European and Asian stocks were hit with further declines on Wednesday [1] after Wall Street suffered its worst day since December. Asian shares followed Wall Street and Europe lower on Friday [2], with markets jittery over the risk that the Federal Reserve and other central banks may bring on recessions in order to get inflation under control. Oil prices and U.S. futures edged higher. Asian and European stocks fell Wednesday [3] after another turbulent day for US markets, as investors continue to sell off amid fears of global inflation, further interest rate hikes and broader economic turmoil.

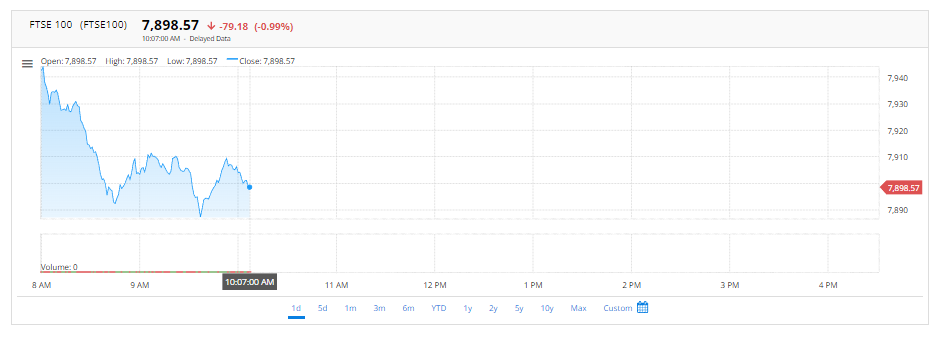

The UK’s FTSE 100 Index dropped 0.99%, Germany’s DAX Index slipped 0.21% and France’s CAC 40 Index dropped 0.4%. Japan’s benchmark Nikkei Index slid 1.34%, China’s benchmark Shanghai Composite Index dropped 0.47%, while Hong Kong’s Hang Seng Index dropped more than 0.49%.

The Fed raised its short-term interest rate by half a percentage point on Wednesday, its seventh increase this year. Central banks in Europe followed along Thursday, with the European Central Bank, Bank of England and Swiss National Bank each raising their main lending rate by a half-point Thursday.

References:

[1] Europe and Asia stocks fall further after Wall Street sell-offFTSE100 is losing today -0.99% to 7,898.57.

FTSE100 is losing today -0.99% to 7,898.57. Lloyds Banking Group today revealed unchanged annual profits of £6.9 billion and Rio Tinto shareholders, meanwhile, can expect a smaller dividend payment this year after the mining giant declared an award of $4.92 a share.

Lloyds Banking Group reported unchanged profits of £6.9 billion for the year [2], thanks to a rise in interest rates and expectations of house prices falling by 7%. Rio Tinto’s shareholders can expect a smaller dividend payment this year [1], while Glencore has lost 13.7 pence to 489.6 pence.

Read Also: Markets Today: European stock markets dropped on Tuesday.

Despite weaker-than-expected fourth quarter profits of 1.6 billion pounds ($2.2 billion), Lloyds said it would pay a special dividend of 0.5 pence and an ordinary dividend of 2.25 pence a share [3]. The amount of the dividends on an annual basis can be choppy with higher payments paid in 2019 as compared to 2021 and 2022. The bank’s common equity tier 1 ratio, a measure of financial strength, stood at 13 percent after the payout.

References:

[1] FTSE 100 Live: Lloyds posts annual results, Rio Tinto cuts … [2] Lloyds Banking Group: Unlocking The Secrets Of A 4 … [3] UPDATE 3-Lloyds Bank’s dividend surprise sweetens profit missNikkei 225 was down -1.34%

On Wednesday, Nikkei 225 was down -1.34%. On Tuesday, the Nikkei 225 index was down 1.25% in Tokyo, with losses in the and sectors leading shares lower [1]. The best performers of the session on the Nikkei 225 were Seven & i Holdings Co., Ltd. (TYO:3382) which rose 6.06% or 351.00 points to trade at 6,142.00 at the close [2]. The Nikkei 225 key figures for performance, 1.21%, high, 27,821.22, and low, 26,788.76, showed a volatility of 8.36% [3].

References:

[1] Nikkei 225 falls more than 2% after Bank of Japan widens … [2] Japan stocks lower at close of trade; Nikkei 225 down 1.25% [3] NIKKEI 225 INDEX TODAY | LIVE TICKER – Markets InsiderUS Stocks tumbled on Tuesday with Nasdaq Composite slid 2.5%

Stocks tumbled on Tuesday, with the S&P 500 index dropping 2% [1]. The main reasons for the decline were fears about higher interest rates and the tightening squeeze on Wall Street and the economy [2]. The yield on the 10-year Treasury rose further to 3.95% from 3.82% late Friday, and the two-year yield rose to 4.72% from 4.62% [2]. The Fed has already pulled its key overnight rate up to a range of 4.50% to 4.75%, up from basically zero at the start of last year [3].

Read also:

- Red day for NIO -1.57%, Disney -2.97% , GME -6.05%, Palantir -7.93% and Tesla -5.25% Stocks

- Dow Jones was up 0.39%, FTSE100 +0.12% and DAX +1.1% watching Biden on Kiev

- Dow Jones +0.19%, Lyft Stocks tumbling 35% and Oil and gas stocks up +2.3%

- Discover the Green Revolution: EV Vehicles Production Is Taking Off!

- How was the US and EU Stock Markets, in historic day of Zelenskyy’s visits UK

- DELL stock is Losing Today 3.63% After Announced 5% Jobs Cut

- Introducing Euronext: Your Guide To Europe’s Largest Stock Exchange

Several reports have recently come in on the economy that were stronger than expected [2], but they could also fuel upward pressure on inflation and give the Fed more reason to stick to the “higher for longer” campaign it’s been espousing for rates [2]. The stock market has fared poorly in the last 10 years [3], with major indices increasing in value but dropping during the pandemic. The most significant spike in volatility from the last decade was in March 2020, at the beginning of the COVID-19 pandemic. Rates of return have been above average almost every year since [3].

References:

[1] US stocks record worst day in two months on rate rise worries [2] Wall Street tumbles, Dow loses 697 on fears about high rates [3] Wall Street tumbles to biggest drop since December as …FAQs about How can I invest in NASDAQ stocks?

Investing in the NASDAQ is a great way to diversify your portfolio and potentially generate returns. Here are some frequently asked questions to consider before investing:

The NASDAQ is a stock exchange based in New York City that focuses on technology and growth companies. It is home to over 3,000 companies, including some of the largest and most well-known tech companies in the world such as Apple, Microsoft, Amazon, and Facebook.

You can buy stocks on the NASDAQ through a brokerage account. When you open a brokerage account, you will be given access to the NASDAQ and other exchanges to buy and sell stocks. You can buy stocks either through a market order or a limit order.

Investing in the NASDAQ carries the same risks associated with investing in any other stock. The value of the stocks can go up or down and you could potentially lose all of your investment. Additionally, the tech sector can be volatile and the companies on the NASDAQ may be more susceptible to economic downturns.

Before investing in the NASDAQ, you should consider the risks associated with investing in the stock market and the tech sector in particular. It is also important to diversify your portfolio and make sure to invest in a range of different companies, industries, and strategies. Additionally, ensure that you understand the stock you are buying and have done research on the company.