Investing in the stock market can be a daunting task and it’s important to understand the risks and rewards associated with any stock you consider investing in. One of the most popular and talked about stocks today is Advanced Micro Devices, Inc. (AMD). There’s a lot of hype surrounding Advanced Micro Devices, Inc., but is it worth investing in? In this article, we’ll take a look at the risk and benefits of investing in AMD stock.

What is AMD?

Advanced Micro Devices, Inc. (AMD) is a semiconductor company headquartered in Santa Clara, California. Founded in 1969, AMD designs, manufactures, and sells on following segments: embedded processors, chipsets, discrete graphics processing units (GPUs), data center and professional GPUs, and development services and other components for computers and other electronic devices. Advanced Micro Devices, Inc. is best known for its desktop and notebook processors, but it also owns several semiconductor businesses, including its own graphics processing units (GPUs). AMD’s stock trades on the New York Stock Exchange under the symbol “AMD”.

Overview of AMD

Advanced Micro Devices, Inc. has been on a roller coaster ride in recent years. The stock price has been volatile, but it has also experienced periods of explosive growth. From 2017 to Nov 2021, AMD rose from around $13 per share to over $155 per share. This impressive run was driven by strong performance in the computing segment, as well as the successful launch of AMD’s Ryzen desktop and notebook processors.

But, since November 2021 AMD was down to 71.10 USD (current price at Jan 18 11.33 EST).

AMD Performance

AMD’s stock price has been volatile in recent years, but overall, the stock has performed well. From 2017 to Nov 2021, AMD rose from around $13 per share to over $155 per share. This impressive run was driven by strong performance in the computing and graphics segment, as well as the successful launch of AMD’s Ryzen desktop processors.

The graphics segment includes desktop has been the primary driver of AMD’s success. This segment includes AMD’s CPUs, GPUs, and other related products. The segment has seen strong growth over the past few years, driven by increased demand from gamers, data centers, and other customers. Furthermore, development services in AMD’s Ryzen desktop processors have been a major success, as they offer strong performance at a competitive price point.

Analyzing the computing and graphics segment

AMD’s integrated graphics processing units is responsible for most of the company’s sales. This segment includes AMD’s CPUs, GPUs, and other related products. The segment and development services has seen strong growth over the past few years, driven by increased demand from gamers, data centers, and other customers.

AMD’s Ryzen desktop processors have been a major success as well. These processors offer strong performance at a competitive price point. Additionally, AMD’s GPUs have been well received by the gaming community, as they offer great performance and features.

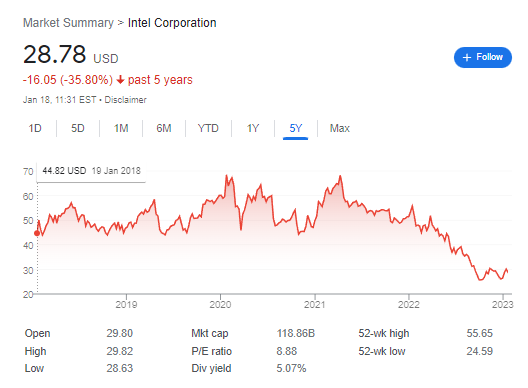

In Past 5 years, AMD increased +464.95% and Intel down -35.80%.

Advanced Micro Devices, Inc. desktop processors

AMD’s Ryzen desktop processors have been a major success. These processors offer strong performance at a competitive price point, which has driven demand for them. Additionally, AMD’s GPUs have been well received by the gaming community, as they offer great performance and features.

Furthermore, AMD’s Ryzen processors are compatible with a wide range of motherboards and systems. This makes them a great choice for gamers and enthusiasts who want to build their own systems and even for data center. AMD’s Ryzen processors are also compatible with many of the latest applications and games, making them a great choice for those who want to stay up-to-date with the latest technology.

AMD semiconductor businesses

In addition to its desktop processors, Advanced Micro Devices, Inc. also owns several semiconductor businesses. These businesses include its own foundry, which manufactures chips for AMD and other companies. AMD also owns several other businesses, including its graphics processing business and its server processor business for data center too.

These businesses have been a major driver of AMD’s success. AMD’s foundry business has enabled the company to manufacture its own chips and leverage the cost savings to offer competitive prices. AMD’s graphics processing business has enabled the company to offer powerful GPUs at a competitive price point. And AMD’s server processor business has enabled the company to target the lucrative server market.

Risk vs. Reward with AMD

Investing in AMD carries both risks and rewards. On the one hand, the stock has experienced periods of explosive growth in recent years. On the other hand, the stock is volatile and could experience drastic drops in price. It’s important to understand the risks and rewards associated with AMD before investing in it.

Analyzing the current market conditions for AMD

Before investing in AMD, it’s important to analyze the current market conditions. The stock has been volatile in recent years, but overall, the stock has performed well. The computing and graphics segment has been the primary driver of AMD’s success, as the segment has seen strong growth due to increased demand from gamers, data centers, and other customers. AMD’s Ryzen processors have also been a major success, as they offer strong performance at a competitive price point.

It’s also important to note that AMD’s stock price is driven by the company’s performance. If AMD’s performance drops, the stock price is likely to follow suit. Therefore, it’s important to keep an eye on the company’s performance before investing.

Stock Price Today

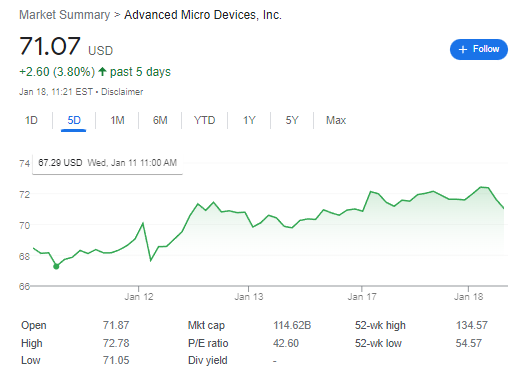

At the conclusion of the most recent trading session, Advanced Micro Devices (AMD) ended at $71.59, representing an increase of 0.83% from the preceding day. This shift exceeded the S&P 500’s 0.2% decrease on the day. Additionally, the Dow experienced a drop of 1.14%, and the tech-heavy Nasdaq experienced a gain of 1.39%. The Dividend yield is not available with a Market cap of 114.62B.

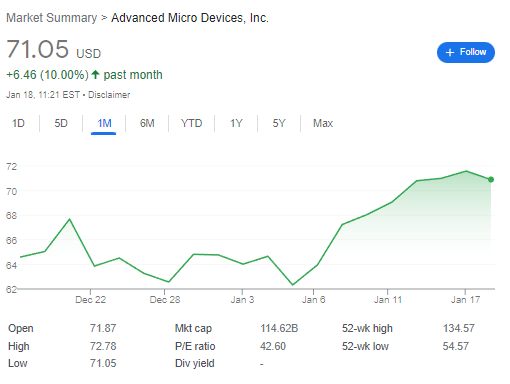

In the last four weeks, the stock of the computer parts manufacturer has increased by nearly 10%. This is more than the growth of 3.75% in the Computer and Technology sector, as well as the 4.01% gain of the S&P 500. Market cap of 114.62B. Read: AMD Stock Increased Today +7.10%. Check Here What we Know.

Investors who have been tracking the AMD have been very pleased with its performance as of late. The stock has been on an uptrend over the past few weeks, with the SMA20 (simple moving average) coming in at +7.94%. This is particularly impressive given the SMA50 of +3.31% and SMA200 of -12.06%. Clearly, the stock is in a very strong position and investors are optimistic about continued growth.

When Advanced Micro Devices releases their next earnings report on January 31, 2023, investors will be hoping for a strong performance. Analysts are forecasting earnings of $0.67 per share, a year-over-year decline of 27.17%. The consensus estimate for quarterly revenue is $5.52 billion, which would be a 14.32% increase from the previous year.

Investors should pay attention to any changes to analyst estimates for Advanced Micro Devices. Those revisions usually correspond with the most current short-term business trends. Consequently, an upgrade in estimates can be seen as an indication of a promising near-term outlook for the company.

It should be taken into account by investors that Advanced Micro Devices is trading at a premium to its industry peers, which is evident in its Forward P/E ratio of 20.44, in comparison to the average Forward P/E of 17.12 for its sector.

It should be noted by investors that AMD is currently carrying a PEG ratio of 1.62. This measure is employed in a manner that is analogous to the widely known P/E ratio, but the PEG ratio also takes into account the anticipated earnings expansion rate of the stock. At the close of yesterday, the Electronics – Semiconductors sector had an average PEG ratio of 2.82.

Analyzing the potential upside for AMD

The potential upside for AMD is high. The stock has already experienced periods of explosive growth in recent years, and there’s potential for more. AMD’s computing and graphics segment has been driving the company’s success, and this segment is likely to continue to grow. Additionally, AMD’s Ryzen processors have been a major success, and this segment is likely to continue to perform well.

Furthermore, AMD’s semiconductor businesses have been a major driver of the company’s success. AMD’s foundry business has enabled the company to manufacture its own chips and leverage the cost savings to offer competitive prices. AMD’s graphics processing business has enabled the company to offer powerful GPUs at a competitive price point. And AMD’s server processor business has enabled the company to target the lucrative server market.

Analyzing the potential downside for AMD

The potential downside for AMD is also high. The stock is volatile and could experience drastic drops in price. Additionally, AMD’s performance is tied to the stock price. If AMD’s performance drops, the stock price is likely to follow suit. Therefore, it’s important to keep an eye on the company’s performance before investing in the stock.

It’s also important to note that AMD’s competitors, such as Intel and NVIDIA, are also strong players in the market. These companies are well established and have strong competitive advantages. AMD will need to continue to innovate in order to stay competitive in the market.

Investing Strategies for AMD

When investing in AMD, it’s important to have a strategy. It’s important to consider the potential upside of the stock, as well as the potential downside. It’s also important to consider the current market conditions and the company’s performance. Lastly, it’s important to diversify your portfolio and not put all your eggs in one basket.

Conclusion

Investing in AMD carries both risks and rewards. On the one hand, the stock has experienced periods of explosive growth in recent years. On the other hand, the stock is volatile and could experience drastic drops in price. It’s important to understand the risks and rewards associated with AMD before investing in it. Additionally, it’s important to have a strategy and to diversify your portfolio. By considering the potential upside and downside of AMD stock, as well as the current market conditions and the company’s performance, you can make informed decisions about investing in AMD stock.

Related Content:

FintechZoom Articles: Unlock the World of Investing for Kids: The Power of Stocks for Kids!, AMD Stock Increased Today +7.10%. Check Here What we Know, NVIDIA Stock Climbed Today +5.18% at 156.28USD, How a 47% YOY Q4 Production Rise Gave Tesla Stock an 8.8% Boost, Uncovering the Potential of DOMA Stock: Analyzing the Price of Doma Holdings Inc., INDEXDJX: .DJI Is Surging (+0.43%) Ahead of Earnings Season, During the Last Year GME Stock Have Dropped -50.05%. It’s time to Sell? , Discover How to Easily Track the DJIA on Yahoo Finance – An Overview of the Dow Jones Industrial Average!, Stock Price of Li Auto Inc (LI) Rose 8.4% Since Announced Their Vehicle Increase of 50.7% YoY., The TSLA Stock Rollercoaster: Will it Continue To Surge or Take a Dive?, Microsoft Stock Down -27.73% last year, now is looking to invest up to $10 billion in AI, Tesla Stock Increased Today +5.93%, Investing Wisely: How to Buy Bitcoin Stock?, Exploring the Potential of Nasdaq QLGN: A Look at Qualigen Therapeutics Inc Stock, Investing in Penny Stocks on Robinhood: A Comprehensive Guide, An Introduction to Contracts for Difference (CFDs): What Every Investor Needs to Know, The Warning Signs: Why Fintech Startups are Serious Trouble!, A Beginner’s Guide to MACD Indicator: What It Is and How To Use It, Understanding the Risks of Pumps and Dumps: What Investors Need to Know, Pfizer Stock, Why Moderna Stock Rose 7.5% After Respiratory Vaccine Results.