Welcome to the Nasdaq, the world’s second-largest stock exchange. It’s a great place for investors to find high-growth stocks and new investment opportunities. But what are the top Nasdaq gainers today? In this blog post, we’ll take a closer look at the top Nasdaq gainers, leading by chipmakers, and uncover some of the strategies and benefits of investing in Nasdaq stocks.

Introduction to the Nasdaq

The Nasdaq exchange is an American stock exchange located in New York City. It was founded in 1971 and is the second-largest stock exchange in the world by market capitalization. The Nasdaq is home to more than 3,000 publicly traded companies, including the world’s largest technology companies such as Apple, Microsoft, and Amazon.

Read this FintechZoom Article: Discover the Green Revolution: EV Vehicles Production Is Taking Off!

The Nasdaq is a great place to find stocks with high potential for growth. As such, the Nasdaq is the go-to exchange for investors looking to capitalize on the potential of new and innovative companies. From artificial intelligence to biotechnology, the Nasdaq is the place to find the cutting edge of technology.

Top Nasdaq Gainers

Now let’s take a look at some of the top Nasdaq gainers. These are the stocks that have seen the biggest increases in their share prices over the past year. Let’s take a closer look at some of the top Nasdaq gainers.

2.1. Rivian Automotive Stock +10.60%

Rivian Automotive is a Michigan-based electric vehicle company that is revolutionizing the auto industry. The company has seen its share price skyrocket over the past year, with its stock more than tripling in value. The company’s success can be attributed to its innovative approach to electric vehicles, which has allowed it to stand out from its competitors.

Rivian has also benefited from its strategic partnerships with companies such as Amazon and Ford. Its partnership with Amazon has allowed it to develop a fleet of electric delivery vehicles, while its partnership with Ford has enabled it to develop a fleet of electric pickup trucks.

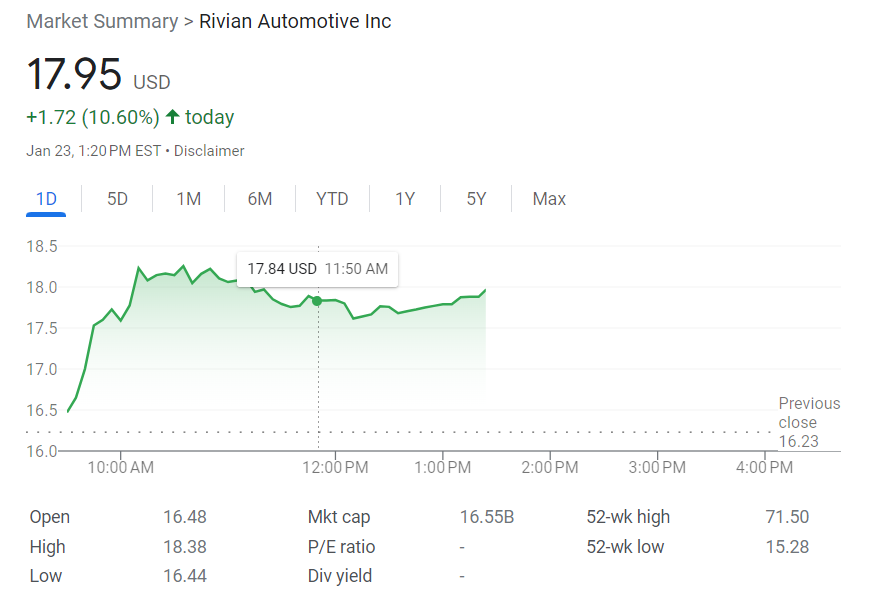

Today Nasdaq is boosting with the news of a $4.84 million investment from SeaTown Holdings Pte Ltd. in Rivian Automotive, Inc. Rivian Stock is now trading at 17.95 USD with a net increase of 10.60%. This is great news for all investors who are considering investing in Rivian Stock.

Rivian Stock is a leading electric vehicle company that is changing the way people experience transportation. They are dedicated to creating the most advanced, sustainable and cost-effective vehicles available. With the new investment, Rivian Stock is looking to expand their production line and create even more innovative products.

The new investment in Rivian Stock provides a great opportunity for investors to get in on the ground floor of a cutting-edge company. Rivian Stock has a strong track record of success, and this investment is likely to further propel their growth in the coming years. The new investment in Rivian Stock is a significant step towards their goal of becoming a global leader in electric vehicles.

Rivian Stock is now a great option for investors who are looking to make a long-term investment. The new investment in Rivian Stock will help the company to continue to grow and develop its electric vehicle offerings, making it an even better investment option for those looking for long-term returns. Rivian Stock is an exciting investment for those looking to get involved in the electric vehicle market.

2.2. AMD Stock +7.81%

AMD is a US-based semiconductor company that designs and manufactures computer processors and graphics cards. The company has seen its share price increase by more than 200% over the past year, as investors have been drawn to the company’s cutting-edge technology.

AMD’s success can be attributed to its ability to stay ahead of the competition. The company has been able to develop new technologies faster than its competitors, allowing it to stay ahead of the curve. Furthermore, AMD’s strategic partnerships with companies such as Microsoft and Google have allowed it to develop new products and services.

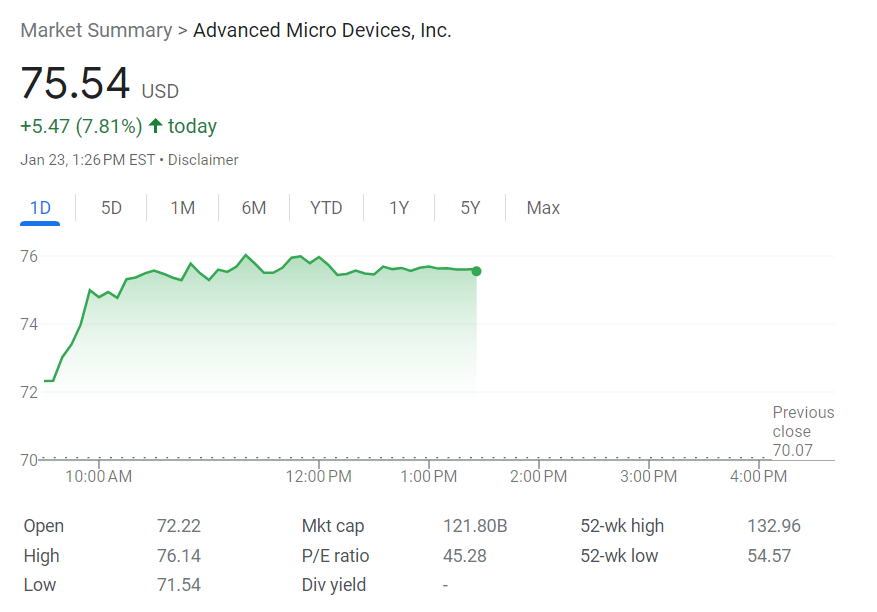

AMD Stock has had a great day today, with an increase of 7.81% at 75.54 USD. This has made AMD Stock the talk of the town on the Nasdaq today.

This increase in AMD Stock is due to the upgrade by Barclays, which gave it a price target boost. This upgrade was based on AMD Stock’s overall performance in the market, which has been impressive. The increase in AMD Stock price is reflective of the positive sentiment around the company and its products.

AMD Stock has been on a steady rise since the beginning of the year and this increase today has only made it better. This upgrade by Barclays is a testament to the faith that the investors have in AMD Stock. This is further reflective of the company’s success in its product launches and initiatives.

The increase in AMD Stock today is a sign of the company’s potential and growth in the market. This is a very positive sign for the company, as it shows that investors are confident in the company and its products. This is also indicative of the company’s strong competitive position in the market.

Overall, AMD Stock has had a great day today, with an increase of 8.39% at 75.95 USD. This increase in AMD Stock is due to the upgrade by Barclays, which gave it a price target boost. This is a very positive sign for the company and its investors, as it shows that AMD Stock is on a steady rise and has potential for further growth in the market.

2.3. Qualcomm Stock +6.67%

Qualcomm is a US-based semiconductor and telecommunications company that designs and manufactures mobile processors and modems. The company has seen its share price increase by more than 100% over the past year, as investors have been drawn to its innovative technology.

Qualcomm has been able to stay ahead of the competition by developing new technologies faster than its competitors. The company’s 5G technology has been an especially attractive investment opportunity, as it has allowed the company to capitalize on the growth of the 5G market. Furthermore, Qualcomm’s strategic partnerships with companies such as Apple and Samsung have allowed it to develop new products and services.

2.4. Nvidia Stock +6.19%

Nvidia is a US-based semiconductor company that designs and manufactures graphics cards. The company has seen its share price increase by more than 150% over the past year, as investors have been drawn to its cutting-edge graphics technology.

Nvidia has been able to stay ahead of the competition by developing new technologies faster than its competitors. The company’s graphics cards have become increasingly popular with gamers, as they offer superior performance compared to its competitors. Furthermore, Nvidia’s strategic partnerships with companies such as Microsoft and Sony have allowed it to develop new products and services.

Strategies for Investing in Nasdaq Stocks

When investing in Nasdaq stocks, it’s important to do your research and understand the company and the industry it operates in. This will help you make informed decisions about which stocks to invest in. Additionally, it’s important to diversify your investments and spread your risk across multiple stocks.

It’s also important to keep track of the news about the stocks you’re investing in. This will help you stay up-to-date on the latest developments in the company and the industry, which can help you make better decisions about when to buy and sell stocks.

Finally, it’s important to have a long-term strategy. Investing in Nasdaq stocks can be risky, so it’s important to have a plan for when and how to exit a position.

Benefits of Investing in Nasdaq Stocks

Investing in Nasdaq stocks can be a great way to diversify your investments and increase your potential returns. The Nasdaq is home to some of the world’s largest and most innovative companies, which can provide investors with the potential for high returns. Additionally, investing in Nasdaq stocks can help you access new markets and industries that you may not have been able to invest in otherwise.

Furthermore, investing in Nasdaq stocks can be a great way to diversify your portfolio and spread your risk across multiple stocks. By diversifying your investments, you can protect yourself from market fluctuations.

How to Monitor Nasdaq Stocks

Monitoring Nasdaq stocks is an important part of the investing process. By keeping track of the news and developments in the company and the industry, you can stay up-to-date on the latest developments and make informed decisions about when to buy and sell stocks.

Additionally, it’s important to keep an eye on the stock market and monitor the performance of the stocks you’re invested in. This will help you stay on top of any changes in the stock price and make sure you’re not missing out on any potential opportunities.

Finally, it’s important to have a system in place to monitor your investments. This could be as simple as setting up alerts or using a financial tracking app.

Conclusion

Investing in Nasdaq stocks can be a great way to diversify your investments and increase your potential returns. By doing your research, diversifying your investments, and monitoring your stocks, you can take advantage of the potential for high returns in the Nasdaq stock market. So what are you waiting for? Start investing today and soar to new heights!