The U.S. stock market has been on a tear in July 2024, with major indices like the Dow Jones Industrial Average, Nasdaq Composite, and S&P 500 reaching new all-time highs.

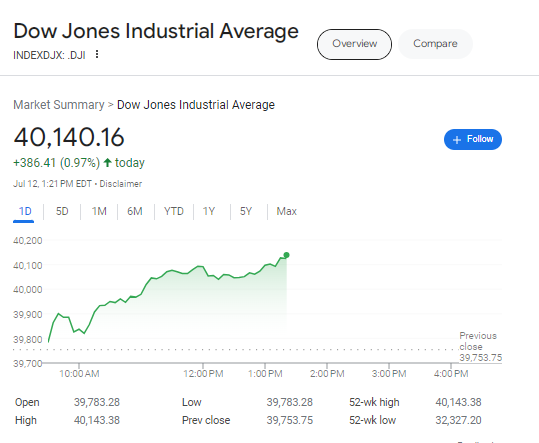

The Dow Jones made a triumphant return above the 40,000 mark for the first time in nearly two months, even briefly touching a record intraday high. The Nasdaq Composite, despite experiencing a rotation from large-cap tech stocks into smaller companies, still managed to gain nearly 1% around midday on Friday and closed at an all-time high on Wednesday, July 10th.

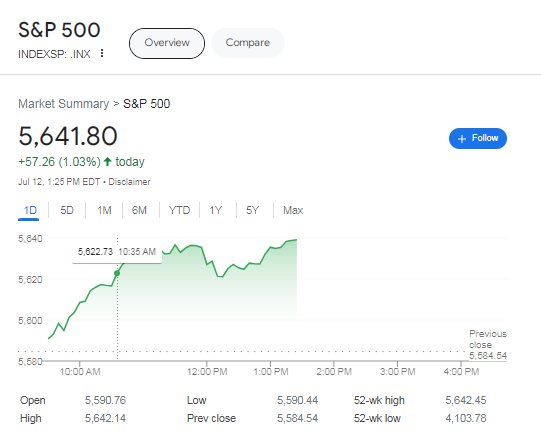

Meanwhile, the S&P 500, which briefly snapped a seven-session winning streak, quickly bounced back with a 1.02% increase on Wednesday, closing at a record high. This momentum continued on Friday, driven by the recovery of several large-cap technology stocks.

This remarkable performance raises questions about the sustainability of this rally and what factors are driving it. Investors are keenly watching for signs of a potential market correction while also exploring opportunities presented by this bullish trend.

Performance of Dow, Nasdaq, and S&P 500

Recent Performance Overview

- Dow Jones Industrial Average (DJIA)

- The Dow Jones Industrial Average has recently experienced significant movements, including a notable rise back above 40,000 for the first time in nearly two months after briefly hitting an all-time intraday high.

- On Wednesday, July 10, 2024, the Dow closed at 39,721.36, adding 429.39 points or 1.09%.

- Nasdaq Composite

- The Nasdaq Composite experienced a rotation out of large-cap tech stocks into small-cap stocks but still managed to rise nearly 1% around midday on Friday.

- It also surged 1.18% on Wednesday, July 10, 2024, closing at an all-time high of 18,647.45, marking its 27th record close of the year.

- S&P 500

- The S&P 500 also saw strong movements, snapping a seven-session winning streak on Thursday but quickly recovering with a 1.02% increase on Wednesday, July 10, 2024, closing at a record high of 5,633.91.

- On Friday, the S&P 500 continued to gain ground, driven by the recovery of several large-cap technology stocks.

Key Drivers of Performance

- Federal Reserve Rate Cut Expectations

- The performance of these indexes has been significantly influenced by investor optimism regarding potential rate cuts by the Federal Reserve, which has led to rotations between large-cap tech stocks and small-cap stocks 1.

- Technology Stocks

- Technology stocks, particularly chipmakers and AI-related companies like Nvidia, have been major contributors to the recent rallies in the Nasdaq and S&P 500 3.

- Small-Cap Index Performance

- The Russell 2000 small-cap index also saw a substantial rise, reflecting a broader market trend where investors are rotating into small-cap stocks expected to benefit more from anticipated rate cuts.

Market Overview

Performance of Dow, Nasdaq, and S&P 500

In the past year, the Dow Jones Industrial Average, Nasdaq Composite, and S&P 500 have all faced significant volatility. The Dow Jones Industrial Average showed relative resilience, with a decrease of about 9% . In contrast, the tech-heavy Nasdaq Composite experienced a more pronounced decline, dropping over 30% due to aggressive interest rate hikes by the Federal Reserve aimed at curbing high inflation . The broader S&P 500 was not immune to these economic pressures either, witnessing a decline of approximately 19% .

Impact of Tech Sell-Off

The technology sector, a major component of the Nasdaq, was particularly hard hit. Major tech companies like Nvidia, Alphabet, Amazon, and Meta saw significant declines in their stock prices. For instance, Nvidia’s shares fell more than 5%, and Tesla experienced a sharp 8% drop after news of a delayed product launch . This sell-off in technology stocks contributed to the Nasdaq’s sharp decline and had a ripple effect across the market, influencing the performance of the S&P 500 and even impacting broader market sentiment .

Big Bank Earnings Reports

JPMorgan Chase

JPMorgan Chase & Co. reported a notable performance in the second quarter, with earnings expectations set at $5.88 per share on revenue of $42.226 billion, a significant increase from the $4.11 per share at the start of the quarter . The adjusted profits for JPMorgan fell as the bank set aside $3.1 billion to cover potentially bad loans, acknowledging rising delinquencies . Despite these challenges, JPMorgan’s headline profits surged, bolstered by billions in gains from its holdings in Visa Inc. . CEO Jamie Dimon emphasized the ongoing risks of inflation and geopolitical tensions, suggesting a cautious outlook for the future .

Wells Fargo

Wells Fargo & Co. experienced a mixed quarter with a reported earnings of $1.33 per share, surpassing last year’s figures and analyst expectations, with revenue reaching $20.7 billion . The bank’s performance was supported by growth in fee-based revenue which helped mitigate a 9% decline in net interest income . However, the bank faced challenges with a decrease in average loan balances and a cautious approach to share repurchases due to upcoming changes in capital requirements . Despite these hurdles, Wells Fargo’s corporate and investment banking sectors showed resilience, with a notable increase in markets revenue .

Citigroup

Citigroup Inc. also outperformed expectations this quarter, posting earnings of $1.39 per share on revenue of $20.07 billion . The bank’s profits were boosted by a strong showing in its investment banking sector and gains from the sale of Visa shares . However, concerns were raised about slowing consumer spending, especially among lower-income individuals . Citigroup’s efforts to address regulatory challenges continued, with a focus on improving its data management systems as part of a broader strategic overhaul led by CEO Jane Fraser .

These earnings reports from JPMorgan Chase, Wells Fargo, and Citigroup highlight the complex dynamics at play in the banking sector, influenced by economic pressures, regulatory challenges, and strategic shifts within each institution.

Analysis and Implications

Rotation from Tech Stocks to Other Sectors

The stock market today reflects a significant shift in investor strategy, particularly evident in the rotation from technology stocks to other sectors. This change is influenced by various factors including interest rates and economic cycles. Historically, sectors such as financials or health care may emerge as new leaders in different economic environments . Investors are advised to consider diversifying their portfolios beyond tech equities, possibly integrating assets like bonds, commodities, and even gold to mitigate volatility .

Investor Reactions to Rate-Cut Hopes

Investor sentiment has been notably impacted by anticipations of Federal Reserve rate cuts. The recent softening in the labor market, with a slowdown in hiring and an increase in the unemployment rate, has fueled speculation about the Fed’s next moves . If the Federal Reserve adopts a more dovish stance, particularly if the upcoming consumer price index indicates a tame inflation environment, it could significantly raise investor confidence in the possibility of multiple rate cuts this year . This scenario would likely bolster the S&P 500 and sustain the current market rally, as a proactive Fed could help ensure a soft economic landing .

Conclusion

Through an insightful exploration of the current stock market dynamics, this article has shed light on the critical interplay between big bank earnings reports, shifting investor strategies, and broader market trends. With the Dow and Nasadaq experiencing remarkable surges in the wake of favorable earnings from leading financial institutions, the analysis underscores the pivotal role of corporate performance and economic indicators in shaping investor sentiment and market directions. Additionally, the rotation from tech stocks to other sectors, alongside investor reactions to potential Federal Reserve rate cuts, highlights the evolving strategies employed by investors to navigate the complex landscape of today’s stock market.

The implications of these trends extend beyond immediate market movements, offering valuable perspectives on the potential for diversified investment approaches and the importance of staying abreast of economic and corporate developments. As we look to the future, the insights garnered from this analysis suggest avenues for further research and strategic consideration, particularly in the context of fluctuating interest rates and the global economic climate. Ultimately, staying informed and adaptable will be key for investors aiming to thrive in the fluctuating yet opportune terrain of the stock market.