In a significant move that has grabbed the attention of the global semiconductor industry, Intel, the renowned American technology company, has announced its plans to invest over 30 billion euros ($33 billion) in Germany. This landmark expansion marks the largest investment by a foreign company in Europe’s top economy and underscores Berlin’s efforts to attract foreign investment. The deal includes the construction of two cutting-edge semiconductor facilities in the city of Magdeburg, with Intel receiving 10 billion euros in subsidies from the German government. The investment is expected to create tens of thousands of jobs and solidify Germany’s position as a high-tech production location. This article delves into the details of Intel’s expansion in Germany, the implications for the semiconductor industry, and the impact on Intel’s stock.

In a groundbreaking move, Intel Corporation has announced plans to invest a staggering $25 billion in a new chip manufacturing plant in Israel. This investment is a testament to Intel’s commitment to advancing technological innovation and solidifying its position as a global leader in the semiconductor industry. The new facility is expected to create thousands of jobs and pave the way for cutting-edge advancements in chip technology.

Intel’s Expansion Push in Europe

Under the leadership of CEO Pat Gelsinger, Intel has been actively investing billions of dollars to regain its dominance in chipmaking and better compete with rivals such as AMD, Nvidia, and Samsung. The company’s expansion strategy spans continents, with the recent announcement of significant investments in Poland and Israel. The global semiconductor manufacturing industry is projected to reach a value of one trillion dollars by 2030, up from $600 billion in 2021. With this in mind, both the United States and Europe are vying to attract major industrial players through a combination of state subsidies and favorable legislation.

Israel has long been recognized as a hub for technological innovation, earning the nickname “Silicon Wadi” due to its concentration of high-tech companies. With a highly skilled workforce and a thriving startup ecosystem, Israel has become a hotbed for semiconductor research and development. Intel’s decision to invest in a new chip plant in Israel further cements the country’s position as a key player in the semiconductor industry.

Attractive Investment Environment

Germany, known for its technological advancements and strong industrial base, has been actively pursuing partnerships with leading tech companies. The government in Berlin has been investing billions of euros in subsidies to entice tech companies, aiming to reduce supply chain fragility and decrease dependence on South Korea and Taiwan for semiconductor supply. Intel’s investment in Germany, coupled with ongoing discussions with Taiwan’s TSMC and Sweden’s Northvolt, demonstrates the country’s commitment to becoming a high-tech production hub. Germany has already convinced Tesla to establish its first European gigafactory in Berlin, further solidifying its appeal as an attractive investment location.

The $25 billion investment in Israel by Intel underscores the company’s confidence in the future of the semiconductor market. With the demand for advanced chips growing exponentially, Intel is strategically positioning itself to meet this demand and stay ahead of the competition. This investment will not only boost Israel’s economy but also strengthen Intel’s capabilities in chip manufacturing, enabling the company to deliver cutting-edge products to its customers.

The Significance of Intel’s Investment in Magdeburg

Intel’s decision to invest in Magdeburg, a city located in the state of Saxony-Anhalt, is viewed as a significant milestone for Germany’s semiconductor industry. The investment includes substantial subsidies from the German government, totaling 10 billion euros, highlighting the government’s determination to build a vibrant and sustainable semiconductor industry. The Magdeburg facility will be Intel’s third major investment in just four days, following the announcements of chip plants in Poland and Israel. Initially, Intel had planned to invest 17 billion euros in the Magdeburg plant, but the expanded scope of the project has increased the investment to over 30 billion euros.

Implications for Job Creation and Economic Growth

Intel’s investment in Germany is expected to have a significant impact on job creation and economic growth. The construction of the Magdeburg facility alone will generate approximately 7,000 jobs, with an additional 3,000 high-tech jobs at Intel. Moreover, the ripple effect across the industry is expected to create tens of thousands of jobs. This infusion of employment opportunities will not only boost the local economy but also contribute to Germany’s resilience and capacity for microchip development and production.

The establishment of a new chip plant in Israel will have a significant impact on job creation. Intel’s investment is expected to create thousands of high-skilled jobs, providing opportunities for engineers, technicians, and other professionals in the semiconductor industry. This influx of employment opportunities will not only benefit the local workforce but also contribute to the overall economic growth of the region.

Intel’s Drive for Competitiveness

Intel’s CEO, Pat Gelsinger, has made it clear that the company’s goal is to regain competitiveness in the semiconductor industry. Gelsinger’s emphasis on cost competitiveness underscores the need for Germany to play a leading role in global competition. The investment in Magdeburg is a step towards bridging the gap between Germany and Asia, where the semiconductor industry currently thrives. By bringing chip production back to Germany, Intel aims to ensure that the country remains at the forefront of technological advancements.

With Intel’s investment, the new chip plant in Israel is set to drive technological advancements in the semiconductor industry. The state-of-the-art facility will leverage Intel’s expertise in chip design and manufacturing, enabling the production of high-performance chips with enhanced capabilities. These advancements will have far-reaching implications across various sectors, including artificial intelligence, autonomous vehicles, and cloud computing.

European Commission’s Approval and Timeline

Before the Magdeburg facility can begin operation, it requires approval from the European Commission. Intel anticipates that the facility will be operational within 4-5 years after receiving the necessary approvals. The expansion timeline aligns with Intel’s ambitious plans to strengthen its chipmaking capabilities across multiple regions. With the Magdeburg facility, Intel aims to leverage European Commission funding rules and subsidies to reduce the EU’s dependence on U.S. and Asian chip suppliers.

Intel’s investment in Israel goes beyond the establishment of a new chip plant. The company has a long history of collaboration with the Israeli innovation ecosystem, partnering with local startups and research institutions to drive technological breakthroughs. This investment will further strengthen Intel’s ties with the Israeli tech community, fostering collaboration and knowledge exchange to accelerate innovation in the semiconductor industry.

Environmental Sustainability Initiatives

In line with its commitment to sustainability, Intel has outlined its plans to make the new chip plant in Israel environmentally friendly. The facility will incorporate state-of-the-art energy-efficient technologies, reducing its carbon footprint and minimizing its impact on the environment. Intel’s dedication to sustainability aligns with global efforts to combat climate change and sets an example for other companies in the semiconductor industry.

Intel’s Continued Leadership in the Semiconductor Industry

Intel’s investment in a new chip plant in Israel solidifies its position as a global leader in the semiconductor industry. With a rich history of technological advancements and a relentless drive for innovation, Intel has consistently pushed the boundaries of what is possible in chip design and manufacturing. This latest investment underscores Intel’s commitment to staying at the forefront of the industry and delivering cutting-edge solutions to its customers.

Intel Stock Performance and Market Response

News of Intel’s expansion in Germany has garnered attention from investors and industry analysts alike. On the Frankfurt Stock Exchange, Intel shares experienced a 0.4% increase in value following the announcement. The positive market response reflects investor confidence in Intel’s strategic investments and its commitment to regaining market dominance. By expanding its manufacturing capabilities in Germany and other European countries, Intel aims to position itself as a strong competitor in the semiconductor market.

Intel is a major player in the semiconductor industry, specializing in the production of microprocessors and chipsets. The company has been expanding its business in data-centric areas such as AI and autonomous driving, with key components such as the Data Center Group, Internet of Things Group, and Mobileye. [1]

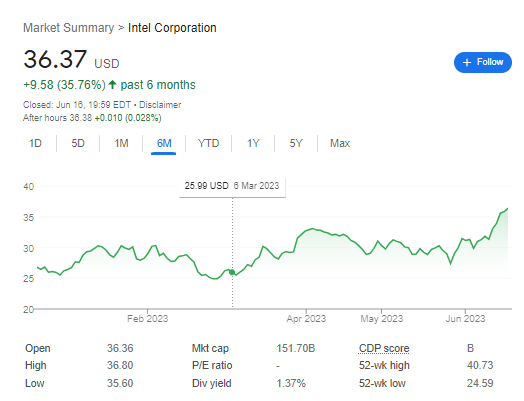

As of June 16, 2023, Intel’s stock price was 36.37 USD per share, with an all-time high of 63.34 USD in April 2021. In the last 52 weeks, the average price per share was 30.54 USD. [1]

Intel’s increased serviceable market is projected to reach $500 billion by 2027, which could further drive the company’s growth and revenue. [2]

According to recent data, Intel’s stock has increased by 35.76% in the past six months, making it a potentially profitable investment option. [3]

References: [1] Intel – 43 Year Stock Price History | INTC [2] Intel Stock Continues to Gain Momentum. Here’s What … [3] INTC (Intel Corporation) Stock Price Today & Updates

Conclusion

Intel’s decision to invest over 30 billion euros in Germany’s semiconductor industry marks a significant milestone for both the company and the country. The expansion in Magdeburg, along with Intel’s recent investments in Poland and Israel, demonstrates the company’s commitment to regaining its competitive edge in chipmaking. Germany’s attractive investment environment, coupled with substantial government subsidies, has made it an appealing location for Intel and other tech giants. The investment is expected to create thousands of jobs and solidify Germany’s position as a leading high-tech production hub. As Intel’s expansion plans unfold, investors will be closely monitoring the company’s stock performance, recognizing the potential for long-term growth and market dominance.

Intel’s decision to invest $25 billion in a new chip plant in Israel is a game-changer for the semiconductor industry. This significant investment not only highlights Israel’s importance as a hub for technological innovation but also reinforces Intel’s position as a global leader in chip manufacturing. The new facility will drive job creation, enable technological advancements, and strengthen collaboration within the Israeli tech ecosystem. As Intel continues to lead the way in the semiconductor industry, the future looks promising for both the company and the broader technology landscape.

Please note that this article is for informational purposes only and should not be considered as financial advice. The performance of Intel stock is subject to market fluctuations and individual investment decisions.

Also read these FintechZoom articles: