If you’re looking for some best stocks to invest your money in, you’ve come to the right place. In this blog post, we will discuss seven of the best 10 dollar stocks that you can buy right now. These stocks are all great value investments, and they offer a lot of potential for growth in the future. So if you’re looking for some solid investment options, these seven stocks should definitely be on your radar!

Without further ado, let’s take a look at the best stocks to buy if you have $100 (or less) to invest.

As always, be sure to do your own research before investing any money in the stock market. And remember, these are just our opinions – it’s ultimately up to you to decide what’s best for your portfolio.

Now let’s get started!

First, let’s Understand the Meaning of Best Value Stock

A best value stock is a company that is trading at a significant discount to its intrinsic value. Intrinsic value is the sum of all future cash flows that the company is expected to generate, discounted back to present value. There are several reasons why a company’s stock price may trade at a discount to intrinsic value. The mark

et may be overreacting to bad news, or the company may be in a short-term downturn. However, the most common reason is simply that the market is inefficient and doesn’t yet recognize the company’s true worth. For patient investors, best value stocks offer an opportunity to buy high-quality businesses at bargain prices, several times investors look to Examples of Growth Stocks, Best Healthcare Stocks or even to Best Dividend Stocks.

Due to Ukraine War, What are the Best Stock Cluster to Invest?

Investing in stock clusters is a great way to diversify your portfolio and protect yourself from potential risks. With the current situation in Ukraine, there are many volatile factors that could impact the stock market. By investing in a stock cluster, you can minimize your exposure to these risks.

There are a few factors to consider when choosing the best stock cluster to invest in. First, you need to consider the economic conditions of the countries involved. For example, if one of the countries is in a recession, this could impact the overall performance of the cluster. Second, you need to look at the political stability of the region. If there is a lot of unrest, this could also have an impact on stock prices. Finally, you need to evaluate the companies that make up the cluster. Make sure that they are financially sound and have a good track record.

By taking all of these factors into consideration, you can make sure that you choose the best stock cluster to invest in for your portfolio. With a little research, you can find a great opportunity to profit from the current situation in Ukraine.

1. Crescent Point Energy (NYSE:CPG)

Crescent Point Energy is a Canadian oil and gas company with assets located in the Western Canada sedimentary basin. The company’s stock trades on the New York Stock Exchange under the ticker symbol CPG. Crescent Point Energy is focused on light oil production and currently has a market capitalization of $3.4 billion. The company’s stock price has been volatile in recent years, but it has trended upward in 2021 and is currently trading near $7.06 per share (September 2022). Despite the volatility, Crescent Point Energy’s stock may be an attractive investment for some investors given its yield, growth potential, and valuation. Crescent Point Energy pays a quarterly dividend of $0.03 per share, which translates to an annual yield of 2.3%. The company’s dividend is well covered by its cash flow from operations and is likely to be sustainable even if oil prices decline. In addition, Crescent Point Energy has significant upside potential as it executes on its plans to increase production and reduce costs. The company is also trading at a significant discount to its peers, with a price-to-earnings ratio of 9.4 compared to an industry average of 21.2. For these reasons, Crescent Point Energy may be an attractive investment for risk-tolerant investors who are bullish on the oil market in 2022.

2. Vaalco Energy (NYSE:EGY)

If you’re looking for an energy stock to invest in during 2022, Vaalco Energy (NYSE: EGY) is a great option. The company is engaged in the exploration, development, production and acquisition of oil and natural gas assets. So far in 2021, the company’s stock price has increased significantly, and analysts expect this trend to continue into 2022. And with Vaalco’s strong financial position and experienced management team, there’s no reason to believe that the stock won’t continue to perform well in the future. As of October 4th, 2022, Vaalco’s stock price was $5.10 per share. Based on the company’s current fundamentals and expected future performance, this is a great time to invest in Vaalco Energy.

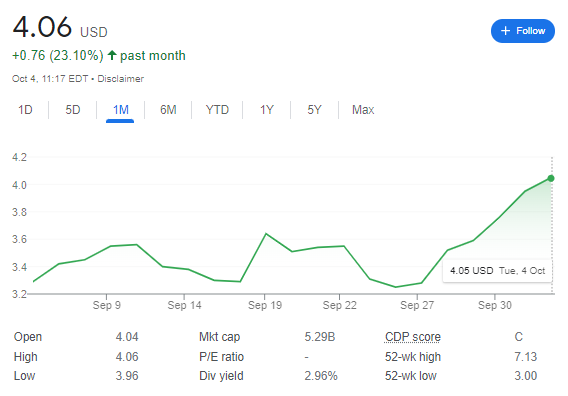

3. Kinross Gold (NYSE:KGC)

On October 4, 2022, Kinross Gold Corporation’s stock price closed at $4.05 per share. The current stock price is up from the 52-week low of $3.00 per share, and down from the 52-week high of $7.13 per share. Despite the recent downturn in the stock price, I believe that Kinross Gold is a good investment for several reasons. First, the company has a long history of operating mines and producing gold, which gives it a solid foundation to weather any economic downturns. Second, Kinross Gold has a strong track record of paying dividends to shareholders, which makes it an attractive investment for income-seeking investors. Third, the company has a large portfolio of quality assets that are located in politically stable jurisdictions. These factors make Kinross Gold a attractive investment for conservative investors who are looking for exposure to the gold sector.

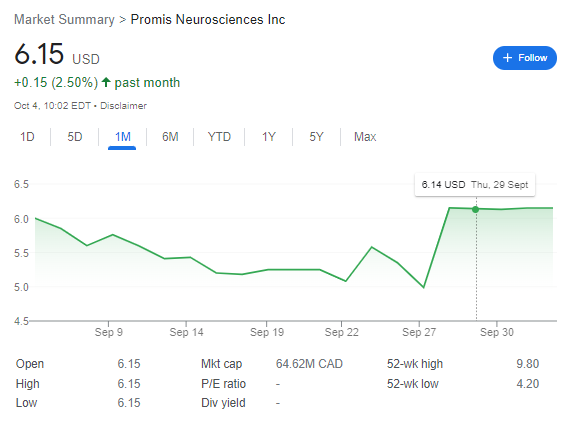

4. ProMIS Neurosciences Inc. (NASDAQ: PMN)

ProMIS Neurosciences Inc. is a clinical stage biotechnology company developing precision treatments for neurodegenerative diseases. The company’s mission is to discover and develop novel therapeutics that specifically target the underlying cause of these diseases. ProMIS has two proprietary technology platforms, which it uses to identify unique disease-causing proteins and to design highly precise and potent antibodies to these targets. The company’s lead drug candidate, PMN310, is a monoclonal antibody that specifically targets toxic oligomers of the protein amyloid beta. Amyloid beta is a key component of Alzheimer’s disease plaques, and it is thought that the ability of PMN310 to bind and neutralize oligomeric amyloid beta could make it an effective treatment for Alzheimer’s disease. PMN310 is currently in Phase I/II clinical trials. The company also has a pipeline of preclinical candidates targeting other neurodegenerative diseases such as Parkinson’s disease, frontotemporal dementia, and amyotrophic lateral sclerosis. ProMIS is headquartered in Toronto, Canada.

ProMIS Neurosciences Inc.’s stock price was $6.15 per share on October 4th, 2022. The company’s market capitalization was $462 million on that date. ProMIS has been successful in raising capital from investors to finance its operations and clinical trials. The company has a strong balance sheet with $98 million in cash and cash equivalents as of June 30th, 2020. ProMIS has acquired licenses to several key patents and technology platforms that will support the commercialization of its products if they are successfully developed and approved by regulators. The company’s products are at various stages of development, with some in clinical trials and others in preclinical testing. ProMIS’ lead drug candidate, PMN310, is expected to enter Phase III clinical trials in 2023. If PMN310 is successful in clinical trials and receives regulatory approval, it could be commercialized by 2025. Given the potential for ProMIS’ products to generate significant revenue in the future, the company’s stock may be undervalued at its current price levels and could offer investors upside potential in 2022 and beyond.

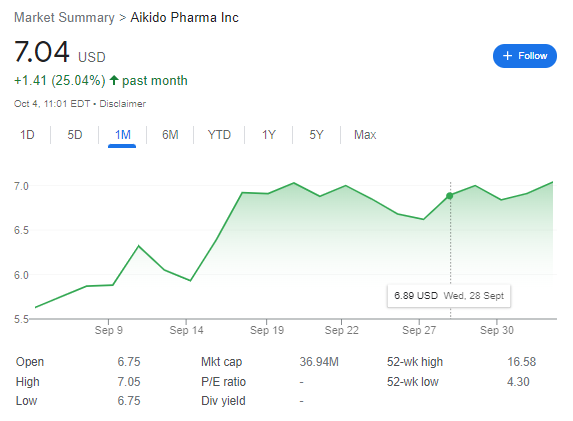

5. AIkido Pharma Inc (NASDAQ: AIKI)

As of October 4th, 2022, AIkido Pharma Inc (NASDAQ: AIKI) is trading at $7.04 per share. The company has a market capitalization of $36.94 M. AIkido Pharma Inc is a clinical-stage biopharmaceutical company focused on developing proprietary small molecule drugs to treat cancer and other diseases. The company’s product candidates include AK001, which is in Phase I/II clinical trials for the treatment of solid tumors, and AK002, which is in Phase II clinical trials for the treatment of non-small cell lung cancer. AIkido Pharma Inc has a strong pipeline of product candidates and is well-positioned to continue its growth trajectory in the coming years. The company’s stock is a good investment for investors who are looking for growth potential in the biotech sector.

6. Payoneer Global (NASDAQ: PAYO)

At current prices, today at $6.50, Payoneer Global (NASDAQ: PAYO) is trading at a price to earnings (P/E) ratio of 436.87x. Payoneer has enjoyed strong revenue growth in recent years, with annual revenues increasing from $371 million in 2017 to $587 million in 2020. This revenue growth has been driven by Payoneer’s growing base of customers, which has increased from 3.4 million in 2017 to 4.8 million in 2020. Payoneer’s growth prospects remain strong, with the company forecasting revenue of $730-$740 million for 2021. Based on these strong growth prospects, I believe that Payoneer is a good investment at current prices.

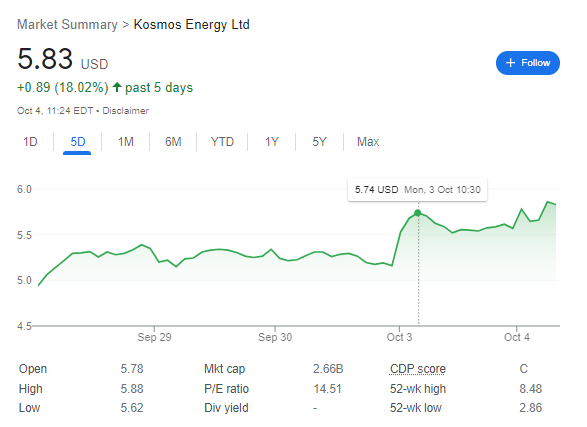

7. Kosmos Energy (NYSE: KOS)

Kosmos Energy is an international oil and gas exploration and production company with a diversified portfolio of world-class assets. The company’s shares are traded on the New York Stock Exchange (NYSE: KOS). Kosmos has a strong financial position, with cash and equivalents of $1.9 billion at the end of 2020. The company’s debt-to-equity ratio was 0.4x at the end of 2020. Kosmos had $2.7 billion of total liquidity at the end of 2020.The company’s proved reserves totaled 535 million barrels of oil equivalent (MMboe) at the end of 2020. Kosmos has a diversified portfolio of high-quality assets across nine countries with significant upside potential. The company’s leading position in the gulf of Mexico provides it with a large, contiguous acreage position in an area with significant potential for new discoveries. Kosmos also has a strong track record of execution, delivering on its commitments to shareholders through disciplined capital allocation and management. The company’s shares are currently trading at $5.84 per share, representing a significant discount to its peers. I believe that Kosmos Energy is an attractive investment opportunity at its current price level and recommend buying the stock for further upside potential in 2022.

Conclusion

There’s no sure thing when it comes to stocks, but if you’re looking for a good bet, these 10 dollar stocks are a great place to start. All of these companies are leaders in their respective industries, and they all have strong fundamentals. In addition, each of these stocks is currently trading at a discount, making them an even more attractive investment. So if you’re looking for the best 10 dollar stocks to invest in, these are the ones you should keep an eye on.