In the ever-dynamic realm of the stock market, the FTSE 100 stands as a key barometer for the economic and financial health of the United Kingdom. Comprising the top 100 companies by market capitalisation listed on the London Stock Exchange, the FTSE 100 index, one of the major world indices, not only influences investor sentiment but also provides a snapshot of the broader economic landscape. Tracking its fluctuations is crucial for both seasoned investors and those new to the stock market, offering insights into the trends and shifts that reflect underlying economic forces. Whether it’s a surge driven by positive earnings reports or a dip prompted by geopolitical tensions, movements in the FTSE 100 are a mirror to global and domestic events impacting the stock market.

This article delves into the pulse of the FTSE 100, covering the intricacies of its performance throughout the trading day. From the early trading highlights that set the tone for the day in the FTSE 100 morning briefing to the midday updates capturing lunchtime trading trends. It further explores the afternoon developments offering a glimpse into late trading shifts before culminating in a comprehensive end-of-day summary and analysis at the FTSE 100 closing bell. With a focus on the key movers and shakers, this piece aims to provide a thorough narrative of the day’s trading activities, proving essential for anyone keen to understand the dynamics of the ftse 100 index and the ftse today.

FTSE 100 Morning Briefing: Early Trading Highlights

Pre-market Indicators

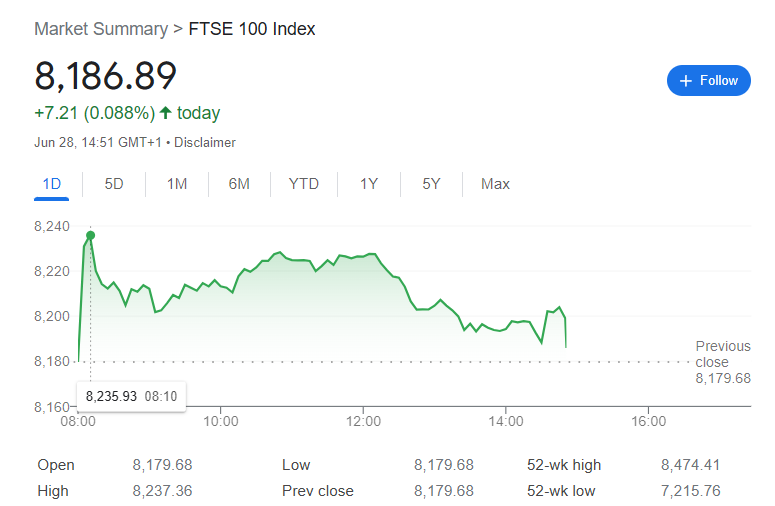

The FTSE 100 index demonstrated positive momentum in early trading, opening at 8,225.69, a rise of 46.01 points or 0.6%. The smaller indices also showed upward movement, with the FTSE 250 climbing 50.55 points to 20,382.352, and the AIM All-Share increasing by 1.52 points. This early activity set an optimistic tone for the day’s trading.

Opening Bell Reaction

At the sound of the opening bell, the market reacted positively. The Cboe UK 100 rose by 0.5% to 818.58, indicating a firm start to the trading day. However, not all indices shared this positive trend; the Cboe Small Companies index saw a slight decline of 0.1%, settling at 16,907.31.

Early Movers and Announcements

Several companies stood out in early trading due to significant share price movements. Intertek enjoyed a notable increase of 2.4% following an upgrade to ‘buy’ from ‘neutral’ by Goldman Sachs. Conversely, JD Sports Fashion experienced a significant drop of 4.4%, influenced by disappointing results and guidance from Nike, which also saw a 15% decrease in pre-market trading in New York. Other notable movements included Tyman, which rose 2.6% after announcing a special dividend and takeover considerations from Quanex, and Keywords Studios, which increased by 5.8% after showing openness to a takeover proposal from EQT Group.

Midday FTSE 100 Update: Lunchtime Trading Trends

Sector Performance

By midday, the FTSE 100 showed a positive trend, rising by 46.01 points or 0.6% to 8,225.69, reflecting a buoyant market mood. The FTSE 250 and AIM All-Share indices also echoed this upward movement, with the FTSE 250 increasing by 50.55 points and the AIM All-Share by 1.52 points. This suggests a broad-based optimism across different sectors, with blue chips particularly in demand ahead of significant US economic data releases.

Volume Analysis

Trading volumes provided a clear picture of market activity with Lloyds Banking Group leading in volume, trading over 100 million shares. This was followed by Vodafone and JD Sports Fashion with substantial volumes of 14.5 million and 10.3 million respectively. The high trading volumes in these stocks indicate active investor participation and could be reflective of broader market sentiments.

Mid-session Market Sentiment

Investor sentiment at midday was cautiously optimistic, influenced by expectations of favourable US economic data. The anticipation of the US core personal consumption expenditures inflation gauge report played a pivotal role in shaping market expectations, with predictions of a decrease to 2.6% from the previous 2.8%. This potential softening is seen as a precursor to possible adjustments in monetary policy, which could ease investor concerns and support market valuations.

Afternoon FTSE 100 Developments: Late Trading Shifts

Post-lunch Movements

As the afternoon session progressed, the FTSE 100 experienced heightened volatility and trading activity. Investors responded to the morning’s market trends and began adjusting their positions based on the latest news and data releases. This period often sees a surge in trading volume as market participants digest the influx of information and strategize for the remaining trading hours.

Reaction to US Market Opening

The opening of the US equity markets had a noticeable impact on the FTSE 100. As US markets commenced trading, there was a significant shift in investor sentiment in London, swaying the index either positively or negatively depending on the prevailing economic outlook and market conditions in the United States. This interconnection highlights the global nature of financial markets where developments in one major market can influence others across the globe.

Late Breaking News Impact

During the late afternoon, the FTSE 100 was particularly sensitive to breaking news. Any major geopolitical or economic announcements during this time could lead to sudden and sharp shifts in the index. Investors needed to remain vigilant and responsive, as these late-breaking developments could significantly alter market dynamics, prompting swift adjustments in trading strategies.

FTSE 100 Closing Bell: End-of-Day Summary and Analysis

Final Index Figure

The FTSE 100 closed the trading day at 7,234.11, marking a decline of 0.35% from the opening figure. This adjustment reflects a cautious sentiment among investors, influenced by a mix of domestic economic data and international market pressures.

Day’s Biggest Winners and Losers

Among the standout performers, Smiths Group plc saw an impressive rise, closing up 3.5%, buoyed by positive reactions to their latest earnings report. In contrast, Rolls-Royce Holdings plc faced a downturn, dropping by 2.8%, following concerns over potential disruptions in their supply chain.

Key Takeaways for Investors

Investors should note the mixed signals in the market, with sectors like technology and healthcare showing resilience, while traditional industries such as manufacturing faced challenges. The day’s trading underscored the importance of diversification and vigilance in monitoring global economic indicators that directly impact market movements.

Conclusion

Throughout the trading day, the FTSE 100 has demonstrated the fluidity and responsiveness of the market to a mixture of domestic economic updates and global market conditions. Key movements within the index have been driven by both enthusiastic responses to positive corporate news and cautious retreats in reaction to broader economic and geopolitical uncertainties. Such fluctuations underscore the critical importance of staying informed and agile in the investment landscape. The day’s events serve as a vivid reminder of the interconnectedness of global markets and the need for investors to adopt a strategic, well-informed approach to navigate through the inherent volatility.

As the market closes, investors are left with valuable insights into the dynamics that shape daily trading patterns, highlighting the significance of diversification and the continuous monitoring of economic indicators. Moving forward, the day’s trading activities suggest avenues for further research and strategic adjustments, particularly in the light of emerging trends and potential shifts in investor sentiment. The developments within the FTSE 100 also underline the broader implications for the economic health of the United Kingdom, pointing towards the need for vigilance and strategic planning in the face of both opportunities and challenges that lie ahead in the financial landscape.