In today’s dynamic financial ecosystem, the FTSE 100 serves as a bellwether for the overall health of the UK’s stock market and, by extension, its economy. Observing a rise of 0.25% in the FTSE 100 today underscores the nuanced shifts that investors and analysts keenly monitor to gauge market sentiment and potential economic foresight. This uptick, though seemingly modest, is part of the broader narrative of the global financial markets’ ebbs and flows, making the ftse 100 live updates an essential pulse to watch. Such movements offer a glimpse into the underlying forces at play within the UK’s premier stock exchange, reflecting broader global economic trends.

This article will delve into the intraday market overview, highlighting the ftse 100 index today and its key drivers. By dissecting the factors contributing to today’s market movement, including the ftse 100 risers today and other significant movers, readers will gain insights into the intricate dynamics shaping the ftse 100 stock market. Additionally, the article will explore the implications of these trends for investors, providing an analytical lens through which to view the ftse 100 chart and ftse 100 latest updates. Concluding with a broad-stroke analysis, it aims to offer a comprehensive snapshot of the ftse 100 today analysis, capturing the essence of today’s financial narrative and its potential impact on future market directions.

Daily Market Overview

Summary of the Day

The FTSE 100 opened with a positive sentiment, with the index trading higher in the early session. This early rise set the tone for the day, reflecting a robust start for the market .

The FTSE 100 (^FTSE) and European markets climbed Thursday as UK GDP grew 0.4% in May. The Office for National Statistics (ONS) reported the economy rebounded from April’s weather-related slowdown.

Economists predicted 0.2% growth. Services led with 0.3% growth, production rose 0.2%, and construction jumped 1.9%.

This follows April’s flat growth due to rainy weather hurting high street spending.

The pound strengthened to $1.287 Thursday morning, its highest versus the dollar since early March.

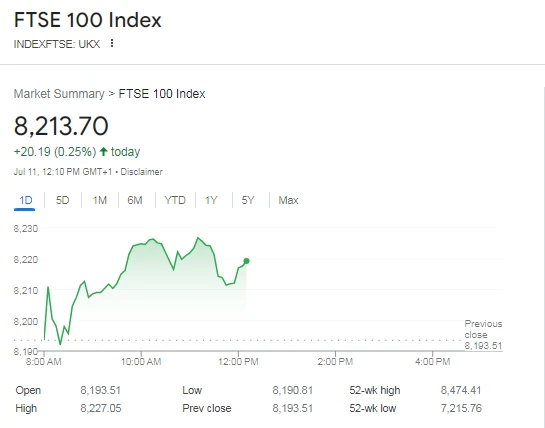

- The FTSE 100 today rose 0.25% in early trading.

- Germany’s DAX gained 0.2% and Paris’ CAC increased 0.4%.

- The pan-European STOXX 600 advanced 0.3%.

- Wall Street futures pointed lower, with S&P 500, Dow, and Nasdaq futures all declining.

- Sterling gained 0.15% against the dollar at 1.2869.

Intraday Movements

Throughout the trading day, the FTSE 100 experienced volatile trading. The index oscillated between gains and losses, indicative of the uncertain market conditions and investor sentiment on that particular day .

Closing Statistics

The market closed on a positive note, with the FTSE 100 ending the day in the green. This upward movement was supported by strong performances in specific sectors, notably banking and IT, which outperformed others. Conversely, the metal and energy sectors did not fare as well, lagging behind the day’s general positive trend . The trading volume was above average, suggesting active participation from investors, which is a positive sign of market engagement .

Key Drivers of Market Movement

Company Earnings

The financial performance of companies listed on the FTSE 100 significantly influences market movements. Earnings that surpass or fall short of market expectations can lead to sizable fluctuations in stock prices. For instance, the earnings of British companies have remained relatively stable over recent years, with revenues growing at an average of 3.9% annually . This stability in earnings, despite increased revenues, suggests that costs or investments have risen correspondingly, impacting profit margins .

Geopolitical Events

Geopolitical events also play a crucial role in shaping market dynamics. For example, political developments can lead to significant market reactions, as seen with the anticipation of policy changes from central banks or government changes. The speculation around the Bank of England’s rate cut and the potential shift in government can create volatility in the market, affecting the FTSE 100 index .

Economic Reports

Economic indicators and reports are pivotal in driving market sentiment and movements. Significant economic data releases, such as inflation reports and GDP figures, can lead to rapid adjustments in market indices. For the FTSE 100, inflation reports are particularly influential, dictating the Bank of England’s interest rate decisions which in turn impact the index . Additionally, unexpected economic data can cause market volatility, as traders and investors reposition their portfolios in response to new information .

Implications for Investors

Investment Strategies

Investors in the FTSE 100 today can consider a range of strategies based on current market evaluations and long-term growth expectations. For instance, the adoption of a long-term investment approach, such as purchasing cost-effective FTSE 100 tracker funds and reinvesting dividends, has historically provided solid returns . This strategy benefits from periodic fund top-ups, especially when the market valuation is favorable. Moreover, the focus on companies with strong financial positions and potential for long-term growth, such as those in the pharmaceutical sector, can yield substantial returns despite short-term fluctuations .

Risks and Opportunities

The current market presents both risks and opportunities for investors. On one hand, geopolitical events and economic reports significantly impact market dynamics, potentially leading to volatility . On the other hand, sectors such as consumer staples and pharmaceuticals offer investment opportunities even during economic downturns due to their essential nature and consistent demand . Additionally, the valuation of the FTSE 100, based on earnings and expected growth, suggests that there are opportunities for investors to buy at lower prices, potentially leading to higher long-term gains .

Expert Advice

Financial experts often emphasize the importance of understanding market cycles and the intrinsic value of investments. Investors are advised to consider the cyclically adjusted price/earnings ratio and other valuation metrics to make informed decisions . Additionally, diversification strategies, such as combining tracker funds with active funds, can mitigate risks and enhance portfolio returns . Investors are also encouraged to stay informed about global economic trends and sector-specific developments to better navigate the complexities of the stock market .

Conclusion

Throughout this examination of the FTSE 100’s performance, key influencers such as company earnings, geopolitical events, and significant economic reports have been highlighted as instrumental in shaping the day’s market dynamics. These factors, combined with the overall upward movement of the index, underscore the importance of staying attuned to both macroeconomic trends and individual sector performances. By understanding these nuances, investors can better navigate the complexities of the financial markets, leveraging opportunities for growth while mitigating risks.

For investors, the insights drawn from today’s market overview emphasize the value of strategic investment approaches and the need for a well-informed perspective on future market directions. Despite the inherent uncertainties and the potential for volatility, there remain avenues for robust investment returns, particularly for those who adopt a long-term view. As the financial landscape continues to evolve, staying informed and adaptable will be key to navigating the opportunities and challenges that lie ahead in the UK’s stock market and beyond.