In the competitive landscape of today’s stock market, with particular emphasis on Dow Jones constituents, few stories are as compelling as the success of J&J (Johnson & Johnson) in surpassing Wall Street estimates through robust drug sales. This achievement not only underscores the company’s financial health but also reflects its strategic prowess in navigating the complex healthcare sector. With the global healthcare market continually evolving, J&J’s ability to exceed expectations has become a key indicator of its resilience and adaptability, virtues that are essential for any entity within today’s economic milieu.

This article delves into the intricacies of J&J’s financial performance in the second quarter, highlighting key statistics that illustrate the company’s triumph. It explores the driving factors behind the impressive sales figures of J&J’s pharmaceutical division, providing insights into the strategic moves that have propelled the company ahead of its competition. Additionally, the future outlook and guidance section will offer a glimpse into J&J’s strategies for maintaining its momentum amidst the fluctuating dynamics of the healthcare industry and the stock market. By concluding with a reflection on the broader implications of J&J’s success for the healthcare sector and investors alike, readers will gain a comprehensive understanding of the factors contributing to the company’s earnings surpassing expectations.

Q2 Financial Performance and Key Statistics

Earnings per Share (EPS) Details

Johnson & Johnson reported an earnings per share (EPS) of $1.96, marking an 8.9% increase from the previous year. The adjusted EPS was even more robust at $2.80, showing an 8.1% rise . These figures surpassed Wall Street’s expectations, where the adjusted EPS was anticipated to be $2.62 .

Total Revenue Overview

For the second quarter of 2023, Johnson & Johnson achieved a reported sales growth of 6.3%, totaling $25.5 billion. The operational growth stood at 7.5%, with an adjusted operational growth of 6.2% . These results exceeded the expectations of analysts who projected a revenue of $24.63 billion . The revenue growth was significantly supported by strong performance in both the pharmaceutical and MedTech sectors.

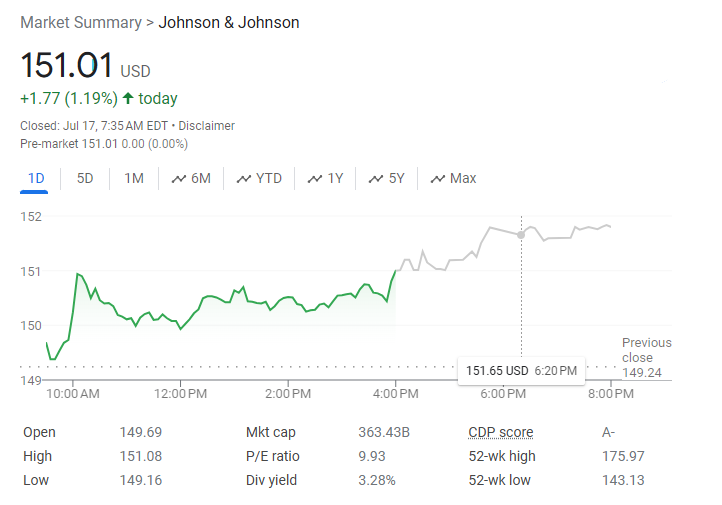

Share Price Reaction

Following the announcement of the quarterly results, shares of Johnson & Johnson closed 6% higher on Thursday . Despite a year-to-date drop of more than 5%, the strong quarterly performance helped bolster investor confidence, reflecting positively on the company’s market value, which was approximately $437 billion at the time .

Driving Factors Behind Strong Drug Sales

Innovative Medicine Segment (Oncology and Immunology)

Johnson & Johnson’s strong drug sales have been significantly boosted by its Innovative Medicine segment, particularly in Oncology and Immunology. Notable growth was driven by key products such as DARZALEX (daratumumab), ERLEADA (apalutamide), TECVAYLI (teclistamab-cqyv), CARVYKTI (ciltacabtagene autoleucel) in Oncology, and STELARA (ustekinumab) and TREMFYA (guselkumab) in Immunology. These products collectively achieved a worldwide operational sales growth of 7.2% . This growth underscores the company’s ability to innovate and meet the complex needs of patients across various therapeutic areas.

MedTech Segment Performance

The MedTech division of Johnson & Johnson also showed impressive performance, contributing substantially to the overall strong sales. The MedTech worldwide operational sales grew by 12.4%, with significant contributions from the acquisition of Abiomed, which alone added 4.7% to the growth . Key areas such as electrophysiology products in Interventional Solutions, contact lenses in Vision, wound closure products in General Surgery, and biosurgery in Advanced Surgery were primary drivers of this growth, reflecting the company’s strategic expansions and innovations within the medical technology space.

Outlook and Future Guidance

Full-year Operational Sales Guidance

Johnson & Johnson projects a steady growth in operational sales for the upcoming year, forecasting an adjusted operational sales increase between 5.0% to 6.0%, with a midpoint estimate of 5.5%. The projected operational sales are expected to range from $88.2 billion to $89.0 billion, targeting a midpoint of $88.6 billion . Additionally, the estimated reported sales are anticipated to vary from $87.8 billion to $88.6 billion, with a midpoint forecast of $88.2 billion, reflecting a growth rate of 4.5% to 5.5% .

Impact of Recent Acquisitions

The recent acquisitions, including Shockwave Medical, Proteologix, and NM26 Bispecific Antibody, have positively influenced Johnson & Johnson’s financial outlook. These strategic acquisitions are expected to enhance the company’s medtech and innovative medicines segments, contributing to an adjusted operational EPS forecasted to range from $10.00 to $10.10, reflecting a subtle growth of 0.8% to 1.8% at the midpoint . The adjusted EPS, considering these acquisitions, is projected to be between $9.97 and $10.07, indicating a growth of 0.5% to 1.5% . This strategic expansion underscores Johnson & Johnson’s commitment to broadening its portfolio and reinforcing its market position in critical healthcare sectors.

Conclusion

Johnson & Johnson’s recent financial performance, especially in surpassing Wall Street estimates, illustrates the company’s adeptness in navigating the complexities of the healthcare sector. Through strategic innovation in its pharmaceutical division and compelling advancements in MedTech, J&J has not only demonstrated financial vitality but also a steadfast commitment to addressing diverse medical needs. This, coupled with an encouraging outlook and future guidance, suggests a trajectory of sustained growth, reflecting the company’s potential to further solidify its position within the global healthcare market.

The implications of these developments extend beyond the confines of financial metrics, accentuating J&J’s pivotal role in propelling the healthcare industry forward. As stakeholders consider the broader significance of these achievements, the vision for future exploration and the call for continued innovation become clear. This narrative not only reaffirms J&J’s resilience and strategic acumen but also serves as an inspiration for the wider industry, highlighting the importance of adaptability, innovation, and strategic foresight in driving success amidst a rapidly evolving global landscape.