Automaker General Motors has faced a tumultuous period marked by labor strikes, setbacks in its electric and autonomous vehicle initiatives, and a pedestrian accident involving its self-driving unit, Cruise. Despite these challenges, the company is demonstrating resilience and taking steps to regain Wall Street’s confidence and put GM Stock on the Rise.

In a recent announcement, GM unveiled measures aimed at bolstering investor trust, including a stock buyback, increased dividends, and reinstated guidance for 2023. These actions signal the company’s commitment to shareholder value and its belief in its long-term growth prospects.

However, amidst these positive developments, GM has also made the difficult decision to reduce spending on Cruise following the San Francisco accident. This move reflects the company’s cautious approach to self-driving technology development, emphasizing safety and reliability as paramount considerations.

Also read: GM Stock dive -8.94% in Past 5 Days: Hyundai Motor’s Acquisition of GM’s India Plant.

While GM’s pretax earnings were negatively impacted by the UAW strike, the company expressed confidence in its ability to absorb the costs and maintain its financial trajectory. This stance underscores GM’s financial strength and its ability to weather temporary disruptions.

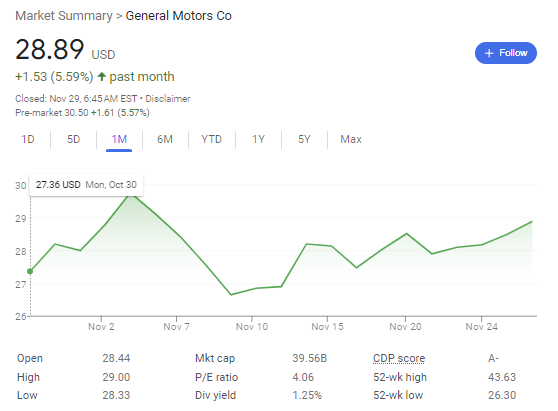

Despite the challenges it faces, GM’s stock price has experienced a positive surge, with a 5.19% increase in premarket trading and a 5.59% rise over the past month. This upward trend suggests that investors are regaining confidence in the company’s ability to navigate the current turbulence and emerge stronger on the other side.

In conclusion, General Motors is demonstrating its resilience in the face of adversity, taking decisive actions to regain investor confidence while remaining committed to its long-term growth strategy. As the company continues to navigate the challenges and capitalize on its opportunities, its trajectory will be closely watched by investors and industry observers alike.

General Motors is taking steps to regain Wall Street’s confidence after a challenging year.

General Motors is taking steps to regain Wall Street’s confidence after a challenging year. The company has announced a stock buyback, increased its dividend, and reinstated its full-year 2023 guidance. These moves are aimed at signaling to investors that GM is committed to shareholder value and has a clear path forward.

The company’s stock price has fallen by more than 40% in the past year, as investors have grown concerned about the impact of the labor strikes and the company’s ability to execute on its electric and autonomous vehicle plans. However, GM is confident that it can weather the storm and emerge stronger.

The stock buyback is expected to return $3.5 billion to shareholders over the next two years. The increased dividend will boost the annual payout to $1.52 per share, up from $1.29. And the reinstatement of full-year guidance signals that GM is confident in its ability to meet its financial targets.

GM is also making progress on its electric and autonomous vehicle initiatives. The company has launched a number of new electric vehicles, including the GMC Hummer EV and the Cadillac Lyriq. And it is continuing to develop its self-driving car technology, with plans to launch a commercial robotaxi service in 2024.

GM’s investor-focused initiatives are a positive step, but the company will need to continue to execute well in order to regain Wall Street’s confidence. The company’s ability to meet its financial targets, launch successful electric vehicles, and develop self-driving car technology will be key to its long-term success.

However, General Motors is cutting spending on its self-driving unit Cruise after a pedestrian accident in San Francisco last month.

The accident left a pedestrian critically injured and led to Cruise halting operations.

The company is still committed to its self-driving car program, but it is taking a more cautious approach in the wake of the accident. GM will be reducing spending on Cruise by about 10% and will focus on developing its technology in a more controlled environment.

The company is also considering changes to its testing procedures to ensure that its vehicles are safe. These changes could include increased supervision of test vehicles and more rigorous testing protocols.

GM’s decision to cut spending on Cruise is a setback for the company’s self-driving car program, but it is a necessary step in the wake of the accident. The company is taking the right steps to ensure that its vehicles are safe and that its self-driving car program is on track for success.

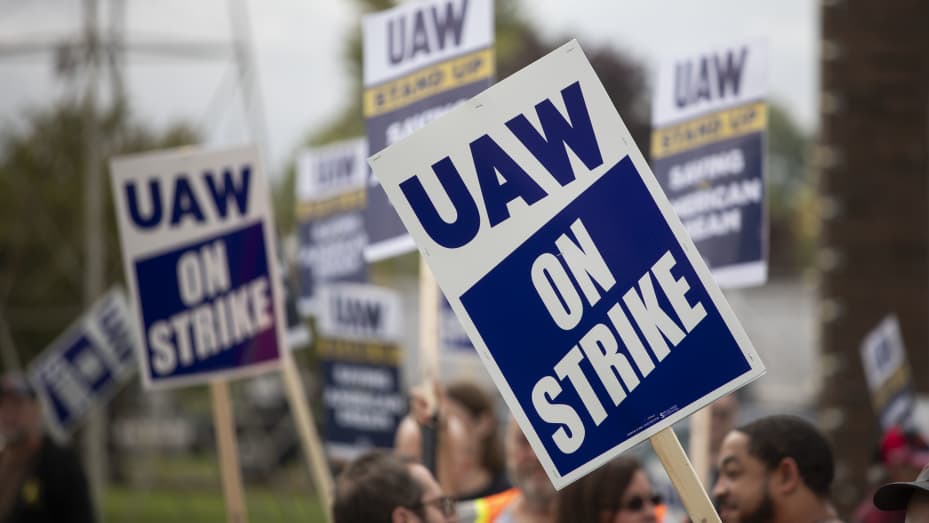

GM also announced that its pretax earnings took a $1.1 billion hit from the six-week strike by the United Auto Workers (UAW) in 2023.

General Motors (GM) announced on Tuesday that its pretax earnings took a $1.1 billion hit from the six-week strike by the United Auto Workers (UAW) in 2023. However, the company said that it expects to be able to absorb the costs of the strike and a new labor contract with the UAW, and it even raised its dividend.

The UAW strike, which began on September 15, 2023, was the longest in the union’s history. It shut down GM’s production plants in the United States and Canada, and it cost the company billions of dollars in lost revenue.

Despite the strike, GM said that it is confident in its future. The company is investing heavily in electric vehicles and autonomous vehicles, and it expects to see strong growth in these areas in the years to come.

GM also said that it is committed to returning value to shareholders. The company raised its dividend by 10%, to $1.52 per share, and it announced a new $3.5 billion stock buyback program.

GM’s announcement was welcomed by investors. The company’s stock price rose by more than 5% on Tuesday.

Here are some key takeaways from GM’s announcement:

- The UAW strike cost GM $1.1 billion in pretax earnings.

- GM expects to be able to absorb the costs of the strike and a new labor contract with the UAW.

- GM is confident in its future and is investing heavily in electric vehicles and autonomous vehicles.

- GM is committed to returning value to shareholders and raised its dividend by 10% and announced a new $3.5 billion stock buyback program.

GM’s announcement is a positive sign for the company and for its investors. The company is overcoming the challenges of the UAW strike and is positioning itself for long-term growth.

GM Stock increased today in premarket +5.19%. And in past month GM stock increased +5.59%.

It’s encouraging to see that GM’s stock price is responding positively to the company’s recent news and initiatives. The stock buyback, increased dividend, and reinstated guidance are all signals to investors that GM is confident in its future and committed to shareholder value. Additionally, the company’s progress on electric and autonomous vehicles is another promising sign for its long-term success.

The recent increase in GM’s stock price suggests that investors are starting to regain confidence in the company. This is a positive development, as it will help GM to raise capital and invest in its future growth initiatives.

Of course, there are still some challenges that GM needs to address, such as the potential impact of the Cruise accident and the ongoing development of its self-driving car technology. However, the company appears to be taking the right steps to address these challenges and position itself for long-term success.

Overall, I am cautiously optimistic about GM’s future. The company is facing some challenges, but it also has a lot of potential. I will continue to monitor GM’s progress and keep you updated on any new developments.