The Dow Jones Index is one of the most recognized stock market indexes in existence. It’s also one of the oldest. The history of the index dates back to the early 1900s, and its origin is based on one man: Charles Henry Dow.

In this FintechZoom article, we’ll cover everything you need to know about the Dow Jones Industrial Average Index. What is it? Why does it exist? How does it work? Let’s get started!

What is the Dow Jones?

The DJIA is an index that tracks the performance of America’s thirty largest companies. It’s one of the most widely recognized stock market indexes in the world, and it’s been used by investors and analysts as an indicator of the health of the US economy since the early 1900s. The index is named after Charles Henry Dow, one of the founders of Dow Jones & Company (the parent company of The Wall Street Journal). In 1884, Dow created the first ever DJIA, which tracked the performance of eleven stocks from the rail, telegraph, and public utility sectors. Over time, the index expanded to include other sectors, and the number of stocks covered by the DJIA has varied from time to time. Currently, the DJIA tracks the performance of America’s thirty largest companies.

Why Does The Dow Jones Exist?

The DJIA is the oldest index of leading stocks in the United States. It was created in the 1880s by Charles Henry Dow, one of the co-founders of Dow Jones & Company. Dow chose these thirty companies because they were the primary leaders of the American economy at the time. This has remained true in the years since. The Dow tracks the performance of these thirty companies, and it gives investors a basic idea of how the US economy is doing. This can be helpful for investors who want to track the health of the US economy but don’t have the time to make informed decisions about individual stocks. The index is also widely recognized as a barometer of the US economy, meaning that it is widely used as an indicator of the US economy’s health.

The equity markets are fascinating places, full of opportunity and excitement. If you’re not familiar with them, here’s a quick overview: the equity markets are where stocks and other securities are traded. They’re also where companies go to raise money by selling shares. The equity markets are important because they provide a way for companies to grow and for investors to make money.

There are two main types of equity markets: the primary market and the secondary market. The primary market is where companies first sell their shares. The secondary market is where investors trade shares that have already been sold. The secondary market is much larger than the primary market, and it’s where most of the trading activity takes place.

The equity markets are a great place to invest because they offer the chance to make a lot of money. However, they’re also risky. So before you invest, it’s important to do your research and understand the risks involved. But if you’re willing to take on some risk, the equity markets can be a great way to grow your money.

How Does the DJIA Work?

The Dow Jones Industrial Average is an index that tracks the performance of America’s thirty largest companies based on their market capitalization. The companies are weighted based on market capitalization so that a larger company has more influence on the index than a smaller company does. The index is composed of only publicly traded stocks. In other words, private companies are not included. The Dow is also only composed of stocks from one sector: the industrial sector. The thirty companies that make up the index are weighted based on their relative market capitalization. A company’s weight is determined by the formula (market cap / number of companies in the index). For example, if the market cap of Company A is $2B and there are thirty companies in the index, it will receive a weight of 6.7% in the index.

How is the Dow-Jones Average calculated?

The Dow Jones Industrial Average is an index that tracks the performance of America’s thirty largest companies based on their market capitalization. The companies are weighted based on market capitalization so that a larger company has more influence on the index than a smaller company. The Dow is composed of only publicly traded stocks. In other words, private companies are not included. The Dow is also only composed of stocks from one sector: the industrial sector. The companies that make up the index are weighted based on their relative market capitalization. A company’s weight is determined by the formula (market cap / number of companies in the index).

Who’s Responsible for Managing the DJIA?

The companies that are included in the Dow Jones Industrial Average are chosen by a committee of market experts. This committee is responsible for managing the Dow-Jones average, making sure it remains relevant, and adjusting it as needed to account for changing conditions and industries. There is no one person or thing responsible for managing the Dow Jones Industrial Average. Rather, it is managed by a committee of experts. This committee is responsible for managing the Dow-Jones average, making sure it remains relevant, and adjusting it as needed to account for changing conditions and industries.

Dow-Jones Trading Day

The Dow-Jones Industrial Average is one of the most watched financial indicators in the world. And with good reason! A single point on the Dow can represent billions of dollars in value. So when the Dow goes up or down, it’s big news. The Dow is affected by a lot of different factors, but one of the most important is the Federal Reserve’s decision on interest rates. When the Fed decides to raise rates, it’s usually bad news for the stock market. That’s because higher rates make it more expensive for companies to borrow money, and that can lead to lower profits. So when the Fed announces a rate hike, it’s usually a negative day for the Dow. Of course, there are other factors that can affect the Dow, like stock quotes and economic data. But the interest rate decision is always a big one. So if you’re watching the Dow, make sure to keep an eye on the Fed!

DJIA , Nasdaq & S&P500

Viewers can watch stock indexes such as the S&P 500, Nasdaq and Dow Jones Industrial Average go up and down in real time with these streaming market indexes live streams. These stock market indexes are excellent indicators of how the broader markets are performing. The three main indexes are commonly used as benchmarks for the performance of different sectors and industries. Watching a stock index live stream is one of the best ways to track performance without having to log into multiple websites or apps every day.

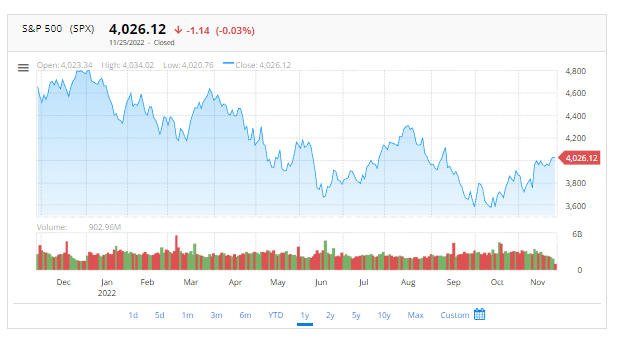

S&P 500 Live Stream

The S&P 500 is a broad-based index of U.S. stocks. It is one of the most commonly used indicators to track the performance of the U.S. equity market. The S&P 500 index is a blended index, meaning it is a combination of large, medium and small cap stocks. As such, it is a good indicator of the overall health of the equity market. The S&P 500 index is a market capitalization weighted index. This means that stocks with higher capitalization have higher weighting in the index. The S&P 500 index is one of the most watched indexes in the world. As such, there are many ways to watch a S&P 500 live stream. Some of the best ways to track the S&P 500 index include: – S&P 500 Live Feed: The S&P 500 live feed is available at various websites including Yahoo Finance and WSJ Market Live. The live feed is a real-time index that shows how the overall market is performing. – S&P 500 Live Chart: S&P 500 live charts are a great way to track the index as you can see how it is trending in real time. – S&-P 500 Historical Graph: You can also track the S&P 500 index with historical graphs that show how the index has performed over time. – S&P 500 Futures: You can also track S&P 500 futures to get an idea of how the index is trending.

Nasdaq Composite Live Stream

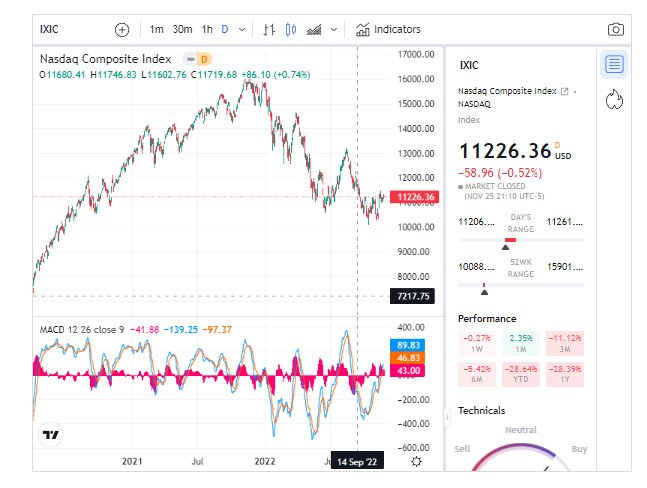

The Nasdaq is a stock market index which tracks the performance of Nasdaq stocks. It is a commonly used broad-based index that is used to track the performance of the technology sector. As such, it is one of the best indicators of how the tech sector is performing. The Nasdaq is a market capitalization weighted index. This means that stocks with higher capitalization have higher weighting in the index.

The Nasdaq is one of the most watched indexes in the world. As such, there are many ways to watch a Nasdaq live stream. Some of the best ways to track the Nasdaq index include:

- – Nasdaq Stock Live Feed: The Nasdaq Live feed is available at various websites including Nasdaq Live and WSJ Market Live. The live feed is a real-time index that shows how the technology sector is performing.

- – Nasdaq Stock Live Chart: Nasdaq live charts are a great way to track the index as you can see how it is trending in real time.

- – Nasdaq Historical Graph: You can also track the Nasdaq index with historical graphs that show how the index has performed over time.

- – Nasdaq Futures: You can also track Nasdaq futures to get an idea of how the index is trending.

DJIA Live Stream

The Dow Jones Industrial Average is a stock market index that tracks the performance of 30 large American companies. It is one of the most commonly used broad-based indexes that is used to track the performance of the American equity market. The DJIA index is a price weighted index. This means that the stocks with higher price have higher weighting in the index. The Dow is one of the most watched indexes in the world. As such, there are many ways to watch a DJIA live stream. Some of the best ways to track the DJIA index include: – DJIA Live Feed: The Dow Live feed is available at various websites including DJIA Live and WSJ Market Live. The live feed is a real-time index that shows how the American equity market is performing. – DJIA Live Chart: DJIA live charts are a great way to track the index as you can see how it is trending in real time. – DJIA Historical Graph: You can also track the DJIA index with historical graphs that show how the index has performed over time. – DJIA Futures: You can also track Dow Jones futures to get an idea of how the index is trending.

Track U.S. Stocks with Streaming Market Indexes Live Streams

You can also track the performance of specific stock quote with streaming market indexes live streams. There are many websites and apps that allow you to stream real-time stock price indices. Some of the best websites and apps to track the performance of specific stocks include: – Yahoo Finance: Yahoo Finance is one of the best websites to track and monitor stocks. It has excellent market data, a great interface and is very easy to use. – Investors log: Investors log is another great website to track and monitor stocks. It has excellent market data and is very easy to use. – Market log: Market log is another great website to track and monitor stocks. It has excellent market data and is very easy to use. – Wall Street Journal Market Live: Wall Street Journal Market Live is one of the best websites to track and monitor stocks. It provides excellent market data and is very easy to use.

How to Watch Streaming Market Indexes Live Streams

The process of watching streaming market indexes live streams is simple. Simply go to a website or app that streams one of the indexes. You can then view the index in real time. That way you will be able to monitor performance in real time without having to log into multiple websites or apps. Streaming market indexes live streams are an excellent way to track performance. You can stream indices such as the S&P 500, Nasdaq and DJIA to get real-time data on how major market sectors and industries are performing. While streaming market indexes are a great way to track performance, they are not a great way to make investment decisions. You can track the performance of various stocks and indices in real time, but that does not mean you will be able to make sound investment decisions based on that data.

DJIA Streaming Market Indexes Live Stream

The Dow Jones is a stock market index that tracks the performance of 30 large American companies. It is one of the most commonly used broad-based indexes that is used to track the performance of the American equity market. The Dow Jones index is a price weighted index. This means that the stocks with higher price have higher weighting in the index. The Dow is one of the most watched indexes in the world. As such, there are many ways to watch a Dow Jones live stream to check of we are on bear market territory or if bulls are coming here.

Some of the best ways to track if Dow Rose or dive, or check the 52 week range, include:

- DJIA Live Feed: The Dow Live feed is available at various websites including DJIA Live and WSJ Market Live. The live feed is a real-time index that shows how the American equity market is performing.

- DJIA Live Chart: Dow Jones Industrial Average live charts are a great way to track the index as you can see how it is trending in real time.

- DJIA Historical Graph: You can also track the DJIA index with historical graphs that show how the index has performed over time.

- Dow Jones Futures: You can also track DJIA futures to get an idea of how the index is trending.

Dow Jones Indices LLC is a global leader in providing investment information and analytics. It offers a wide variety of products and services, including index-based and analytical products, data services, and investment research.

Nasdaq Composite Streaming Market Indexes Live Stream

The Nasdaq is a stock market index which tracks the performance of tech stocks. It is a commonly used broad-based index that is used to track the performance of the technology sector. As such, it is one of the best indicators of how the tech sector is performing. The Nasdaq is a market capitalization weighted index. This means that stocks with higher capitalization have higher weighting in the index. It’s one of the most watched indexes in the world. As such, there are many ways to watch a Nasdaq live stream.

Summing up

The Dow Jones is one of the most widely recognized stock market indexes. It tracks the performance of America’s thirty largest companies based on their market capitalization. The companies are weighted based on market capitalization so that a larger company has more influence on the index than a smaller company does. The index is managed by a committee of market experts. The Dow is named after Charles Henry Dow, one of the founders of Dow Jones & Company. In 1884, Dow created the first ever Dow Jones index, which tracked the performance of eleven stocks from the rail, telegraph, and public utility sectors. Over time, the index expanded to include other sectors, and the number of stocks covered by the index has varied from time to time. Currently, the Dow Jones Industrial Average tracks the performance of America’s thirty largest companies.