The FTSE 100 index has reached a three-month high, signaling a positive shift in investor sentiment on the London Stock Exchange. This upward movement has caught the attention of market watchers, with LondonMetric Property standing out as a notable performer. The surge in the FTSE 100 index today reflects broader economic trends and has an impact on various sectors of the UK economy.

This article delves into the factors behind the FTSE 100’s recent performance and examines LondonMetric Property’s impressive 3.07% gain. It also explores the role of interest rates in shaping market dynamics and considers the wider implications for investors and businesses. By analyzing these developments, we aim to provide insights into the current state of the UK’s financial landscape and what it might mean for the future.

FTSE 100 Reaches Three-Month High

The FTSE 100 index has achieved a significant milestone, reaching a three-month high and demonstrating a positive trend in the UK’s financial markets. This upward movement has caught the attention of investors and market analysts alike, signaling a potential shift in economic sentiment.

Key Drivers

The blue-chip FTSE 100 index has shown remarkable resilience, rising 0.3% and setting itself on track for its second consecutive monthly gain . This upward trajectory has been sustained over three consecutive weeks, indicating a consistent positive trend in the market. The index closed at 7,564.91 points, marking its highest level in three months .

Several factors have contributed to this upward movement. Bank shares have taken the lead, with investors closely watching crucial global economic data that could provide insights into the pace of rate cuts by major central banks . This anticipation has fueled optimism in the financial sector, driving the overall index higher.

Top Performing Sectors

The FTSE 100’s rise has been bolstered by strong performances across various key sectors. Notably, the energy and mining sectors have played a significant role in propelling the index upward. The oil and gas sector saw an impressive gain of 1.8%, while basic materials rose by 1.6% .

Notable Stock Movements

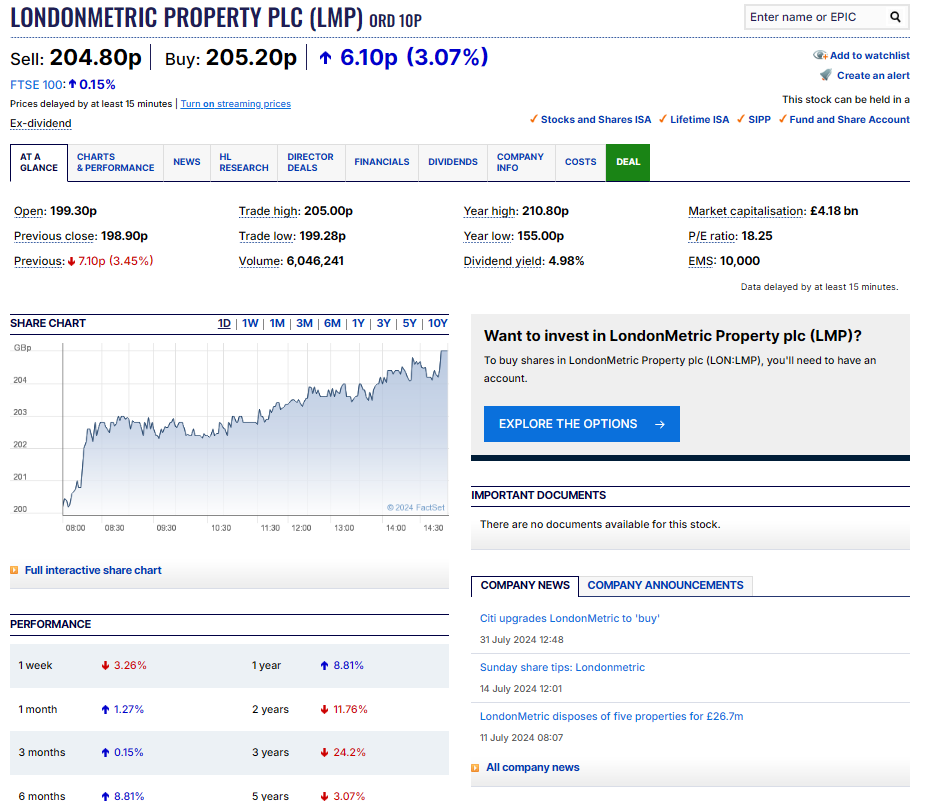

Several individual stocks have stood out with remarkable gains, contributing to the FTSE 100’s overall performance. LondonMetric Property plc led the pack with a substantial increase of 3.27% . Other notable performers included:

- Severn Trent Plc, which saw a rise of 3.12% .

- Entain plc, with a gain of 3.04% .

- Land Securities Group plc, increasing by 2.67% .

In the energy sector, oil giants BP and Shell recorded gains of 1.8% and 1.6% respectively, benefiting from rising oil prices . The mining industry also saw significant movements, with Rio Tinto and BHP gaining 1.9% and 1.7% respectively .

The FTSE 100’s recent performance reflects a broader positive sentiment in the UK market. While the main index has shown strength, it’s worth noting that the domestically-focused mid-cap FTSE 250 has also seen a modest rise of 0.2%, although it is eyeing a monthly decline . This contrast highlights the complex dynamics at play in the UK’s financial landscape.

LondonMetric Property’s 3.07% Surge

Company Overview

LondonMetric Property, a FTSE 100 REIT, has established itself as a prominent player in the UK real estate market. The company owns and manages a diverse portfolio of desirable real estate valued at £6.0 billion, with over 40% of its assets concentrated in the logistics sector . LondonMetric’s focus extends to emerging consumer trends, including online shopping, convenience, healthcare, and staycations .

The company’s portfolio comprises 26 million square feet of property under management, with a significant portion consisting of single-let properties on long leases . Approximately 80% of LondonMetric’s rental income benefits from contractual uplifts, providing a stable and growing income stream . This strategy has allowed the company to maintain a consistently high occupancy rate of around 99%, demonstrating the strength of its relationships with high-quality occupiers .

Factors Behind the Rise

LondonMetric Property’s recent 3.07% surge can be attributed to several factors that have bolstered investor confidence. The company’s financial performance has been robust, reflecting its strategic focus on structurally supported sectors and the efficiency of its operations . This has resulted in material earnings growth, allowing LondonMetric to increase its covered dividend by 7.4% .

The company’s long-term “all-weather” approach to investing and its commitment to behaving as a “true REIT” have likely contributed to its positive market performance . LondonMetric’s ultimate objective of growing earnings to deliver sustainable and progressive dividend returns has been evident in its track record. Since the company’s creation in 2013, it has grown its earnings from 3.9p to 10.9p, enabling an increase in dividends per share from 7.0p to 10.2p per annum .

Analyst Perspectives

Despite the recent surge, analysts have expressed mixed views on LondonMetric Property’s future performance. The company’s Return on Equity (ROE) stands at 3.0%, which is considered relatively low compared to the industry average of 5.6% . This lower ROE has been linked to a five-year net income decline of 14% .

However, analysts are projecting a positive outlook for LondonMetric Property. Revenue forecasts for 2025 suggest a substantial 108% improvement compared to the last 12 months, reaching UK£370.2m . This growth rate significantly outpaces the company’s historical growth of 13% per annum over the past five years and is notably faster than the industry average of 0.9% .

Earnings per share (EPS) are predicted to surge by 166% to UK£0.15 in 2025 . While there has been a slight downward revision in EPS estimates, the overall growth trajectory remains strong. The company’s recent quarterly earnings data exceeded analysts’ expectations, with reported earnings per share of USD 4.40, meeting consensus estimates .

Broader Market Trends

Global Economic Influences

The FTSE 100 index’s performance is increasingly influenced by global economic factors. As international capital flows become more significant, it has become nearly impossible for countries to isolate their financial markets from external influences . This interconnectedness has led to a paradigm shift, challenging the traditional “trilemma” of economic policy. Some experts argue that independent monetary policy is only possible with capital controls, regardless of the exchange rate regime .

Global liquidity has a particularly strong impact on emerging market economies (EMEs), often leading to heightened volatility in their financial markets . This effect is more pronounced in EMEs with low market depth, where global variables can have an asymmetric impact . The influence of global factors is so strong that in 15 out of 16 countries studied, stock prices were significantly affected by global variables, contradicting the traditional view that country-specific factors primarily determine stock prices .

Sector-Specific Performances

Different sectors often move in opposite directions based on industry fundamentals and broader economic trends. For instance, the energy sector, which struggled between 2015 and 2020 due to falling crude prices, saw a significant rebound in 2021 and 2022 amid global turmoil and increased demand . The financial sector, after facing challenges due to low interest rates, experienced a revival post-COVID-19, benefiting from government stimulus and rising interest rates .

The technology sector, a frequent top performer during 2010-2020, faced headwinds in 2022 due to rising interest rates, which tend to negatively impact growth stocks . Sector performance can also diverge based on specific events or economic conditions. For example, during the COVID-19 pandemic, consumer staples stocks saw a boost as demand for essentials increased, while consumer discretionary stocks, such as restaurants and airlines, suffered .

Investor Sentiment

Investor sentiment plays a crucial role in shaping market trends. It reflects the overall attitude of buyers and sellers in a financial market and influences the supply and demand of financial assets . Market participants use various indicators of market mood and trading tactics to maximize their profits, with quick reactions to investor views being critical for success in the equity market .

The relationship between investor sentiment and equity market returns has been a topic of extensive research. While some studies find sentiment to be a weak predictor of returns, others consider it a reliable indicator . The impact of sentiment on returns can vary in both direction and time frame, with some research showing positive effects in the short term and others indicating negative relationships in the long term .

Conclusion

The FTSE 100’s recent climb to a three-month high, coupled with LondonMetric Property’s impressive 3.07% surge, highlights the dynamic nature of the UK financial market. These developments have an impact on various sectors and reflect broader economic trends, including the influence of global factors and changing investor sentiment. The performance of different sectors, such as energy and technology, shows how market conditions can affect various industries differently, underscoring the importance of a diversified investment approach.

Looking ahead, the FTSE 100’s performance and individual stock movements like LondonMetric Property’s will continue to be shaped by a mix of local and global economic factors. Investors and market watchers will need to keep an eye on upcoming economic data, central bank decisions, and sector-specific trends to navigate the ever-changing financial landscape. As the market evolves, it will be crucial to consider both short-term fluctuations and long-term economic patterns to make informed investment decisions.