETFs that track specific sectors or regions, such as energy or emerging markets.

Pros of ETFs

The biggest advantage of ETFs is that they are broadly diversified within an asset class. They are also much less expensive to trade than mutual funds. ETFs are transparent and easy to buy, so they’re great for long-term investors who don’t want to be constantly monitoring their investments. ETFs track the performance of an index, so if the index rises, the ETF will rise by the same amount. However, if the index falls, the value of the ETF will fall by the same amount as well. ETFs are transparent: The fund company publishes the holdings, the performance of the fund, and the expenses. This is not the case for mutual funds, where investors have no idea what’s inside the fund or what their performance will be. Also, if you want to buy or sell an ETF, the transaction is instantaneous, whereas mutual funds take two days to trade. ETFs are less expensive than mutual funds, which can lead to greater long-term returns. They also have lower management fees than actively managed mutual funds, which cost more because the managers have to constantly trade securities in an attempt to outperform the market.

Cons of ETFs

The biggest disadvantage of ETFs is that they can be used by speculative or short-term traders who want to make frequent trades. This is not the case with mutual funds, which are better suited to long-term investors who don’t intend to trade frequently. Mutual funds have certain advantages over ETFs, such as the fact that they can have lower capital gains tax. This is because an ETF is treated as a single stock, whereas a mutual fund is treated as a basket of stocks. If the ETF has a high turnover rate (meaning it frequently buys and sells securities), it can be more taxable than a mutual fund.

When Should You Use an ETF?

The best time to use an ETF is when you want broad exposure to an entire market or sector. For example, you could use an ETF to gain exposure to emerging markets, gold, the S&P 500, or the technology sector. The best time to use a mutual fund is when you want greater control over your investment or want to invest in a niche area. For example, you could invest in a mutual fund that invests in specific companies or industries that you’re familiar with. Mutual funds are also useful when you want to time your investment (although ETFs have become increasingly easy to time as well). Because ETFs are less costly to trade than mutual funds, they are better suited to those who want to trade often. If you’re an investor who wants to make a long-term investment but still wants the ability to quickly get in and out, ETFs are a great option. They’re also a good choice for younger investors who may not be able to withstand the fluctuations that come with actively managed mutual funds.

Diversification ETFs

Diversification is key when it comes to investing, and ETFs are a great way to achieve it. ETFs, or exchange-traded funds, are a type of investment that allows you to buy a basket of assets in one fell swoop. This means you can diversify your portfolio without having to buy individual stocks or bonds. And because ETFs trade on an exchange, they’re easy to buy and sell. Plus, they offer the potential for high returns while still being low risk. So if you’re looking for a way to diversify your portfolio, ETFs are a great option.

Final Words: Is an ETF the Right Investment for You?

Exchange-traded funds are baskets of stocks or other securities that track a particular market index and trade like a stock on an exchange. They are broadly diversified and can be traded easily, making them a good choice for long-term investors who don’t want to constantly monitor their investments. While ETFs have many advantages over mutual funds, they are not a good choice for those who want to invest in specific companies or industries, or who want to time their investments.

We’ve covered a lot of information about ETFs in this article, but it can still be a little confusing. The key is to know what you’re investing in. You should always do your research and know what the ETFs in your portfolio track. You should also make sure that you are picking ETF funds that have low fees. The lower the fees, the more likely it is that your investment will grow. An ETF is a great choice for investors who want to grow their portfolios. It’s important to remember that investing is a long-term game. Don’t make changes to your portfolio too often because you risk making bad decisions.