As we dive into the FTSE 100 today, we’re keeping a close eye on the latest market updates and news. The FTSE 100, often referred to as the FT100, is a key indicator of the UK’s economic health, making its daily movements crucial for investors and analysts alike. We’re here to provide you with the most up-to-date information on the FTSE 100 share price and its live performance.

In this article, we’ll explore the key market movers shaping the FTSE 100 today live. We’ll also take a look at the global economic factors that are having an impact on the index. Additionally, we’ll provide a technical analysis of the FTSE 100, giving you insights into potential trends and patterns. By the end, you’ll have a comprehensive understanding of what’s driving the FTSE 100 today and what it means for the broader financial landscape.

Key Market Movers

As we delve into the FTSE 100 today live, we’re seeing some significant movements that are shaping the market. Let’s take a closer look at the top risers, biggest fallers, and sector performance that are influencing the FTSE 100 share price.

Top Risers

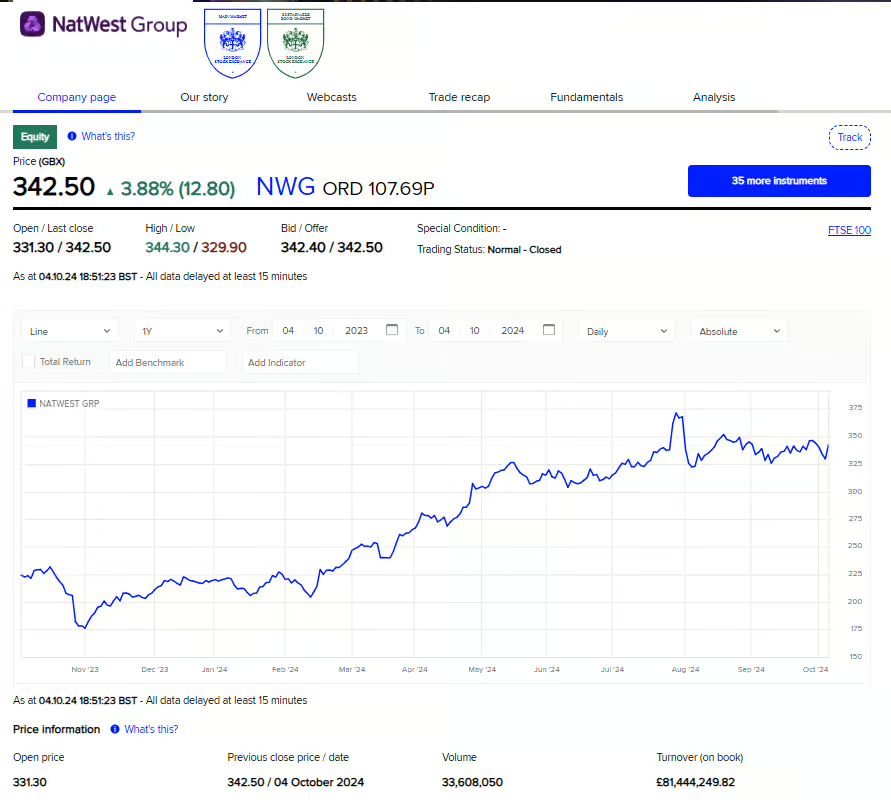

We’ve observed some impressive gains among several companies in the FTSE 100 today. NatWest Group plc is leading the pack with a substantial increase of 3.88%, followed closely by Schroders plc at 3.86%. Standard Chartered plc isn’t far behind, showing a robust growth of 3.84%. Croda International plc and Barclays plc are also performing well, with gains of 3.71% and 3.15% respectively.

These top performers are having a positive impact on the FTSE 100 today live, contributing to the overall market sentiment. It’s worth noting that the banking sector seems to be having a strong day, with three of the top five risers coming from this industry.

Biggest Fallers

On the flip side, we’re also seeing some significant declines in the FT100:

The top 5 fallers are now:

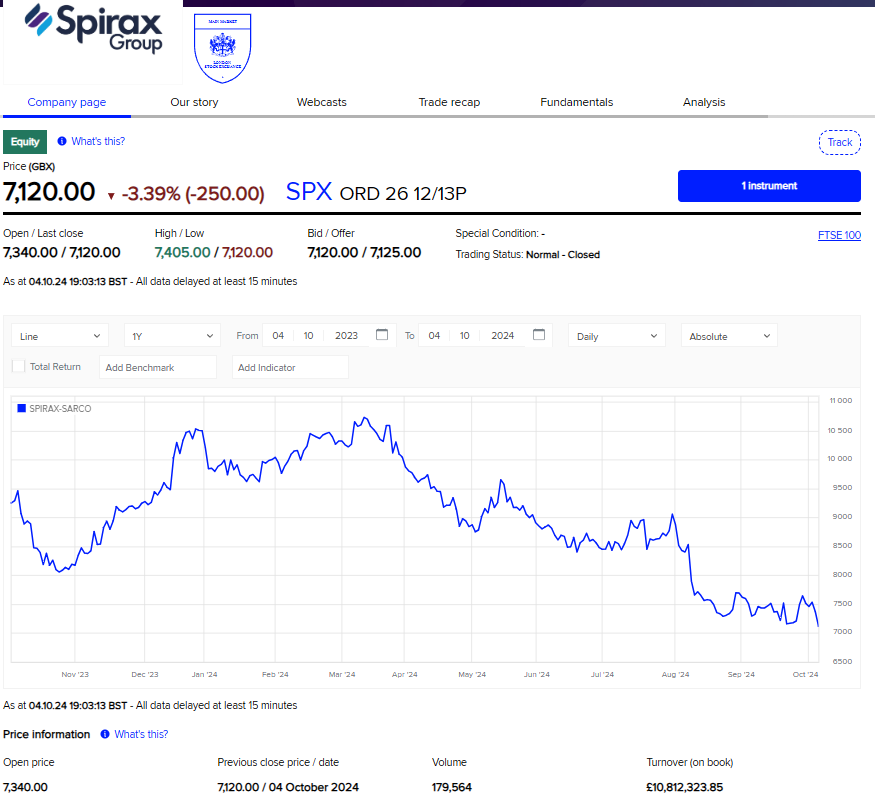

- Spirax Group plc (SPX): Down 3.39%

- SSE plc (SSE): Down 2.78%

- JD Sports Fashion plc (JD.): Down 2.67%

- Experian Plc (EXPN): Down 2.45%

- AstraZeneca plc (AZN): Down 1.89%

These fallers are putting downward pressure on the FTSE 100 share price, balancing out some of the gains we’ve seen from the top risers.

Sector Performance

Looking at the broader picture, we’re seeing mixed performance across different sectors in the FTSE 100 today. The financial sector is showing strength, with a 0.97% increase led by strong performances in life insurance and banking industries. Energy and technology sectors are also in positive territory, with gains of 0.93% and 0.73% respectively.

However, not all sectors are faring as well. Real estate and telecommunications are experiencing slight declines, with drops of 0.66% and 0.73% respectively. These sector movements are playing a crucial role in shaping the overall performance of the FTSE 100 today live.

Global Economic Factors

As we analyze the FTSE 100 today live, we need to consider the global economic factors that are having a significant impact on the index. These factors play a crucial role in shaping the FTSE 100 share price and overall market performance.

Interest Rate Impact

We’ve observed that interest rates have a substantial influence on the FT100. There’s an inverse relationship between interest rates and investment levels in equities. When rates rise, we see a decline in investment in FTSE 100 component shares. This is because higher rates lead to decreased corporate profitability due to increased interest repayments. As a result, higher interest rates are associated with reduced investment in stock markets.

Recently, we’ve seen some positive developments in this area. The Bank of England now expects a less severe downturn this year, with inflation predicted to fall sharply in 2023. We’re forecasting that the Bank might stop its cycle of raising interest rates this summer, with expectations that the Bank rate could peak below 4.5% in August.

Geopolitical Influences

Geopolitical events have a significant impact on the FTSE100 live. We’re currently seeing heightened tensions in the Middle East, which are causing ripples across global markets. The situation between Israel and Iran has put investors on edge, potentially affecting the FTSE 100 share price.

These geopolitical tensions are also influencing oil prices, which in turn affect the FTSE 100. We’ve seen crude oil rise by 3.2% recently, and there’s potential for further increases if the conflict escalates. This has implications for energy sector stocks within the FTSE 100.

Currency Fluctuations

Currency movements play a crucial role in shaping the FTSE 100 today. We’ve noticed that FTSE earnings are influenced by changes in the foreign exchange market. Over the past year, the pound has depreciated against the euro and US dollar, which has implications for companies with international operations.

For instance, when sterling weakens against other currencies, it can actually benefit many FTSE 100 companies that generate a significant portion of their earnings overseas. This is because their foreign earnings become more valuable when converted back to pounds.

FTSE 100 Technical Analysis

As we analyze the FTSE 100 today live, we’re focusing on key technical indicators to gain insights into the index’s performance and potential future movements. Our analysis covers crucial aspects that traders and investors use to make informed decisions.

Support and Resistance Levels

We’ve identified several important support and resistance levels for the FTSE100 . The current support levels are at GBP 648,931.83, GBP 648,143.04, and GBP 647,361.89. These levels are likely to limit downward movements in the index. On the other hand, resistance levels are set at GBP 653,642.48, GBP 654,433.46, and GBP 655,221.86, which could potentially cap upward movements.

The pivot point, a critical level for traders, is situated at GBP 650,501.65. With the FTSE 100 share price currently above this pivot point and supportive indicators, we’re seeing a bullish scenario developing.

Trading Volume

Trading volume is a crucial indicator of market sentiment and the strength of price movements in the FTSE 100 today live. While specific volume data isn’t available at the moment, we’re keeping a close eye on this metric. High trading volumes often indicate strong investor interest and can validate price trends, whether bullish or bearish.

Market Sentiment

The overall market sentiment for the FTSE100 appears to be positive. This optimism is reflected in the technical indicators we’re observing. The Relative Strength Index (RSI) stands at 50.195, indicating a neutral position but with potential for upward movement. The Stochastic Oscillator and StochRSI are showing buy signals, further supporting the bullish outlook.

However, it’s important to note that some indicators are giving mixed signals. The Moving Average Convergence Divergence (MACD) is showing a sell signal, while the Average Directional Index (ADX) is indicating a buy. This mixed picture suggests that while the overall sentiment is positive, there’s still some uncertainty in the market.

Conclusion

To wrap up, the FTSE 100 today offers a mixed bag of performance across different sectors and companies. The index has an influence on the UK’s economic health, with key movers in banking and finance showing strength, while some sectors face challenges. Global factors like interest rates, geopolitical tensions, and currency fluctuations have an impact on the FTSE 100’s performance, shaping investor sentiment and market dynamics.

Technical analysis points to a generally positive outlook for the FTSE100, with support levels and bullish indicators suggesting potential for growth. However, it’s crucial to keep in mind that market conditions can change quickly. Investors and analysts will need to stay alert to ongoing developments in both domestic and international markets to make well-informed decisions about the FTSE 100’s future performance.