In the bustling landscape of global finance, European markets hold a pivotal position, shaping economic trends and investor strategies around the world. With the FTSE 100, CAC 40, and DAX 40 serving as barometers for economic health in the UK, France, and Germany, respectively, their performance provides essential insights into the broader European economy. The significance of these indices cannot be overstated, as they reflect not only the corporate heartbeat of some of Europe’s largest economies but also the impact of global events, including political elections such as the French election, on European market sentiments.

This article offers an in-depth examination of the latest movements within the FTSE 100, CAC 40, and DAX 40, dissecting the factors driving change in these key European market indices. Furthermore, it provides a comprehensive overview of the current state of the European markets, incorporating European market insights that are vital for investors looking to navigate the complexities of international finance. Through analysis of individual performance and broader market trends, readers will gain a nuanced understanding of European market dynamics, setting the stage for informed investment decisions and strategic planning in the context of global economic shifts.

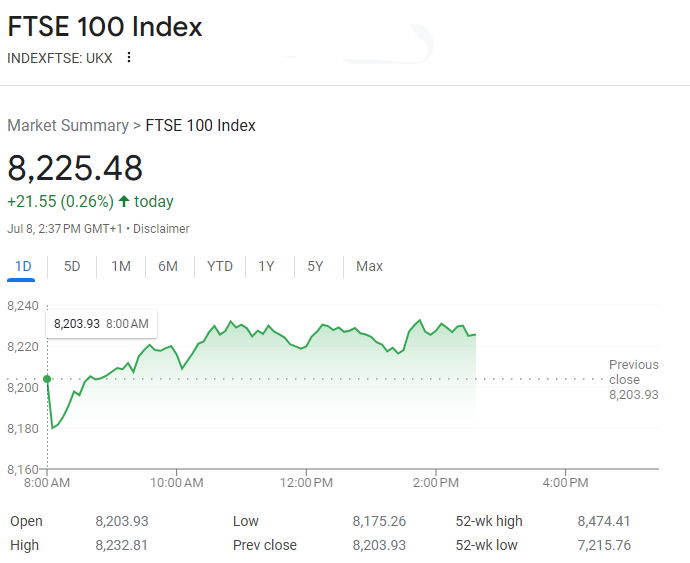

FTSE 100 Analysis

Market Movement

The FTSE 100 has demonstrated resilience, maintaining its position above the crucial support levels between 8046 and 8120, despite a lack of immediate gains following a bull flag breakout. This support, previously the all-time high in February 2023, has remained intact, indicating a bullish outlook for the index . Currently, the index is attempting to surpass the resistance near the 8235/8245 range, with an eye towards the significant 8300 mark. Surpassing this could target the record high of 8480 set in May .

Sector Performances

The performance of different sectors within the FTSE 100 varies significantly, reflecting the diverse economic activities that these companies represent. Technology and healthcare sectors have shown strong performances, contrasting with the more modest results from energy and financial sectors . This variation highlights the impact of external economic conditions and sector-specific developments on the index’s overall performance.

Political and Economic Impact

The FTSE 100’s movements are closely tied to the UK’s political landscape, particularly evident with the impending UK elections. The expectation of a Labour victory suggests minimal changes to fiscal policies, with proposed tax increases to support a £9 billion spending rise. However, this is considered modest against the UK’s £3 trillion economy. The market has seemingly adjusted to the potential outcomes, with more dramatic index movements likely only if unexpected election results occur, such as a hung parliament .

Furthermore, the index reacts to broader European political events, such as the French elections. The anticipation of preventing a far-right victory in France has led to a positive response in European markets, including the FTSE 100. This illustrates how political events within Europe can have ripple effects across the region’s financial markets, influencing investor sentiment and market performance .

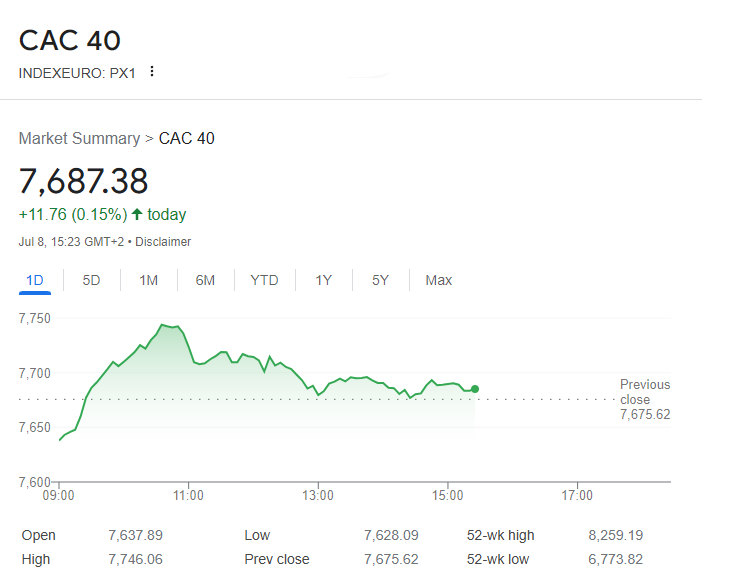

CAC 40 Analysis

Market Movement

The CAC 40, a key indicator of the French stock market, is calculated in real-time and reflects the performance of the 40 largest French stocks traded on Euronext Paris . This index, heavily influenced by global economic and political events, provides insights into the health of the French economy and the broader European market . Recent market activities have shown that the CAC 40 responds dynamically to domestic and international political events, which can significantly affect the performance of the companies within the index .

Sector Performances

Sector performances within the CAC 40 reveal the relative strength or weakness of different industries in the French economy. Technology, finance, energy, and manufacturing sectors play pivotal roles, with each sector’s performance providing deeper insights into economic conditions . The index is heavily weighted towards sectors like finance and energy, which can skew its overall performance, reflecting broader economic trends and investor sentiment . Additionally, the Purchasing Managers’ Index and Consumer Price Index are indicators that help gauge the health of manufacturing and service sectors, further influencing the CAC 40’s movements .

Political and Economic Impact

Political stability and economic policies significantly impact the CAC 40. The index is sensitive to changes in government policies, interest rates, and global economic conditions . For instance, the recent French elections saw market fluctuations in response to political outcomes, affecting investor confidence and market stability . The European Central Bank’s monetary policies also play a crucial role, as they influence the euro’s strength, which in turn affects the CAC 40’s performance . Moreover, the index’s correlation with global indices like the FTSE 100 and DAX highlights its responsiveness to international market trends and economic events .

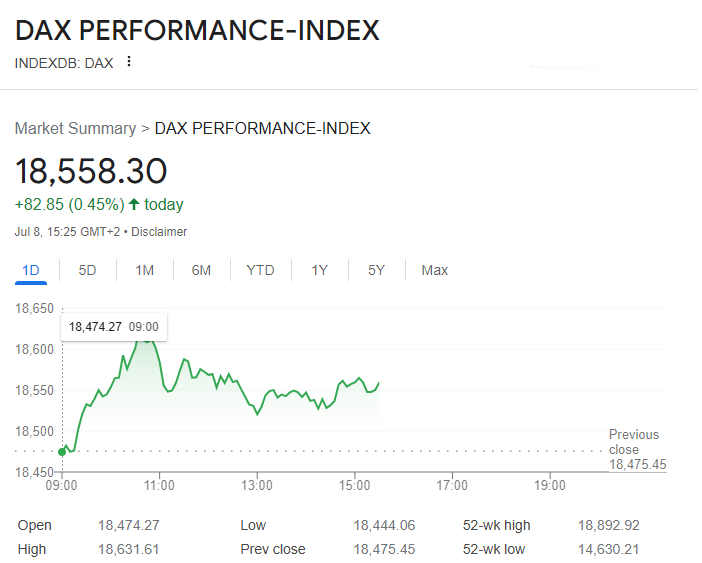

DAX Analysis

Market Movement

The DAX experienced a slight decline of 0.34% on Monday, following a 0.51% drop on the preceding Friday, closing the session at 18,495 . This downturn reflects investor concerns over the potential economic impact of political shifts in Europe, particularly the possibility of a far-right victory in France which could lead the European Central Bank (ECB) to reconsider its stance on interest rate cuts . German banks, including Commerzbank and Deutsche Bank, also mirrored this negative sentiment, with respective losses of 1.48% and 0.10% .

Sector Performances

Sector performance within the DAX was varied, with significant losses observed in retail and technology sectors. Notably, Adidas and Zalando SE saw their stock prices drop by 0.56% and 0.60%, respectively, while tech giants Infineon Technologies and SAP incurred losses of 0.78% and 0.30% . Conversely, the automotive sector displayed mixed results; Daimler Truck Holding and Volkswagen recorded declines, whereas Mercedes Benz Group and Porsche posted gains .

Political and Economic Impact

The political landscape in Europe, particularly the outcomes of the French general elections, has introduced significant volatility and uncertainty in the market. A shift towards the right could alter the economic policies significantly, affecting the ECB’s future decisions on interest rates . Additionally, upcoming speeches by ECB Chief Economist Philip Lane and the release of the US CPI Report are expected to influence the near-term trends for the DAX . Investors are advised to stay attuned to these developments, as they could potentially bring the DAX below the 18,000 mark depending on the geopolitical and economic outcomes .

European Market Overview

Overall Market Health

The European market has exhibited a mixed performance in recent years. Some sectors and regions have outperformed others, while the overall pace of growth has been uneven across different countries and industries . Despite these challenges, there are signs of recovery within the European market, although it generally lags behind other major global markets in terms of overall performance . However, sectors such as technology and healthcare have demonstrated stronger growth and resilience, indicating a robust sectoral health within these areas .

Comparative Performance

When analyzing the comparative performance of the European markets, it is evident that while some sectors like technology and healthcare have been able to outperform their global counterparts, the broader market still faces significant challenges . Political and economic uncertainties, along with ongoing issues related to the COVID-19 pandemic, have contributed to this uneven performance . The table below provides a snapshot of the current market indices and their recent changes, reflecting the dynamic nature of the European markets:

| SYMBOL | PRICE | CHANGE | %CHANGE |

|---|---|---|---|

| FTSE | 8,220.23 | +16.3 | +0.2% |

| DAX | 18,612.36 | +136.91 | +0.74% |

| CAC | 7,742.41 | +66.79 | +0.87% |

| STOXX600 | 519.62 | +3.02 | +0.58% |

| AEX | 937.93 | +4.17 | +0.45% |

| BEL 20 | 3,970.17 | +10.33 | +0.26% |

| FTSE MIB | 34,379.39 | +391.72 | +1.15% |

| OMXS30 | 2,566.57 | +10.04 | +0.39% |

| SMI | 12,037.13 | +30.99 | +0.26% |

| HEX | 10,010.63 | -18.28 | -0.18% |

| PSI20 | 6,680.1 | +1.5 | +0.02% |

| OMXC 25 | 1,980.79 | +2.05 | +0.1% |

| Russia | 3,215.91 | +44.22 | +1.39% |

This data highlights the current state and fluctuations within the European markets, underscoring the importance of monitoring these indices for understanding broader market trends .

Conclusion

Throughout this analysis, we’ve navigated the intricate dynamics of the European markets, focusing on pivotal indices such as the FTSE 100, CAC 40, and DAX 40. These indices not only reflect the current economic health of their respective countries but also serve as bellwethers for broader global economic trends. By delving into the market movements, sector performances, and the impact of political and economic factors, we’ve offered a comprehensive view that underscores the interconnectedness of these markets and their significance on the European financial landscape.

The insights presented highlight the importance of staying informed and adaptable in the face of the constantly evolving market environment. The fluctuating dynamics underscored by recent political events, sector-specific performances, and overall market health point to a need for strategic consideration by investors and policymakers alike. As we look ahead, these findings emphasize the ongoing relevance of these European market indices not just as indicators of regional economic performance but as integral components of the global financial system.