In the world of technical analysis, candlestick patterns play a crucial role in identifying potential trading opportunities. One such pattern that traders often look out for is the bullish engulfing pattern. This powerful candlestick formation can provide valuable insights into market sentiment and help traders identify profitable entry points. In this article, we will delve into the intricacies of bullish engulfing patterns, understand how to identify them on a stock chart, and explore their significance in price action.

Understanding Candlestick Patterns in Technical Analysis

Before we dive into the specifics of bullish engulfing patterns, let’s first gain a solid understanding of candlestick patterns and their role in technical analysis. Candlestick charts, developed by Japanese rice traders centuries ago, provide a visual representation of price movements over a given time period. Each candlestick consists of a body and two wicks (also known as shadows). The body represents the price range between the opening and closing prices, while the wicks depict the high and low prices for the period.

What is a Bullish Engulfing Pattern?

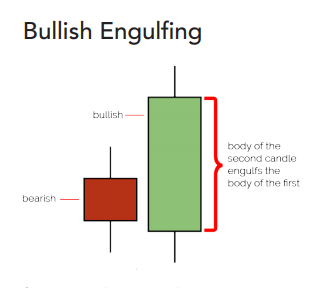

This pattern is a two-candlestick formation that signals a potential trend reversal from bearish to bullish. It occurs when a small bearish candlestick is followed by a larger bullish candlestick that engulfs the entire body of the previous candlestick. This pattern suggests that buying pressure has overwhelmed selling pressure, indicating a shift in market sentiment. This pattern is considered a strong bullish signal and is often used by traders to identify potential buying opportunities.

How to Identify a Bullish Engulfing Pattern on a Stock Chart

To spot a bullish engulfing pattern on a stock chart, follow these steps:

- Look for a downtrend: A bullish engulfing pattern is most effective when it occurs after a prolonged downtrend. This indicates a potential reversal in the market.

- Identify a small bearish candlestick: The first candlestick in the pattern should be smaller in size and have a bearish (red or black) body.

- Look for a larger bullish candlestick: The second candlestick should be larger in size and have a bullish (green or white) body that engulfs the entire body of the previous candlestick.

- Confirm the pattern: Ensure that the bullish candlestick closes above the high of the bearish candlestick, confirming the engulfing pattern.

The Significance of These Patterns in Price Action

These patterns carry significant importance in price action as they indicate a shift in market sentiment from bearish to bullish. When this pattern occurs after a downtrend, it suggests that buying pressure has gained momentum, potentially leading to a trend reversal. Traders often interpret this as a signal to enter into long positions or to close out short positions. The larger the bullish candlestick in the pattern, the stronger the signal and the higher the probability of a price reversal.

Using Bullish Engulfing Patterns to Identify Profitable Entry Points

Traders can utilize these patterns to identify profitable entry points by combining them with other technical analysis tools. One common approach is to wait for the confirmation of the pattern by observing the price action in the following candles. If the price continues to rise after the engulfing pattern, it may be a signal to enter a long position. Additionally, traders can use support and resistance levels, moving averages, and other chart patterns to further validate the potential entry points suggested by the bullish engulfing pattern.

Examples of Bullish Engulfing Patterns in Different Market Conditions

Let’s take a look at a few examples of bullish engulfing patterns in different market conditions to better understand their significance:

Example 1: Bullish Engulfing during an Uptrend

In this scenario, the market is already in an uptrend, and this pattern forms. This pattern can be seen as a continuation signal, indicating that the upward momentum is likely to persist. Traders can consider adding to their existing long positions or entering new positions.

Example 2: Bullish Engulfing after a Downtrend

In this case, the market has been experiencing a prolonged downtrend, and a bullish engulfing pattern emerges. This pattern suggests a potential reversal in the market sentiment, with buying pressure overpowering selling pressure. Traders may take this as an opportunity to enter long positions or close out their short positions.

Example 3: Bullish Engulfing at a Support Level

Here, the market is approaching a significant support level, and this pattern forms. This pattern, combined with the support level, can provide a strong signal for a potential price reversal. Traders may consider entering long positions at the support level, expecting a bounce in price.

The Psychology Behind Bullish Engulfing Patterns and Market Sentiment

The psychology behind bullish engulfing patterns lies in the shift of market sentiment from bearish to bullish. During a downtrend, sellers dominate the market, resulting in falling prices. However, when this pattern forms, it indicates that buyers have stepped in and overwhelmed the sellers. This shift in market sentiment can be attributed to various factors such as positive news, strong earnings reports, or favorable economic data. Traders who recognize this change in sentiment can capitalize on the potential price reversal and profit from the subsequent upward movement.

Confirming These Patterns with Other Technical Indicators

While bullish engulfing patterns are powerful on their own, traders often use other technical indicators to confirm their validity. Some commonly used indicators include:

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. An oversold RSI reading combined with a bullish engulfing pattern can strengthen the bullish signal.

- Moving Averages: Traders often use moving averages to identify trends and potential support or resistance levels. When a bullish engulfing pattern occurs near a rising moving average, it adds further confirmation to the potential trend reversal.

- Volume: Increasing volume during the formation of a bullish engulfing pattern suggests strong buying pressure, reinforcing the bullish signal. Traders should look for above-average volume accompanying the pattern for greater reliability.

Tips for Successfully Trading Bullish Engulfing Patterns

Here are some useful tips to enhance your trading success when using bullish engulfing patterns:

- Combine with other technical analysis tools: Utilize other indicators, chart patterns, and support/resistance levels to confirm the validity of the this pattern.

- Consider the overall market trend: these patterns are more effective in an established downtrend. Always analyze the broader market context before placing trades based on this pattern.

- Practice proper risk management: Set appropriate stop-loss levels to protect your capital in case the trade doesn’t go as expected. Implement a risk-to-reward ratio to ensure your potential profits outweigh potential losses.

- Continuously learn and adapt: Stay updated with market trends, news, and changes in market sentiment. Adapt your trading strategy accordingly to maximize your chances of success.

Common Mistakes to Avoid When Trading Bullish Engulfing Patterns

While bullish engulfing patterns can be highly profitable, it’s essential to avoid common mistakes that can lead to trading losses. Here are a few pitfalls to watch out for:

- Ignoring the overall market trend: Failing to consider the broader market trend can result in false signals and poor trade execution. Always analyze the market context before making trading decisions.

- Overlooking confirmation signals: Don’t solely rely on the bullish engulfing pattern. Confirm its validity with other technical indicators and price action signals to increase the reliability of your trades.

- Neglecting risk management: Proper risk management is crucial in trading. Set stop-loss levels and adhere to them to protect your capital. Avoid risking a large portion of your account on a single trade.

- Failing to adapt to changing market conditions: Markets are dynamic and constantly evolving. Adjust your trading strategy as market conditions change to stay ahead of the game.

FAQs

A bullish engulfing pattern is a candlestick pattern that signals a potential reversal from a downtrend to an uptrend. It is formed when a large white candle engulfs a smaller black candle. The white candle indicates that buyers have taken control of the market and are pushing prices higher.

To be considered a valid pattern, the following requirements must be met:

* The first candle must be a black candle.

* The second candle must be a white candle.

* The body of the white candle must completely engulf the body of the black candle.

* The white candle must close above the open of the black candle.

It´s a reversal pattern, which means that it signals a change in the direction of the trend. In this case, the pattern signals a change from a downtrend to an uptrend.

One way to trade with this is to buy the asset at the open of the white candle. This is because the pattern suggests that the buyers are in control and that prices are likely to continue to rise.

Another way to trade the pattern is to wait for a confirmation candle. A confirmation candle is a candle that follows the bullish engulfing pattern and confirms the reversal. The confirmation candle can be either a white candle or a green candle.

This is not always reliable. It is important to use other technical indicators to confirm the pattern before making a trading decision.

Some other reversal patterns include the:

* Piercing pattern

* Harami pattern

* Morning star pattern

* Evening star pattern

Conclusion: Harnessing the Power of Bullish Engulfing Patterns for Profitable Trades

Bullish engulfing patterns are valuable tools in a trader’s arsenal, offering insights into potential trend reversals and profitable entry points. By understanding how to identify and interpret these patterns, traders can make informed trading decisions and increase their chances of success. Remember to combine this pattern with other technical analysis tools, consider the overall market trend, and practice proper risk management. With these strategies in place, you can harness the power of these patterns to achieve profitable trades and navigate the dynamic world of the financial markets.