The FTSE100 index experienced notable movements, with Rightmove’s stock leading the charge. This sudden surge in Rightmove’s shares has caught the attention of investors and market analysts alike, highlighting the dynamic nature of the UK’s premier stock market index. The contrasting performance of the Stoxx 600, which saw a slight decline, adds an intriguing layer to the current state of European markets.

As we delve into the details of these market shifts, we’ll examine the factors behind Rightmove’s impressive rally and its impact on the FTSE 100. We’ll also look at how the FTSE 100’s performance stacks up against other global indices and explore the broader economic landscape in Europe. This analysis aims to give investors and market watchers a clearer picture of the forces at play in today’s financial markets.

Rightmove’s Stock Rally: Analyzing the Surge

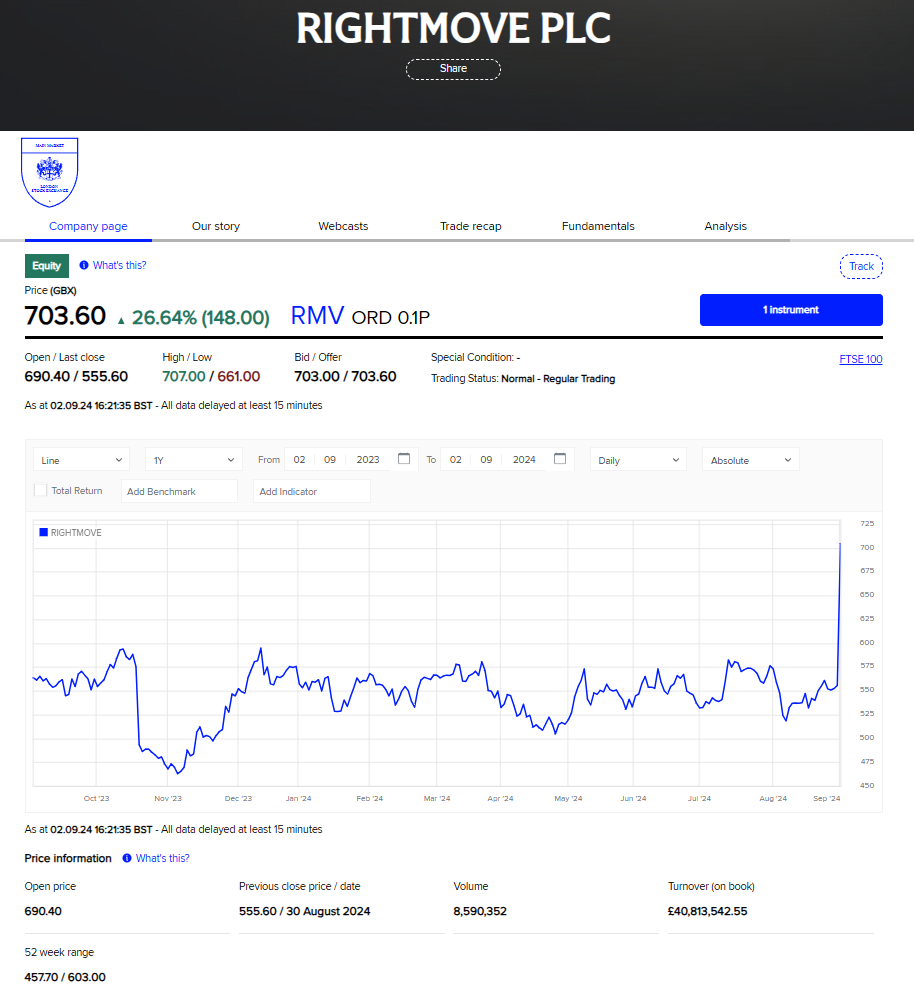

Rightmove, the UK’s leading online property platform, experienced a significant surge in its stock price, with shares jumping 25% following news of a potential takeover bid . The catalyst for this rally was the announcement by REA Group, an Australian digital property giant majority-owned by Rupert Murdoch’s News Corp, that it was considering a cash and share offer for Rightmove’s entire issued and to-be-issued share capital .

REA Group sees clear similarities between itself and Rightmove in terms of their leading market positions in the core residential business . The potential merger could create one of the biggest players in the digital real estate industry, with a broader range of offerings and top positions in both Australia and the UK .

Rightmove’s strong market position, with an 86% share of time spent on UK property portals, has contributed to its attractiveness as an acquisition target . The company’s platform received over 2.2 billion visits in 2023, with users spending more than 15.4 billion minutes searching and researching properties .

FTSE 100 Performance in Global Context

The FTSE 100 has recently hit an intraday record high of 8,076 points, surpassing its previous peak of 8,047 reached in February 2023 . This surge has been driven by expectations of interest rate cuts and easing geopolitical tensions. The UK economic picture has improved, with inflation slowing to 3.2% and the economy returning to growth after a brief recession .

Despite this recent success, the FTSE 100’s performance in 2023 was modest, with a 3.8% increase . It currently lags behind its European counterparts, with a 4% gain year-to-date compared to Germany and France’s 7% increases and Italy’s 12% gain . The index’s composition, with its low exposure to the tech sector, has proven beneficial recently, especially after the “Magnificent 7” tech stocks experienced a significant market value decline .

European Economic Landscape

The European economic landscape is characterized by a diverse industrial sector that plays a crucial role in the region’s economy. In 2022, the value of industrial products sold in the European Union amounted to €6,179 billion . The manufacturing sector, including food and beverages, motor vehicles, and basic metals, stands out as a significant contributor to the European economy .

Despite its economic importance, the industrial sector faces challenges related to environmental impact. The costs of air pollution caused by Europe’s largest industrial plants in 2021 corresponded to about 2% of the EU’s GDP . However, there has been progress in reducing environmental and health costs, with a 33% decrease from 2012 to 2021 .

The services sector also plays a vital role in the European economy, constituting over 70% of total value added . Market services, which include business services, typically exhibit more cyclical growth patterns compared to non-market services like education and health . The relationship between manufacturing and services sectors varies, with business services showing higher correlation with manufacturing trends .

Conclusion

The FTSE 100’s recent performance, highlighted by Rightmove’s impressive stock rally, sheds light on the ever-changing nature of financial markets. This leap, sparked by a potential takeover bid, showcases how corporate moves can have a big impact on market dynamics. At the same time, the slight dip in the Stoxx 600 serves as a reminder that European markets are dealing with a mix of challenges and opportunities.

Looking at the bigger picture, the UK’s main index has hit new highs, driven by hopes for interest rate cuts and a calmer geopolitical scene. However, it’s still playing catch-up with its European counterparts. The diverse makeup of Europe’s economy, from its strong industrial base to its growing services sector, points to a complex financial landscape. As markets keep evolving, investors would do well to keep an eye on both company-specific news and broader economic trends to make smart decisions.