When it comes to investing, there are countless options available. But two assets that have gained significant attention in recent years are gold and bitcoin. Both have their avid supporters and skeptics, but which one is truly the best investment? In this article, we will explore the pros and cons of investing in gold and bitcoin, helping you make an informed decision about where to put your money. Whether you’re a seasoned investor or just starting out, understanding the differences between these two assets is crucial for making the right investment choice.

Also read: Bitcoins ATM Near Me – The Ultimate Guide.

Gold and Bitcoin Advantages and Disadvantages

Whether gold or bitcoin is the better investment depends on your individual circumstances and investment goals. Both assets have their own advantages and disadvantages.

Gold

- Advantages:

- Has a long history of retaining its value over time

- Is a tangible asset that can be held and used physically

- Is relatively stable and less volatile than bitcoin

- Disadvantages:

- Can be difficult and expensive to store and transport

- Is subject to government regulation and taxation

- Has limited growth potential

Bitcoin

- Advantages:

- Is a digital asset that is easy to store and transport

- Is not subject to government regulation or taxation

- Has the potential for high returns

- Disadvantages:

- Is a new and untested asset

- Is highly volatile and can experience wild price swings

- Is not widely accepted as a form of payment

Which is Better?

Ultimately, the best investment for you depends on your risk tolerance, investment goals, and time horizon. If you are looking for a safe and stable investment that has a long history of retaining its value, gold may be a better choice. If you are willing to take on more risk for the potential of higher returns, bitcoin may be a better option.

Here is a table that summarizes the key differences between gold and bitcoin:

| Characteristic | Gold | Bitcoin |

|---|---|---|

| History | Thousands of years | Less than 15 years |

| Tangibility | Yes | No |

| Volatility | Low | High |

| Liquidity | High | Medium |

| Government regulation | Yes | No |

| Growth potential | Limited | High |

It is important to note that both gold and bitcoin are risky investments. You should never invest more than you can afford to lose. It is also important to do your own research before investing in either asset.

Bitcoin Price Today

Currently Bitcoin is 26,842.40USD. In Past year Bitcoin increased +7,424.80 (+38.24%)

This is a significant increase, but it is important to note that Bitcoin is a highly volatile asset, and its price can fluctuate wildly. It is also important to remember that past performance is not indicative of future results.

If you are considering investing in Bitcoin, it is important to do your own research and understand the risks involved.

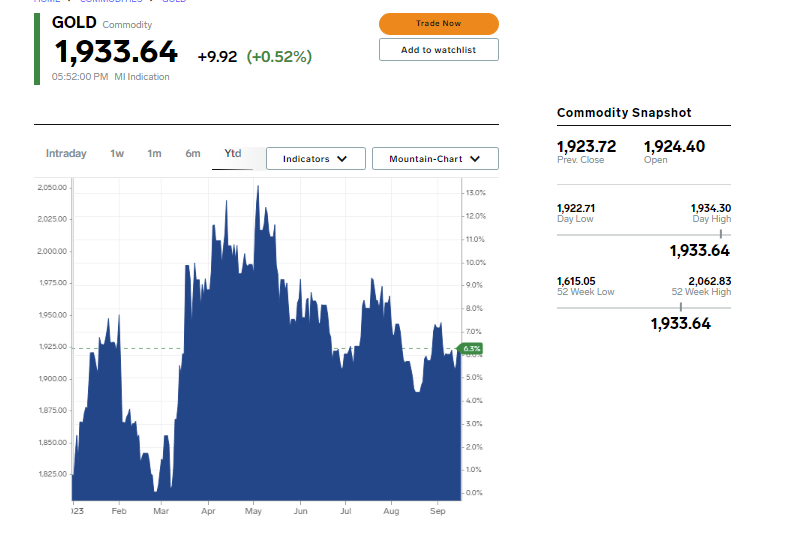

Gold Price Today

Gold Price change over selected period: 15.6% +260.98.

Considering past year, the best investment was on Bitcoin than Gold. Bitcoin increased +38.24% and Gold increased +15.6%. However Bitcoin is highly volatile asset.

Conclusion

Bitcoin outperformed gold in terms of investment return in the past year. However, it is important to note that Bitcoin is a much more volatile asset than gold. This means that its price can fluctuate more wildly, both up and down.

If you are considering investing in Bitcoin, it is important to weigh the risks and rewards carefully. If you are looking for a safe and stable investment, gold may be a better choice. If you are willing to take on more risk for the potential of higher returns, Bitcoin may be a better option.

It is also important to remember that past performance is not indicative of future results. Bitcoin is a new and untested asset, and its price is still highly speculative.

Here are some things to consider before investing in Bitcoin:

- Volatility: Bitcoin is a highly volatile asset, and its price can fluctuate wildly. This means that you could lose a significant amount of money on your investment in a short period of time.

- Regulation: Bitcoin is not subject to government regulation, which means that there is no investor protection if something goes wrong.

- Acceptance: Bitcoin is not widely accepted as a form of payment, so it can be difficult to use your investment to purchase goods and services.

If you do decide to invest in Bitcoin, it is important to only invest money that you can afford to lose. You should also diversify your portfolio by investing in a variety of different assets.