The stock market can be unpredictable, with prices fluctuating based on a variety of factors. But understanding these factors and their impact on specific companies can help investors make informed decisions. In today’s market outlook, we’ll take a closer look at two major companies and their recent performance.

Boeing and Disney are both well-known companies with significant influence in their respective industries. However, their recent market performance has been quite different. Boeing experienced a positive boost after Emirates announced a massive $52 billion order, while Disney faced a setback with disappointing numbers from “The Marvels” opening weekend.

Keeping track of market trends and understanding how specific events affect individual companies is crucial for investors. In this market outlook, we will delve into the details of Boeing’s positive news and Disney’s disappointing weekend, providing insights into the potential implications for the companies and the market as a whole.

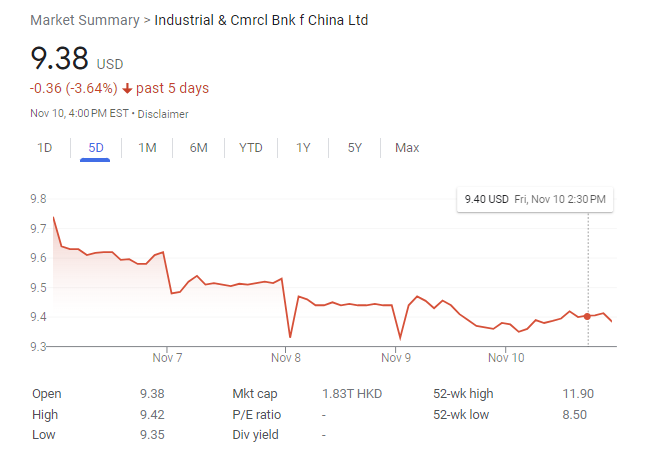

After the Ransomware Attack, ICBC Stock (OTCMKTS: IDCBY) Dropped -3.64% to 9.38 USD

After the ransomware attack on ICBC on Wednesday, the stock price dropped -3.64% to 9.38 USD. This is a significant drop, and it is likely due to a number of factors, including:

- Investor concern about the security of ICBC’s systems. The ransomware attack showed that ICBC is vulnerable to cyberattacks, and this could deter investors from investing in the bank.

- The financial cost of the attack. ICBC was forced to pay a ransom of over $100 million to regain access to its data. This is a significant expense, and it could impact the bank’s profitability in the future.

- The damage to ICBC’s reputation. The ransomware attack damaged ICBC’s reputation as a secure and reliable bank. This could lead to customers withdrawing their money from the bank and could also make it more difficult for ICBC to attract new customers.

It is important to note that the stock market is often volatile, and it is possible that ICBC’s stock price will recover in the future. However, the ransomware attack is a reminder of the risks involved in investing in any financial institution.

In Opposite Movement, Bitcoin increased +2.96% to 36,750.70 USD

In the opposite movement of stocks, Bitcoin increased +2.96% to 36,750.70 USD on the same period that ICBC’s stock price dropped -3.64%.

There are a few possible explanations for this opposite movement. First, it is possible that investors were seeking refuge in Bitcoin after the ransomware attack on ICBC. Bitcoin is often seen as a safe haven asset, and its price can go up when investors are feeling nervous about the traditional financial system.

Second, it is possible that investors were buying Bitcoin in anticipation of a future increase in its value. Bitcoin is a relatively new asset class, and its price has been very volatile in the past. However, some investors believe that Bitcoin has the potential to become a major global currency in the future.

Finally, it is also possible that the increase in Bitcoin’s price was simply due to supply and demand. The supply of Bitcoin is limited, and the demand for Bitcoin has been increasing in recent months. This has led to an increase in the price of Bitcoin.

It is important to note that Bitcoin is a very volatile asset, and its price can go down just as easily as it can go up. Investors should carefully consider their investment objectives and risk tolerance before investing in Bitcoin.

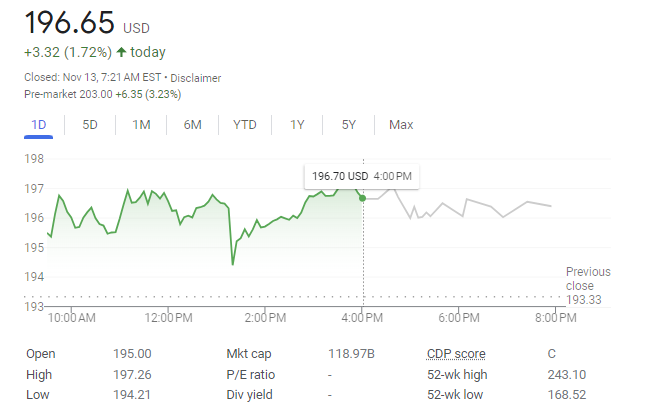

Boeing Stock is Increasing Today +1.72% at 196.65 USD after Emirates announced $52 billion order for 95 Boeing aircraft

Boeing stock is increasing today, November 13, 2023, by +1.72% to 196.65 USD after Emirates announced a $52 billion order for 95 Boeing aircraft. This is a significant order for Boeing, and it is a good sign for the company’s future.

The order from Emirates includes a mix of Boeing 777X and 787 Dreamliner aircraft. The 777X is Boeing’s newest wide-body aircraft, and it is expected to enter service in 2025. The 787 Dreamliner is a popular fuel-efficient aircraft that is already in service with many airlines around the world.The order from Emirates is a good sign for Boeing because it shows that there is still demand for its wide-body aircraft. Boeing has been struggling in recent years due to the COVID-19 pandemic, which has caused a sharp decline in air travel. However, the order from Emirates suggests that airlines are starting to invest in new aircraft again.The order from Emirates is also good news for the aviation industry as a whole. It shows that airlines are confident in the long-term growth of air travel. This is good news for all companies that operate in the aviation industry, including Boeing, Airbus, and other aircraft manufacturers.

US stock futures dipped after Moody’s downgraded the US outlook from “stable” to “negative”

US stock futures dipped after Moody’s downgraded the US outlook from “stable” to “negative” on November 10, 2023. This is a significant downgrade, and it is a sign that Moody’s is concerned about the US economy.

Moody’s cited a number of reasons for the downgrade, including:

- The US’s large and growing budget deficit. The US budget deficit is expected to reach $1.2 trillion in 2023, and it is projected to continue to grow in the coming years. This is a concern for Moody’s because it suggests that the US government will eventually need to raise taxes or cut spending in order to balance its budget.

- The US’s high debt-to-GDP ratio. The US debt-to-GDP ratio is currently at 122%, which is the highest level it has been since World War II. This is a concern for Moody’s because it suggests that the US government is becoming increasingly indebted.

- The risk of political gridlock in the US. The US Congress is currently divided, with the Democrats controlling the House of Representatives and the Republicans controlling the Senate. This division makes it difficult to pass legislation, and it could lead to gridlock in the future. This is a concern for Moody’s because it could make it difficult for the US government to address the challenges facing the economy.

The downgrade from Moody’s is a negative development for the US economy. It could make it more expensive for the US government to borrow money, and it could also deter businesses from investing in the US. The downgrade could also lead to a decline in consumer confidence.

It is important to note that Moody’s is just one of three major credit rating agencies. The other two agencies, Standard & Poor’s and Fitch Ratings, both maintain a “stable” outlook for the US. However, the downgrade from Moody’s is still a significant event, and it is a sign that there are concerns about the US economy.

The US government should take steps to address the concerns raised by Moody’s. The government should develop a plan to reduce the budget deficit and the debt-to-GDP ratio. The government should also work to find common ground with the opposition party in order to avoid gridlock in Congress.

Disney Stock futures is losing -2.29% at 88.27 USD after the ‘The Marvels’ Worst Opening Weekend

Disney stock futures are losing -2.29% at 88.27 USD after the “The Marvels” worst opening weekend. This is a significant drop, and it is likely due to a number of factors, including:

- Investor disappointment in the performance of “The Marvels.” “The Marvels” is the latest film in the Marvel Cinematic Universe (MCU), and it was expected to be a major box office hit. However, the film fell short of expectations, grossing just $47 million in its opening weekend. This is the lowest opening weekend for any MCU film since “Ant-Man” in 2015.

- Concerns about the future of the MCU. The MCU has been incredibly successful for Disney in recent years, but some investors are now concerned that the franchise is starting to lose its momentum. The poor performance of “The Marvels” is just the latest example of this trend.

- General concerns about the entertainment industry. The entertainment industry is facing a number of challenges, including the rise of streaming services and the decline of traditional cable TV. This is making investors cautious about investing in entertainment stocks.

The drop in Disney stock futures is a negative development for the company. It suggests that investors are losing confidence in Disney’s ability to generate profits from its entertainment business. Disney will need to address these concerns if it wants to turn its stock price around.