The FTSE 100, often seen as a barometer for the economic and investment health of the United Kingdom, opened higher today, highlighting a moment of optimism among investors. This uplift is mirrored in the substantial 1.3% growth witnessed in the early trade of the FTSE 250, indicating a ripple of positive sentiment across different sectors of the UK economy. The significance of these movements is amplified when considering the backdrop of fluctuating interest rates, the ongoing discussions around house prices, and the political atmosphere influenced by the anticipation of a general election—all factors that keenly affect investment strategies and economic forecasts.

Delving deeper into this article, we will explore the specific performance metrics of the FTSE 100 and the FTSE 250, shedding light on what these numbers suggest about the current state of the economy and investor confidence. Additionally, the impact of sterling on these indices will be evaluated, providing insights into how currency fluctuations are intertwined with market movements. The discussion will further extend to analyzing the sector performances that contributed to these figures and the article will conclude with an overview of the implications these trends may have for future growth and investment strategies. In weaving through these insights, readers will gain a comprehensive understanding of the factors driving the day’s market dynamics, and what it potentially signals for the broader economic landscape.

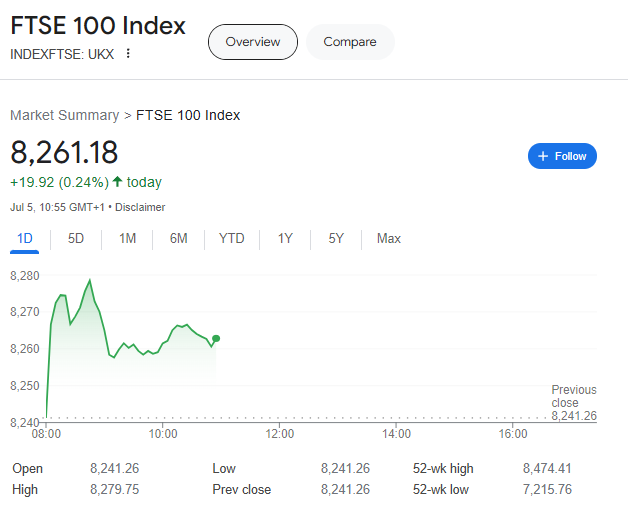

FTSE 100 Performance

Initial Gains

The FTSE 100 index demonstrated a notable increase, rising by 0.36% in early trade on Friday . This uptick was supported by significant contributions from UK housebuilders, who experienced robust gains following Labour’s housing target announcement. Notably, Barratt Developments saw its shares increase by 2.7%, Taylor Wimpey by 2.4%, and Berkeley Group by 1.1% . However, the banking sector showed more modest growth, with NatWest and Barclays’ shares rising by 0.5% and 0.3% respectively, while HSBC’s shares dropped by 1.1% .

Market Sentiment

Despite some sectors showing strong performance, the overall market sentiment for the FTSE 100 was tempered by challenges faced by major players such as GSK. The pharmaceutical giant saw its shares decline from a multi-decade high to four-month lows, now trading around nine times earnings . This downturn in GSK’s stock value reflected broader market sentiments, where despite a positive start, the index struggled to maintain its initial momentum due to several stocks going ex-dividend and specific negative news impacting key constituents . Meanwhile, technical analysis remains bullish on the FTSE 100, as it held above critical support levels and attempted to breach higher resistances, aiming for an all-time high .

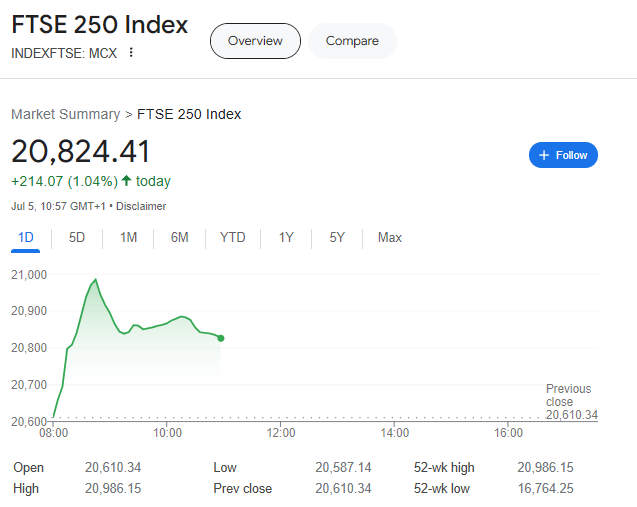

FTSE 250 Performance

Significance of the FTSE 250

The FTSE 250, often considered a rich hunting ground for investors, represents a significant segment of the UK market, featuring rapidly growing companies that have moved beyond the riskiest stages of expansion. Historically, this index has been a reliable indicator of the UK’s economic health, particularly because it includes a wide range of companies not found in the larger FTSE 100. Notably, the FTSE 250 traded at just 10.2 times historic earnings at the end of October, reflecting its affordability and the potential for investment despite recent market fluctuations .

Key Drivers of the 1.3% Gain

The recent 1.3% increase in the FTSE 250 index can be attributed to several key factors. Strong earnings reports from several mid-cap companies played a crucial role, bolstering investor confidence and contributing to a positive market sentiment. Additionally, about 57% of the revenues for these companies are now derived from overseas, which aligns the index more with global economic trends rather than being solely dependent on the domestic market. This international exposure has helped to mitigate some of the economic uncertainties at home, providing a buffer against local economic shifts .

Impact of Sterling

Sterling Against the Dollar

The value of the pound sterling, commonly referred to as the sterling, plays a pivotal role in the financial dynamics of the UK, particularly in relation to the US dollar. The exchange rate between the pound and the dollar is influenced by various factors including economic performance, interest rates, and political stability . For instance, a stronger pound makes UK exports more expensive for foreign buyers, potentially dampening trade balances, while a weaker pound may boost exports by making them more affordable on the global market . This fluctuation was notably observed when the pound rose against the dollar following the announcement of the UK’s Brexit deal, leading to a simultaneous drop in FTSE 100 stocks .

Currency’s Influence on Market Movements

Sterling’s strength or weakness significantly impacts the performance of the FTSE 100 index, as many of the companies listed are multinational and transact in multiple currencies, including GBP. This exchange rate fluctuation can directly affect profitability . For example, when the GBP/USD rate strengthens, dollar revenues convert to fewer pounds, reducing profits . This correlation often manifests as a negative pattern, particularly visible during the Brexit negotiations and subsequent agreements . Moreover, the sterling’s performance is closely monitored by investors due to its substantial influence on both market movements and investment returns, especially for those with significant exposure to UK assets .

Sector Performances

Leading Sectors

The performance metrics across various sectors reveal significant insights into market dynamics. Notably, the Finance sector boasts a market capitalization of 4.28 trillion GBP, with a dividend yield of 3.20% and a modest growth of 0.43% . Health Technology follows, with a market cap of 3.036 trillion GBP and a growth of 0.38% . Electronic Technology and Technology Services sectors also show promising trends with growth rates of 1.68% and 0.67% respectively .

Notable Performers

Recent trading has highlighted several FTSE 100 companies as top risers, reflecting robust sectoral performance. International Consolidated Airlines Group SA led with a significant increase of 5.36%, followed by Fresnillo and easyJet plc with gains of 4.08% and 3.76%, respectively . Other notable performers include Croda International plc and Rio Tinto plc, both showing strong upward movements . This trend underscores the dynamic nature of market movements and the potential for strategic investment opportunities within these sectors.

Conclusion

Throughout this article, we’ve traversed the optimistic terrain of the FTSE 100 and FTSE 250’s performance amidst the complex backdrop of economic factors such as fluctuating interest rates, anticipated political shifts, and global market trends. This landscape, marked by the resilience of key sectors like housing and finance and the strategic positioning of mid-cap companies for international growth, reflects a nuanced understanding of how multifaceted elements coalesce to drive market dynamics. This exploration not only sheds light on the immediate ups and downs of the indices but also delves into the deeper currents of investor confidence and economic indicators that are shaping the present state of the UK economy.

As we look ahead, the movements of sterling against the dollar and the realignments within diverse sectors underscore the interconnectedness of global economies and the pivotal role of currency fluctuations in investment outcomes. These observations compel investors and stakeholders to remain vigilant, adapting strategies to harness the opportunities presented by shifting market sentiments. The broader implications of our findings suggest a cautious optimism, advocating for a balanced approach to navigating the investment landscape, underpinned by informed, strategic decision-making. Emphasizing the potential for future growth, it becomes crucial to continue monitoring these trends and their impact on the UK and global economies, paving the way for robust investment strategies and sustained economic health.