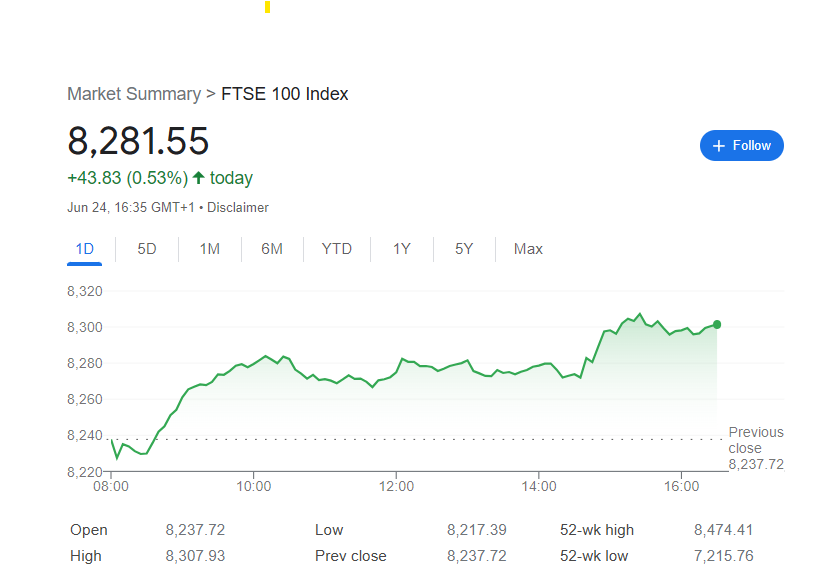

The FTSE 100 index, a barometer of the UK’s largest listed companies, experienced a mixed performance on Monday, June 24th, 2024. The index opened at 8237.72, slightly lower than the previous close, reflecting investor caution ahead of key inflation data releases in the United States. Throughout the day, the index fluctuated between a low of 8217.39 and a high of 8307.93, demonstrating the underlying volatility in the market.

By the end of the trading session, the FTSE 100 closed at 8281.55, a modest 0.53% increase compared to the opening price. This uptick was driven by a few factors, including positive corporate earnings reports from some of the index’s constituents and a slight weakening of the British pound, which boosted the value of multinational companies’ overseas earnings.

However, the overall sentiment remained cautious as investors awaited the release of crucial economic data that could influence the Bank of England’s future monetary policy decisions. The ongoing concerns about global economic growth and geopolitical tensions also weighed on market sentiment.

Some sectors within the FTSE 100 performed better than others. Defensive sectors, such as consumer staples and healthcare, attracted investor interest due to their perceived resilience in uncertain economic times. On the other hand, commodity-related sectors, such as energy and mining, faced headwinds due to a decline in oil and copper prices.

Overall, the FTSE 100’s performance on June 24th was a reflection of the complex and dynamic interplay of various economic and geopolitical factors. While the index managed to close slightly higher, the underlying market sentiment remained cautious. The coming days and weeks will be crucial in determining the index’s future trajectory as investors closely monitor economic data releases and assess the impact of ongoing global events.

Despite the day’s volatility, the FTSE 100 remains an important benchmark for investors looking to gain exposure to the UK’s largest and most established companies. The index’s diverse composition provides a degree of diversification and stability, making it a popular choice for both institutional and individual investors.

FTSE 100 Top 3 Gainers: A Look at the Standout Performers on June 24th

While the FTSE 100 experienced mixed results on June 24th, 2024, three companies emerged as clear winners.

Prudential plc (PRU): Leading the pack with a remarkable 7.32% increase, Prudential’s share price closed at 759.00 p. This surge can be attributed to positive investor sentiment surrounding the financial services sector and the company’s robust performance in Asian markets.

Frasers Group plc (FRAS): Not far behind, Frasers Group saw a 3.85% jump, ending the day at 903.50 p. This retail conglomerate, known for its diverse portfolio of brands, benefited from strong consumer spending and a successful expansion strategy.

Burberry Group plc (BRBY): Rounding out the top three, Burberry Group experienced a solid 3.35% gain, closing at 1,018.00 p. This iconic luxury fashion brand continues to attract global demand, especially in the Chinese market, driving its share price higher.

These three gainers demonstrate the diversity of the FTSE 100, with representation from financial services, retail, and luxury goods sectors. Their success highlights the importance of adapting to changing market conditions and catering to evolving consumer preferences. While the broader market may fluctuate, these companies have proven their ability to deliver strong returns for investors.

FTSE 100 Top 3 Losers: A Closer Look at Underperformers on June 24th

While some FTSE 100 companies celebrated gains on June 24th, 2024, others faced challenges. The top three losers provide insights into the market’s shifting dynamics.

Ocado Group plc (OCDO): This online grocery retailer experienced the most significant decline, with its share price falling by 5.13% to close at 364.70p. The drop could be attributed to concerns about increased competition in the online grocery market and potential margin pressures.

JD Sports Fashion plc (JD.): This sportswear retailer also faced headwinds, witnessing a 3.82% decrease in its share price, ending the day at 134.65p. Investors may have reacted to concerns about consumer spending habits and the company’s exposure to global supply chain disruptions.

Anglo American plc (AAL): This mining company rounded out the top three losers, with its share price declining by 3.34% to close at 2,220.50p. The dip could be linked to fluctuations in commodity prices, particularly copper and iron ore, and broader concerns about global economic growth.

These three companies represent diverse sectors, including retail, online grocery, and mining. Their underperformance on this particular day highlights the challenges faced by various industries in a complex economic landscape. However, it’s important to remember that stock prices can fluctuate, and these companies may rebound in the future based on their strategic decisions and market conditions.

STOXX Europe 600 Index: A Positive Close Amidst Global Uncertainty

The STOXX Europe 600 index, a broad representation of European equities across various sectors and countries, ended Monday, June 24th, 2024, on a positive note. The index closed at 518.87, marking a 0.73% increase compared to its opening price of 514.47. This upward movement suggests a degree of resilience in European markets despite ongoing global economic concerns and geopolitical tensions.

Throughout the trading day, the index experienced fluctuations, reaching a high of 519.97 and a low of 514.37. These fluctuations reflect the inherent volatility in the market as investors react to various news and data releases. However, the overall trend remained positive, with buying pressure outweighing selling pressure.

Several factors contributed to the positive performance of the STOXX Europe 600. Positive corporate earnings reports from some major European companies boosted investor confidence. Additionally, a slight weakening of the euro against other major currencies, such as the US dollar, made European exports more competitive and supported the index’s constituents with significant international operations.

However, it’s important to note that the market sentiment remains cautious. Investors are closely monitoring developments in the global economy, including inflation trends, central bank policies, and geopolitical risks. These factors could potentially impact the future trajectory of the STOXX Europe 600.

Overall, the index’s performance on June 24th suggests a degree of optimism among investors regarding the prospects of European companies. However, the road ahead remains uncertain, and investors will need to remain vigilant and adaptable in navigating the ever-changing market landscape.