In today’s rapidly fluctuating financial landscape, the performance of major stock indexes such as the Nasdaq not only reflects the current economic pulse but also predicts future market trends. Particularly, the Nasdaq today witnessed a notable increase of 0.42%, a movement that garnered widespread attention from investors and analysts alike. This uptick is especially significant considering the influence of global economic indicators and corporate earnings reports on market sentiment. With Jerome Powell’s recent testimony playing a pivotal role in shaping investor outlook, understanding the nuances of today’s market dynamics becomes crucial for both seasoned participants and those new to the trading floor.

As we delve deeper into the article, our focus will shift towards a comprehensive overview of the Nasdaq’s performance, including a detailed analysis of the Nasdaq-100 and key stocks that have made notable movements. Additionally, we will examine the direct impact of Jerome Powell’s testimony on the market, highlighting how his words influence both the Nasdaq index today and futures. By exploring the various factors influencing market sentiment, such as earnings, the performance of the Dow and Nasdaq today, and the landscape of nasdaq futures today, readers will gain a holistic view of the intricate interplay between political, economic, and corporate events on the stock market. Through this lens, we aim to provide valuable insights into the current state and future prospects of investing in the Nasdaq stock market today.

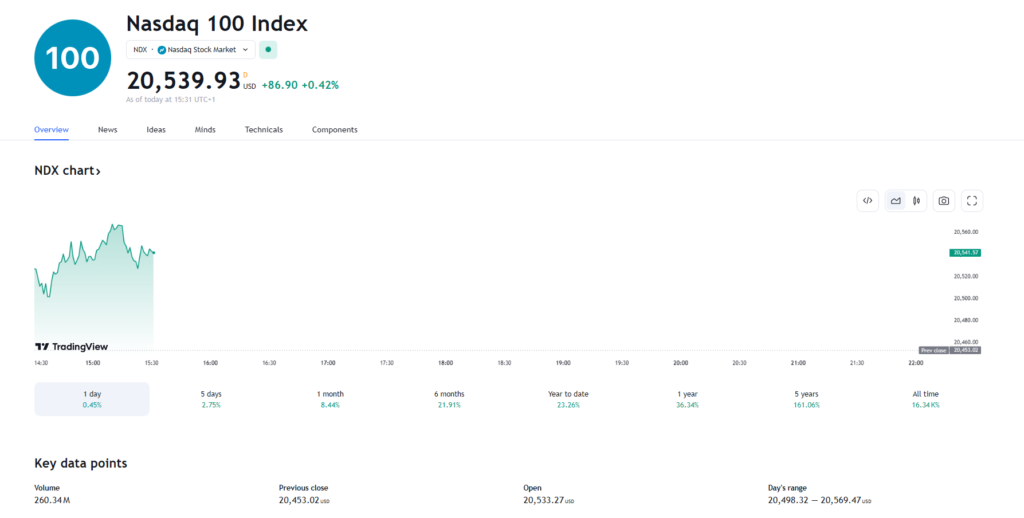

Market Overview of Nasdaq’s Performance

Statistical Highlights

The Nasdaq Composite Index and the Nasdaq-100 have shown notable movements in today’s market. The Nasdaq-100 Equal Weighted Index also reflects significant activity, capturing a broad spectrum of retail trading dynamics. The Retail Trading Activity Tracker indicates a positive buy/sell sentiment, suggesting an increased retail investor engagement in the Nasdaq markets . This engagement is quantified by the “% of Retail Activity,” which measures the proportion of USD traded by retail investors against the total USD traded across all tickers .

Key Movers

Today’s trading session highlighted several top gainers and losers within the Nasdaq-100. Notable gainers included NVIDIA, which saw a price increase of 2.31%, and Micron Technology, with a 3.03% rise . On the flip side, significant losses were observed in companies like Old Dominion Freight Line and CrowdStrike, with declines of 1.25% and 1.32%, respectively . These movements are crucial indicators of market sentiment and potential trends in the Nasdaq stock market today.

The data underscores the dynamic nature of the Nasdaq market, influenced by both macroeconomic factors and individual corporate performances. This detailed overview provides investors with critical insights into the factors driving market movements and the potential strategies for navigating the Nasdaq stock market today.

Impact of Powell’s Testimony

Summary of Testimony

Federal Reserve Chair Jerome Powell’s recent testimony before Congress emphasized the central bank’s cautious approach towards inflation and interest rate adjustments. Powell highlighted that while inflation shows signs of cooling, the Federal Reserve requires more “good data” to confidently move towards its 2% inflation target . He reiterated the delicate balance the Fed must maintain; lowering rates too hastily might reverse progress on inflation, whereas maintaining higher rates for too long could harm economic growth and employment .

Market Reaction

The market’s response to Powell’s testimony was mixed, reflecting the complexity of the economic signals and the Fed’s cautious stance. Initially, the stock market dipped as investors processed the potential for more aggressive rate hikes and the looming risk of a recession . However, the markets later recovered some losses, indicating a nuanced investor interpretation of Powell’s remarks . This recovery suggests that investors might have found some reassurance in Powell’s commitment to a balanced policy approach, even amidst discussions of potential economic slowdowns and interest rate strategies .

Factors Influencing Market Sentiment

Technological Stock Performance

The NASDAQ-100 Technology Sector Index (NDXT) provides a snapshot of the performance within the technology sector, highlighting significant movements and trends . Despite the unavailability of real-time quote data, investors can leverage tools like the Nasdaq+ Scorecard to analyze stocks based on specific investment priorities and market data, offering insights into the technological stocks’ current standings and future potentials .

Economic Data Releases

Recent economic data releases have played a pivotal role in shaping market sentiment. For instance, ON Semiconductor experienced a notable decline, dropping over 4% after announcing a workforce reduction, impacting investor perspectives on the semiconductor industry . Conversely, Adobe’s stock surged over 14% following strong quarterly results and optimistic future earnings guidance, reflecting investor confidence in the creative software sector .

Global economic indicators also influence market dynamics, as seen with Chinese economic data. May’s Industrial Production and Retail Sales figures came in mixed, with production slightly below expectations and retail sales outperforming forecasts . Such data points are crucial for investors who monitor international markets for cues on global economic health and its impact on the Nasdaq.

In the U.S., key reports such as the Consumer Price Index (CPI) and Producer Price Index (PPI) are closely watched. The CPI, a critical inflation measure, along with the PPI, an early indicator of inflationary trends, directly influence Federal Reserve’s policy decisions, affecting investor strategies and market sentiment .

Conclusion

Through the comprehensive overview provided, it’s clear that the performance of the Nasdaq today, influenced by a spectrum of internal and external factors, presents a multifaceted picture of the current financial environment. Key movements within the Nasdaq-100 and significant corporate performances, coupled with Jerome Powell’s cautious yet optimistic testimony, have signaled a nuanced navigation through the economic indicators and corporate earnings reports. This synthesized understanding underscores the intricate relationship between macroeconomic policies, global economic indicators, and individual corporate strategies, all of which are critical in shaping the market’s direction and investor sentiment.

The exploration into the factors influencing market sentiment and technological stock performance further elucidates the dynamic nature of the financial markets and the critical role of economic data releases in investment decision-making. As investors and analysts digest this plethora of information, the insights garnered offer a forward-looking perspective on the potential trajectories of the Nasdaq market. Moving ahead, continuous monitoring of economic indicators, alongside a keen observation of corporate earnings reports and global economic performances, will be essential in navigating the complexities of the market. It encourages a proactive approach to investment, highlighting the importance of informed decision-making in the pursuit of financial success.