Swing trading is a type of trading strategy that involves taking advantage of short-term market movements, typically over a period of several days or even weeks. It is a popular trading style for those who are looking to capitalize on short-term market movement, but it does come with a certain amount of risk. In this blog post, we will look at trading strategies, how to manage risk, and how to identify profitable trades. We will also discuss technical and fundamental analysis for trading, and provide some examples of swing trading strategies.

What is Swing Trading?

Swing trading is a type of trading strategy that involves taking advantage of short-term market movements, typically over a period of several days or even weeks. It is a popular trading style for those who are looking to capitalize on short-term market movement, but it does come with a certain amount of risk. Swing trading is generally done in the forex markets, but it can also be done in other markets such as stocks, commodities, and options.

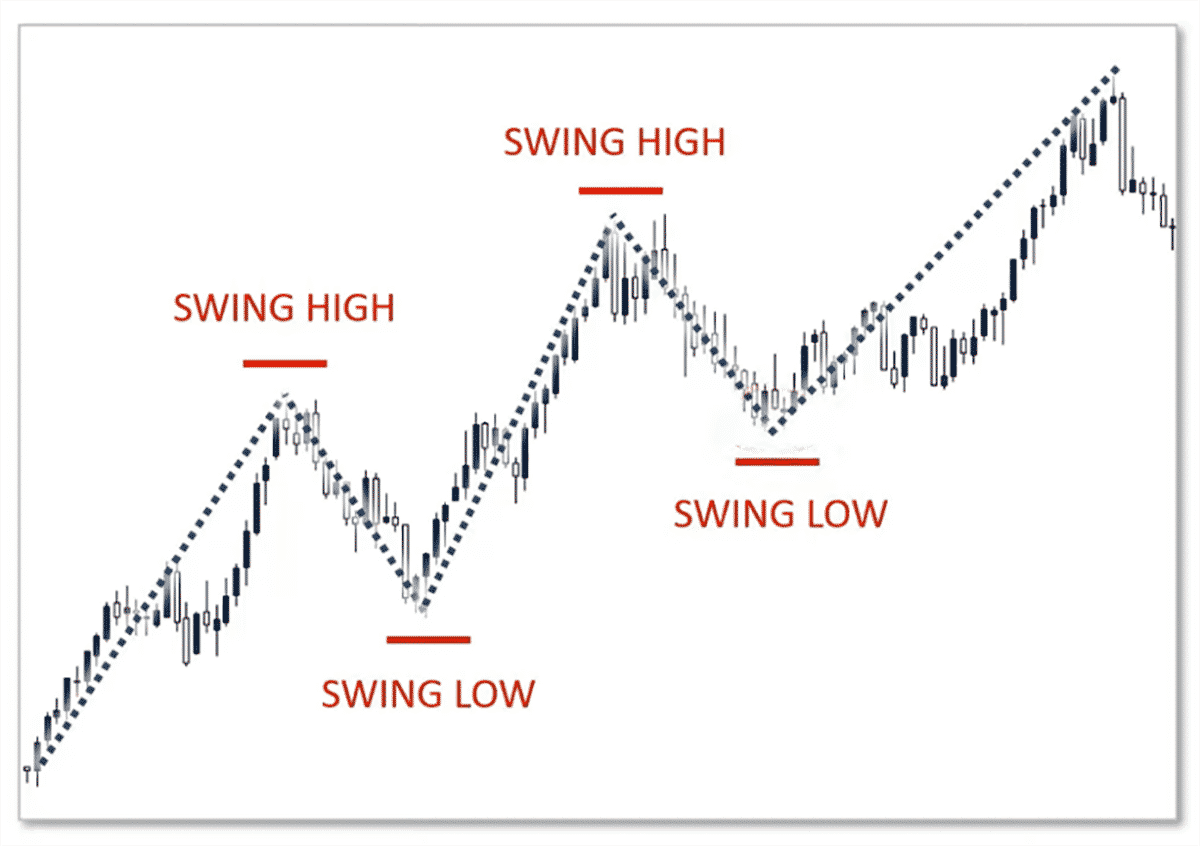

The goal of this trading is to identify opportunities to buy and sell stocks, currencies, or other assets in order to make a profit. Swing traders typically use technical analysis to identify trends and patterns in the market, and then use these trends and patterns to determine when to enter and exit trades. Swing traders often use short-term price movements to make their profits, meaning that they are more likely to take short-term risks in order to make a profit.

Benefits of Swing Trading

Swing trading is a popular trading style for many traders, as it allows them to capitalize on short-term market movements. The main benefit of swing trading is that it is a low-risk trading style, as traders are not exposed to the same level of risk as they would be with long-term trading strategies. Additionally, swing trading is relatively easy to learn, as it does not require a deep knowledge of the financial markets or technical analysis.

In addition to the low risk, this trading also offers the potential for high returns. This is because swing traders can take advantage of short-term market movements, which can result in large profits in a short period of time. Swing traders can also use leverage to increase their potential profits, although this should be done with caution.

Risk Management Strategies for Swing Trading

Swing trading does come with a certain amount of risk, and it is important to manage this risk in order to be successful. One way to manage risk is to use stop-loss orders, which are orders placed with your broker to automatically close your position if it reaches a certain level of loss. This can help to limit your losses if the market moves against you.

Another risk management strategy is to limit the amount of money you invest in each trade. This can help to reduce the amount of risk you are exposed to, as you are not putting all of your capital into one trade. It is also important to diversify your investments, as this can help to reduce the amount of risk you are exposed to.

Identifying Profitable Trades

In order to be successful with swing trading, it is important to identify profitable trades. The best way to do this is to use both technical and fundamental analysis. Technical analysis involves looking at charts and indicators to identify potential trends and patterns in the market. Fundamental analysis involves looking at economic data and news to identify potential opportunities.

When using technical analysis, it is important to look for patterns such as support and resistance levels, trend lines, and candlestick patterns. These patterns can help to identify potential entry and exit points for trades. When using fundamental analysis, it is important to look for news and economic data that could have an effect on the markets. This could include news about central bank decisions, economic indicators, or geopolitical events.

Technical Analysis for Swing Trading

Technical analysis is an important part of swing trading, as it can help to identify potential entry and exit points for trades. There are a variety of different technical indicators that can be used, such as moving averages, relative strength index (RSI), and Bollinger bands. These indicators can help to identify trends and patterns in the market, which can be used to identify potential entry and exit points for trades.

It is important to use multiple technical indicators when trading, as this can help to confirm the signals that you are receiving. Additionally, it is important to use technical analysis in conjunction with fundamental analysis, as this can help to give a more complete picture of the market.

Fundamental Analysis for Swing Trading

Fundamental analysis is another important part of swing trading, as it can help to identify opportunities in the markets. Fundamental analysis involves looking at news and economic data to determine the potential direction of the markets. This data can include central bank decisions, economic indicators, or geopolitical events.

When using fundamental analysis, it is important to look at both the short-term and long-term effects of news and data. This can help to identify potential opportunities in the markets, as well as potential risks. It is also important to stay up to date with news and economic data, as this can help to identify potential trading opportunities.

Developing a Swing Trading Strategy

Once you have identified potential trading opportunities, it is important to develop a swing trading strategy. This strategy should be tailored to your own trading style and risk tolerance. It should include how much capital you are willing to risk, what type of trades you will take, and how you will manage your risk.

It is important to remember that no trading strategy is perfect, and it is important to be prepared for losses. It is also important to keep in mind that the markets can be unpredictable, and it is important to be prepared for unexpected events. Additionally, it is important to keep track of your trades, as this can help you to identify what is working and what is not working.

Examples of Swing Trading Strategies

There are a variety of different swing trading strategies, and it is important to find one that is suitable for your trading style and risk tolerance. Here are some examples of swing trading strategies:

- Momentum Trading: This strategy involves taking advantage of short-term price movements in order to make a profit. Traders will typically look for stocks or currencies that are trending in one direction, and then enter and exit trades based on these trends.

- Range Trading: This strategy involves looking for stocks or currencies that are trading within a certain range. Traders will typically look for stocks or currencies that are trading in a range, and then enter and exit trades based on these ranges.

- Breakout Trading: This strategy involves looking for stocks or currencies that are breaking out of a range. Traders will typically look for stocks or currencies that are breaking out of a range, and then enter and exit trades based on these breakouts.

FAQs

Swing trading is a type of trading strategy that involves taking advantage of short-term market movements, typically over a period of several days or even weeks. It is a popular trading style for those who are looking to capitalize on short-term market movement, but it does come with a certain amount of risk.

The main benefit of swing trading is that it is a low-risk trading style, as traders are not exposed to the same level of risk as they would be with long-term trading strategies. Additionally, swing trading is relatively easy to learn, as it does not require a deep knowledge of the financial markets or technical analysis.

Swing traders typically use technical analysis to identify trends and patterns in the market, and then use these trends and patterns to determine when to enter and exit trades. It is also important to use fundamental analysis in order to identify potential trading opportunities.

It is important to limit the amount of money you invest in each trade, as this can help to reduce the amount of risk you are exposed to. It is also important to diversify your investments, as this can help to reduce the amount of risk you are exposed to.

Brokers online offer Swing Trading Analysis?

Yes, there are many online brokerages that offer swing trading analysis. TradeStation is one of the best in the market and tops the list of the best swing trading brokers [1]. It offers a variety of features and tools designed to help traders make informed decisions and maximize their profits.

Additionally, TrendSpider is an excellent technical analysis tool that can be used to spot trends and capitalize on them [2]. Charles Schwab is also an online discount broker that provides users with access to swing trading analysis [3]. By subscribing to Benzinga Pro, users can get access to stock analysis and trading ideas on a monthly basis [2].

References:

[1] 9 Best Platforms For Swing Trading (Brokerages, Apps, Tools … [2] 14 Best Swing Trading Platforms, Software & Brokers [2023] [3] Top Best Swing Trading Platform for Swing TradersConclusion

Swing trading is a popular trading style for those who are looking to capitalize on short-term market movements. It is important to understand the risks associated with swing trading, and to use risk management strategies to limit losses. It is also important to use both technical and fundamental analysis to identify potential trading opportunities. Finally, it is important to develop a swing trading strategy that is tailored to your own trading style and risk tolerance.

If you are looking to get started with swing trading, it is important to do your research and practice with a demo account before risking your own capital. Swing trading can be a profitable trading style if done correctly, and with the right amount of knowledge and practice, it can be a successful way to make money in the markets.