Stripe, a leading online payment processing company, has made a significant move in the crypto space. The company has acquired Bridge, a stablecoin infrastructure provider, in a deal worth $1.1 billion. This acquisition marks Stripe’s entry into the world of stablecoins, which are cryptocurrencies designed to maintain a stable value relative to traditional currencies.

This deal has far-reaching implications for the global payments landscape. It shows Stripe’s commitment to expanding its services beyond traditional online payments. The acquisition of Bridge will allow Stripe to offer its businesses new options for cross-border transactions and currency management. It also highlights the growing importance of stablecoins in the broader financial ecosystem, as more companies look to harness the benefits of blockchain technology while minimizing volatility risks.

Stripe’s Strategic Move into Stablecoins

Overview of the $1.1 billion acquisition

Stripe, the global payments giant, has made a significant leap into the world of digital assets with its acquisition of Bridge, a stablecoin infrastructure provider. The deal, valued at $1.1 billion, marks Stripe’s largest acquisition since its founding in 2010 1. This move signals Stripe’s commitment to expanding its services in the rapidly evolving cryptocurrency sector, with a specific focus on stablecoin solutions.

Bridge, founded in 2022, has quickly established itself as a key player in the stablecoin market. The company’s technology allows businesses to move, store, and accept stablecoins using just a few lines of code . This acquisition positions Stripe to offer instant, low-cost settlements through stablecoins, potentially revolutionizing global transactions.

Stripe’s motivation for entering the stablecoin market

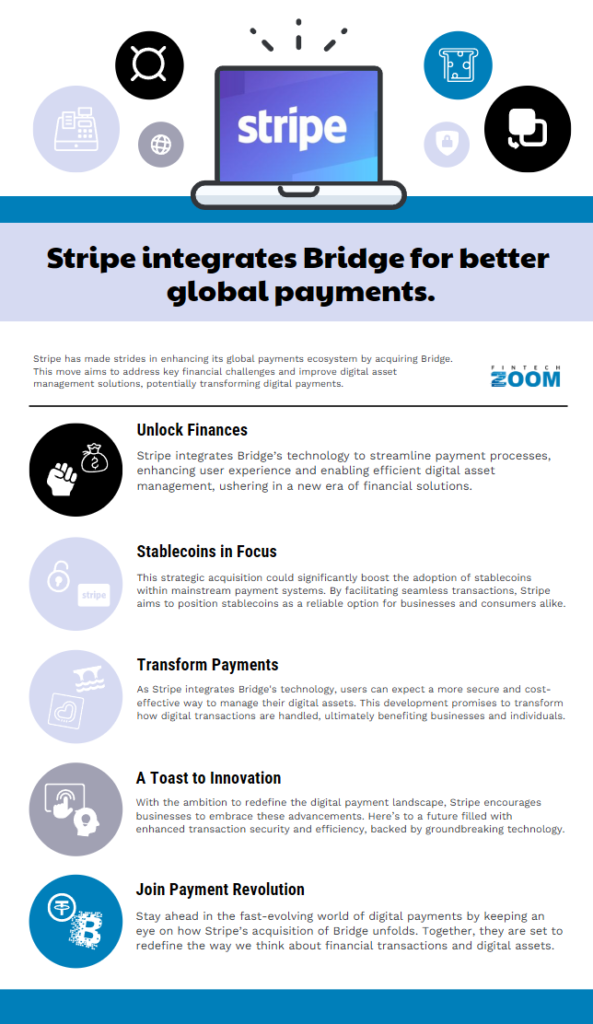

Stripe’s decision to acquire Bridge aligns with its vision to enhance its global payments infrastructure. By integrating Bridge’s technology, Stripe aims to address critical financial problems and offer more efficient, secure, and cost-effective digital asset management solutions to its clients. According to FintechZoom.com, this move could lead to wider adoption of stablecoins in mainstream payment systems.

The acquisition comes at a time when stablecoins are gaining traction as a next-generation payment platform. Stripe’s CEO, Patrick Collison, emphasized the potential of stablecoins, stating, “Thanks to stablecoins, businesses around the world will benefit from significant speed, coverage, and cost improvements in the coming years” . This sentiment reflects Stripe’s belief in the long-term potential of stablecoins to reshape the payments landscape.

FintechZoom.com’s analysis of the deal’s significance

FintechZoom.com suggests that this acquisition could have far-reaching implications for the fintech and crypto industries. By leveraging Bridge’s expertise, Stripe is poised to become a major player in the digital asset space, aligning with broader trends of fintech giants embracing blockchain technology.

The deal is expected to accelerate the adoption of stablecoins and unlock new possibilities for developers, businesses, and consumers worldwide. FintechZoom.com notes that Stripe’s entry into the stablecoin market will likely increase competition among fintechs offering stablecoin-based payment services, potentially leading to innovation and improved offerings across the industry.

Moreover, as reported by FintechZoom.com, Stripe’s move into stablecoins could attract more crypto-friendly businesses and customers, allowing for smoother cross-border transactions. This aligns with Stripe’s goal of building “the world’s best stablecoin infrastructure” , which could significantly impact the global financial landscape.

Bridge: A Stablecoin Infrastructure Pioneer

Bridge’s founding and rapid growth

Bridge, a stablecoin infrastructure provider, was founded in 2022 by former Coinbase executives Zach Abrams and Sean Yu. The company quickly established itself as a key player in the stablecoin market, offering innovative solutions for businesses to integrate stablecoin functionalities. According to FintechZoom.com, Bridge’s rapid growth caught the attention of major investors, leading to a successful USD 58 million funding round in August, led by Sequoia Capital, Ribbit Capital, and Index Ventures 1.

The company’s impressive trajectory is evident in its processing of over USD 5 billion in annualized payment volume, a testament to its growing influence in the digital asset space . This rapid expansion has positioned Bridge as a formidable player in the stablecoin infrastructure sector, attracting the attention of industry giants like Stripe.

Key features of Bridge’s stablecoin platform

Bridge’s platform stands out for its user-friendly approach to stablecoin integration. The company’s Orchestration APIs allow businesses to seamlessly incorporate stablecoin capabilities into their existing financial systems. This feature has made it easier for both crypto-native and traditional firms to harness the benefits of stablecoins without grappling with the underlying blockchain complexities.

One of Bridge’s standout offerings is its ability to facilitate the creation, storage, sending, and acceptance of various stablecoins, including popular options like Tether’s USDT and Circle’s USDC . This versatility has made Bridge an attractive option for businesses looking to expand their payment options and tap into the growing stablecoin market.

FintechZoom.com notes that Bridge’s platform also offers global USD and EUR accounts, enabling users to transfer funds across different blockchains such as Ethereum, Base, and Solana. This cross-chain functionality enhances the platform’s utility for businesses operating in multiple jurisdictions.

Notable clients and partnerships

Bridge’s innovative approach and robust infrastructure have attracted a diverse range of clients, from tech giants to financial institutions. According to FintechZoom.com, some of Bridge’s notable clients include SpaceX, Coinbase, Stellar, and Strike . This impressive client list showcases the platform’s ability to cater to the needs of both established companies and emerging players in the crypto space.

The company has also formed strategic partnerships to expand its reach and capabilities. For instance, Bridge has collaborated with Bitso to conduct stablecoin-based B2B cross-border payments in Latin America, significantly reducing costs compared to traditional SWIFT transfers. Additionally, partnerships with African fintech company Chipper Cash and Dolar App have enabled consumers in Africa and Latin America to save and spend in USD, broadening access to stable currencies in regions with volatile local economies.

These partnerships and client relationships highlight Bridge’s role in facilitating global financial transactions and its potential to transform cross-border payments. As Stripe acquires Bridge, this extensive network of clients and partners is likely to play a crucial role in Stripe’s expansion into the stablecoin market, potentially reshaping the landscape of digital payments.

Implications for the Global Payments Landscape

Potential disruption of traditional cross-border payments

Stripe’s acquisition of Bridge has the potential to cause a revolution in the world of cross-border payments. Traditional methods, such as wire transfers and international bank transfers, often involve high fees and lengthy processing times. According to FintechZoom.com, these transactions can take days or even weeks to complete, causing inconvenience for both senders and recipients. In contrast, stablecoin transactions facilitated by Stripe’s new infrastructure could be completed in a matter of minutes or seconds 1.

This speed and efficiency have the potential to disrupt the existing payment landscape dominated by established players like Mastercard and Visa. FintechZoom.com reports that these companies extracted combined revenues of USD 13.40 billion from cross-border payments in 2019 alone . Stripe’s entry into the stablecoin market could challenge this dominance by offering a more cost-effective alternative.

Enhanced speed and cost-efficiency in transactions

One of the most significant advantages of Stripe’s move into stablecoins is the potential for enhanced speed and cost-efficiency in transactions. Traditional cross-border payments often involve multiple intermediaries, each charging fees that can accumulate significantly. FintechZoom.com notes that some stablecoins have fees as low as 0.1% for conversion from and to fiat currencies, with network fees potentially less than USD 1.00 .

This cost-effectiveness could be particularly beneficial for small and medium-sized enterprises (SMEs) engaged in international trade. FintechZoom.com highlights that SMEs make up 90% of businesses and 50% of jobs globally, and easier access to international payments could significantly boost their operations .

Market Expert Comment

Marca Wosoba, COO of ZBD, a payments company which aims to power the future of digital economies has shared her thoughts to FintechZoom.com:

“Stripe’s acquisition of Bridge is newsworthy, as this is yet another major fintech entering the crypto space, following Robinhood’s $200 million acquisition of Bitstamp in June this year. This acquisition further demonstrates that traditional fintech companies are increasingly recognising the value of crypto to transform industries and leapfrog outdated payment technologies and infrastructure. Fintech giants like Stripe are also taking advantage of current valuation multiples—which haven’t yet recovered from their 2021 highs—to acquire crypto businesses at relatively attractive prices.

Stripe’s acquisition of Bridge is clearly a bet on stablecoins and their potential to revolutionise cross-border payments, which remain inefficient in terms of both speed and cost. These transactions also lack transparency—payments can take multiple days to process, with limited visibility for both the sender and the recipient. In a world where real-time/instant payments have existed since the UK introduced Faster Payments in 2008, the fact that cross-border payments remain so inefficient 16 years later is astonishing. The industry can and must transform cross-border payments—and stablecoins, alongside other cryptocurrencies, have a significant role to play in this evolution. I’m excited to see what emerges”

Konstantin Shulga, CEO and co-founder of Finery Markets told to FintechZoom.com:

“2025 could be a pivotal one for M&A in the crypto industry. The recent deals signal that the big consolidation wave is approaching in the crypto space. This trend is supported by the increasing adoption by institutions and the urgency for startups to secure new funding for scaling.”

Bridge’s technology empowers businesses to seamlessly move, store, and accept stablecoins with minimal coding effort. By leveraging Bridge’s Issuance APIs, companies can both accept and issue their own stablecoins. Once integrated, this technology allows businesses to conduct global transactions with remarkable speed and reduced costs.

This advancement fosters a more regulated landscape for stablecoins and heralds heightened competition among issuers.

Konstantin and Finery Markets told to FintechZoom.com:

Stablecoins have clearly found their product-market fit in the real world, as they reduce friction for global payments and international money remittance businesses. Stripe’s recent activity serves as a benchmark for this tidal wave. In October, it relaunched online crypto payments for merchants, attracting buyers from 70 countries to use stablecoin payments. The Bridge acquisition reinforces their push to lead in the adoption of digital currencies. The price of the $1.1 billion suggests they anticipate rapid stablecoin adoption and want immediate access to the technology that could facilitate this transition.

Last year, PayPal introduced a U.S. dollar stablecoin, becoming the first major fintech company to integrate digital currencies for payments and transfers.

Bridge’s technology empowers businesses to seamlessly move, store, and accept stablecoins with minimal coding effort. By leveraging Bridge’s Issuance APIs, companies can both accept and issue their own stablecoins. Once integrated, this technology allows businesses to conduct global transactions with remarkable speed and reduced costs.

This advancement fosters a more regulated landscape for stablecoins and heralds heightened competition among issuers.

FintechZoom.com’s perspective on the future of digital payments

FintechZoom.com suggests that Stripe’s acquisition of Bridge could lead to wider adoption of stablecoins in mainstream payment systems. The integration of Bridge’s technology into Stripe’s existing infrastructure has the potential to revolutionize global transactions, delivering a more streamlined, secure, and cost-effective payment method.

Moreover, FintechZoom.com points out that this move could lend greater credibility to the crypto sector, which has faced skepticism due to volatility and regulatory concerns. As a major player in payment processing embraces stablecoins, it could help normalize cryptocurrency transactions in everyday business.

Looking ahead, FintechZoom.com anticipates that Stripe’s entry into the stablecoin market will increase competition among fintechs offering stablecoin-based payment services. This competition could lead to further innovation and improved offerings across the industry, potentially reshaping the global financial landscape.

However, FintechZoom.com also notes that challenges remain, including regulatory uncertainty and the need for interoperability between fintechs and the broader financial system. As these issues are addressed and blockchain technology matures, stablecoins are poised to play an increasingly significant role in shaping the future of digital assets and cross-border payments.

Challenges and Opportunities Ahead

Regulatory considerations for Stripe-Bridge integration

As Stripe integrates Bridge’s stablecoin technology into its payment infrastructure, regulatory scrutiny is likely to increase. The company may face challenges in navigating the complex regulatory landscape surrounding digital assets. According to FintechZoom.com, this increased attention toward the stablecoin space could prompt regulators to step up enforcement efforts and potentially create clearer guidelines for stablecoin use 1.

The regulatory environment for stablecoins is evolving rapidly across different jurisdictions. In Europe, new stablecoin rules came into force on June 30 under the Markets in Crypto-Assets Regulation (MiCA), with USDC becoming the first MiCA-compliant dollar stablecoin in the region . Meanwhile, the United States is working to establish its own regulatory framework, with bills in both the House of Representatives and the Senate addressing stablecoin regulation .

Competitive landscape in the stablecoin sector

Stripe’s acquisition of Bridge positions the company to become a major contender in digital asset-based payments. This move puts Stripe in direct competition with traditional payment players like PayPal and Block, as well as leading stablecoin providers such as Tether and Circle . The stablecoin market has seen significant growth, with the supply reaching USD 150 billion since USDT’s debut in 2014 2.

The competitive landscape is characterized by tight competition, with USDT leading in supply and USDC dominating transaction volume. Ethereum continues to be the leading blockchain for stablecoin supply, holding almost 50% of all stablecoins 3. However, other blockchains like Tron and BSC are gaining traction, indicating a dynamic and evolving market.

Potential impact on Stripe’s valuation and market position

Stripe’s bold move into the stablecoin market through the acquisition of Bridge has the potential to significantly impact its valuation and market position. The deal, valued at USD 1.1 billion, marks Stripe’s largest acquisition to date and positions the company to capitalize on the growing stablecoin market .

The stablecoin sector has seen remarkable growth, with experts predicting that the market could reach USD 3 trillion by 2030 . By integrating Bridge’s expertise in stablecoin technology, Stripe aims to enhance its digital payment infrastructure and solidify its position as a leader in the fintech industry.

FintechZoom.com suggests that this acquisition could lead to wider adoption of stablecoins in mainstream payment systems. As Stripe begins to use stablecoins in more traditionally regulated financial environments, it may attract increased attention from regulators and potentially shape future regulatory frameworks 4.

The integration of Bridge’s technology into Stripe’s existing infrastructure has the potential to revolutionize global transactions, offering businesses new options for cross-border transactions and currency management. This move aligns with Stripe’s goal of building “the world’s best stablecoin infrastructure,” which could significantly impact the global financial landscape and potentially boost Stripe’s valuation in the long term 5.

Conclusion

Stripe’s acquisition of Bridge for $1.1 billion marks a significant step in the evolution of digital payments. This move has the potential to cause a revolution in cross-border transactions, offering businesses new options for global money management and potentially reshaping the financial landscape. As reported by FintechZoom.com, the integration of Bridge’s stablecoin technology into Stripe’s existing infrastructure could lead to wider adoption of stablecoins in mainstream payment systems, potentially challenging traditional payment methods.

Looking ahead, the impact of this acquisition on the global payments scene remains to be seen. FintechZoom.com suggests that as Stripe begins to use stablecoins in more traditionally regulated financial environments, it may attract increased attention from regulators and potentially shape future regulatory frameworks. This move aligns with Stripe’s goal of building “the world’s best stablecoin infrastructure,” as noted by FintechZoom.com, which could significantly impact the global financial landscape and potentially boost Stripe’s position in the long term.

References

[1] – https://cointelegraph.com/news/stripe-acquires-stablecoin-platform-bridge-techcrunch-founder[2] – https://www.paymentsdive.com/news/stripe-buy-stablecoin-company-bridge-blockchain/730471/

[3] – https://www.investmentnews.com/industry-news/stripe-to-acquire-stablecoin-startup-in-11b-deal/257806

[4] – https://www.nasdaq.com/articles/stripes-billion-dollar-bet-stablecoins

[5] – https://finovate.com/what-stripes-purchase-of-bridge-means-for-stablecoins-in-the-u-s/