In the ever-evolving landscape of the financial markets, the Nasdaq today stands as a critical barometer for tech-driven and innovative companies. Reflecting the pulse of major industrial trends and technological advancements, the performance of the Nasdaq-100, along with broader indexes, captivates investors and market analysts worldwide. The importance of keeping abreast of nasdaq stock market today’s movements cannot be understated, as it offers insights into the dynamic nature of global finance, technology sectors, and consumer behavior shifts. Moreover, with figures like Jerome Powell influencing market sentiment through monetary policy decisions, understanding the nuances of the Nasdaq today is more crucial than ever.

This article will explore the latest market trends, highlighting significant movements in the Nasdaq-100 today and discussing how recent regulatory changes are shaping investment strategies. Additionally, it will delve into the potential investment opportunities emerging within this landscape and assess the impact of these trends on the broader stock market trends. By providing a comprehensive overview of the current state of the Nasdaq, this piece aims to offer valuable insights for investors looking to navigate the complexities of the nasdaq stock market today, ensuring readers are well-informed of the critical factors at play in making investment decisions.

Nasdaq Today

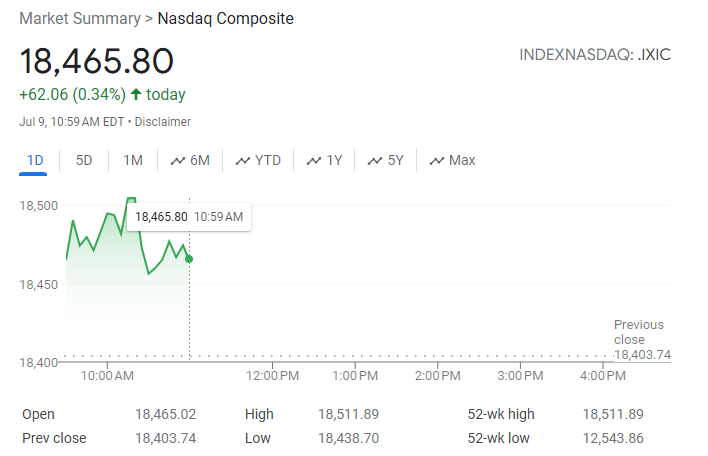

NASDAQ Composite Update – July 9, 2024

Early Trading Performance:

- Index: NASDAQ Composite (IXIC)

- Current Level: 18,465.80

- Change: Up 0.34%

Key Data Points

- Opening Price: 18,465.02

- High: 18,511.89

- Low: 18,438.71

- Volume: 211.79M shares

- Previous Close: 18,403.74

- Change from Previous Close: +0.33%

Summary

In early trading on July 9, 2024, the NASDAQ Composite Index increased by 0.34%, reaching a level of 18,465.80. This performance comes after the index opened at 18,465.02 and traded between a high of 18,511.89 and a low of 18,438.71. The trading volume for the session so far stands at 211.79 million shares.

Additional Information

- Market Sentiment: Positive, with a slight increase in the index

- Comparative Performance: The previous day’s close was at 18,403.74, marking a 0.33% rise.

Main Economic Factors Influencing NASDAQ Today – July 9, 2024

Several key economic factors are set to influence the NASDAQ Composite Index today:

1. Federal Reserve Chair Jerome Powell’s Testimony

- Jerome Powell is scheduled to testify before Congress this week. His statements are highly anticipated as they may provide insights into the Federal Reserve’s stance on interest rates and economic growth.

2. Upcoming Inflation Data

- Investors are closely watching the release of inflation data, specifically the Consumer Price Index (CPI) and Producer Price Index (PPI), later this week. These reports will offer critical information on inflation trends, which could impact market sentiment and the Fed’s monetary policy decisions.

3. Second-Quarter Earnings Season

- The second-quarter earnings season kicks off this week with reports from major companies including Delta Air Lines, PepsiCo, Citigroup, and JPMorgan Chase. The performance of these companies could influence market dynamics and investor sentiment.

4. Economic Data on Consumer Credit

- A recent report from the Federal Reserve showed an increase in consumer credit for May by $11.3 billion, which was higher than the consensus of $8 billion. This data might impact perceptions of consumer spending and economic health.

5. Market Sentiment and Recent Performance

- The NASDAQ Composite has been on an upward trend, recently closing at record levels. This positive momentum could be influenced by the aforementioned economic factors and investor reactions to them.

Summary

Today’s economic landscape is heavily influenced by expectations surrounding Jerome Powell’s testimony, upcoming inflation data, the beginning of the earnings season, and recent consumer credit data. These factors collectively contribute to the market sentiment and could significantly impact NASDAQ’s performance throughout the trading day.

Latest Market Trends

Current Performance Metrics

The Nasdaq-100 has demonstrated a robust increase, marking a 5.5% rise in December, contributing to an annual performance surge of 53.8% on a price return basis . Index Values are consistently updated throughout the day to reflect real-time market conditions, ensuring investors receive the most current data .

Sector Analysis

December showed significant strength across various sectors, with notable performances in the Nasdaq Thematic Tech Indexes and Nasdaq Green Economy Indexes, each averaging gains of 8-9%. The Nasdaq CTA Global Digital Payments and Nasdaq Lux Health Tech were among the top performers, each registering a 13.4% increase . This sector-wide growth underscores the diverse investment opportunities within the Nasdaq indexes.

Notable Stock Movements

Within the Nasdaq’s active trading landscape, the Nasdaq Most Active by Share Volume and Nasdaq Most Active by Dollar Volume lists are updated throughout the day, reflecting the dynamic trading environment . This includes high-performing stocks such as Nvidia, which has seen a remarkable 220% year-to-date increase, primarily driven by its booming data center business .

Investment Opportunities

Emerging Sectors

The construction and automotive sectors have shown remarkable growth, driven by specific catalysts such as a shortage in housing inventory and a surge in electric vehicle adoption. Notably, the construction sector gained more than 50%, with homebuilder stocks increasing about 80% due to a lack of resale market inventory and favorable mortgage rates . The automotive sector, boosted by the electric vehicle trend, promises exciting developments, with companies like Blue Bird experiencing a 159% increase .

Top Performing Stocks

In the realm of top-performing stocks, technology and restaurant sectors have outshined others. Nvidia, a leader in visual computing technologies, has seen a dramatic 237% increase, supported by strong earnings and growth in the AI sector . Similarly, Carrols Restaurant Group, the largest Burger King franchisee in the U.S., surged by 464%, reflecting significant consumer confidence and spending . These examples highlight sectors and companies that have more than doubled their market value, offering lucrative investment opportunities.

Investor Sentiments

Investor sentiment remains a crucial barometer for market trends. Currently, US Investor Sentiment, % Bullish stands at 41.74%, slightly down from last week but still above the long-term average of 37.62% . This indicates a generally positive outlook among investors, which can guide investment strategies, particularly in identifying bullish trends in the market.

Regulatory Changes and Their Impact

Recent Policy Updates

Institutional trading firms in the U.S. are currently navigating an environment of increased regulation, with significant repercussions for non-compliance. The Securities and Exchange Commission (SEC), under Chair Gary Gensler, has been particularly active, introducing proposals that have stirred controversy, such as adjustments to equity market structure . Similarly, the Commodity Futures Trading Commission (CFTC) has intensified its focus on enforcement, with heavier monetary penalties aimed at deterring misconduct . These regulatory bodies emphasize the necessity for brokers to enhance their compliance measures, which now often involves the integration of advanced technological systems to manage these requirements efficiently .

Implications for Traders

The regulatory landscape significantly affects trading strategies, particularly in markets like forex where leverage limits have been imposed to mitigate risk . These restrictions reduce the amount of borrowed capital traders can use, prompting a shift towards more conservative trading strategies and enhanced risk management . High-frequency traders, for instance, must adapt to stringent real-time reporting requirements, necessitating robust technological infrastructure to comply . Moreover, the broader financial sector faces increased capital requirements, which can constrain liquidity and influence market dynamics .

Future Predictions

Looking ahead, the regulatory environment is expected to evolve further, particularly with the transition from T+2 to T+1 settlement for equity trades set for May 2024, which will require significant adjustments from market participants . Additionally, expansions in regulations like the Regulation Systems Compliance and Integrity (Reg SCI) are anticipated to broaden its application to larger broker-dealers, increasing the regulatory scope and complexity . These changes underscore the ongoing need for firms to reassess and possibly streamline their compliance and technological frameworks to remain competitive and compliant in the changing regulatory landscape .

Conclusion

Throughout this exploration of the Nasdaq’s current landscape, it’s clear that the market is continuously impacted by a myriad of factors, from sector-specific growth trends to broader economic and regulatory changes. The significant performance metrics and diverse sector analysis discussed underscore the rich tapestry of investment opportunities and challenges that lie within the Nasdaq indexes. These insights not only highlight the dynamic nature of the market but also serve as a crucial resource for investors aiming to navigate its complexities with informed strategies and an eye toward future trends.

As we look ahead, the implications of regulatory changes and the evolving investment landscape will undoubtedly shape the course of trading and investment strategies in profound ways. The pointed analysis of regulatory shifts and their impact on market practices offers a forward-looking view on how traders and institutions can adapt to remain compliant and competitive. This article, by delving into key trends and shifts within the Nasdaq today, provides a comprehensive overview that empowers investors to make more nuanced and informed decisions in a rapidly changing environment.