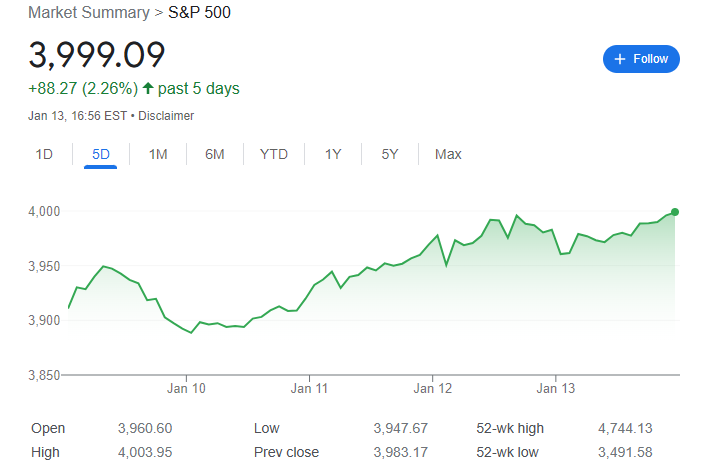

The S&P 500 index finished at its highest point in a month on Friday, and the various indexes all rose for the week as companies began to reveal their quarterly earnings results.

The stock prices of all four businesses increased, and the S&P 500 banks index (.SPXBK) grew by 1.6%. Notably, JPMorgan’s shares rose by 2.5%.

On Friday, New York stock markets reached their highest levels in a month. JPMorgan Chase shares increased by 2.5% and other financials provided the most support to the S&P 500, which climbed 4.2% in the present year.

The Cboe Volatility index, which is known as Wall Street’s fear gauge, concluded at the lowest point since one year.

JPMorgan Chase & Co and Bank of America Corporation surpassed their quarterly earnings estimates, while Wells Fargo Stock (+3.25%) & Co and Citigroup Stock failed to do so. However, the S&P 500 banks index rose by 1.6%.

Most Recent Developments

Wall Street’s major banks have been storing up additional emergency funds to protect against the potential recession and their investment banking results have been weak, with the companies being watchful about predicting income growth.

The strategists noted that the rise in interest rates has helped to expand their profits. Peter Tuz of Chase Investment Counsel in Charlottesville, Virginia stated that the attention has now shifted back to earnings and people are taking a wait-and-see approach as they wait to hear more from the corporate executives.

According to Refinitiv data, the S&P 500 firms’ earnings are anticipated to have dropped 2.2% in the quarter. Furthermore, the University of Michigan survey showed an improvement in U.S. consumer sentiment, with the one-year inflation outlook dropping in January to its lowest level since spring 2021.

INDEXDJX: .DJI, S&P 500 and Nasdaq Composite

The Dow Jones Industrial Average (INDEXDJX: .DJI), S&P 500, and Nasdaq Composite all rose, with the S&P 500 reaching its highest level since December 13th and the Nasdaq hitting its highest level since December 14th.

The S&P 500 was up 2.7% for the week and the Dow rose 2%, with the Nasdaq experiencing its biggest weekly percentage gain +6.9% since November 11th.

The recent Consumer Price Index data has increased the expectations that there could be a sustained decrease in inflation, giving the Federal Reserve the space to reduce its interest rate increases.

Shares of UnitedHealth Group were up after they beat Wall Street’s estimates for the fourth-quarter profit, but the stock ended down on the day. Delta Air Lines’ stock dropped 3.5% after they predicted a lower than expected first-quarter profit.

Trading volume was 10.77 billion shares, which is close to the 10.81 billion average for the last 20 trading days. There were more advancing issues than declining ones on the NYSE and Nasdaq, while the S&P 500 had 12 new 52-week highs and 2 new lows, and the Nasdaq had 105 new highs and 8 new lows.

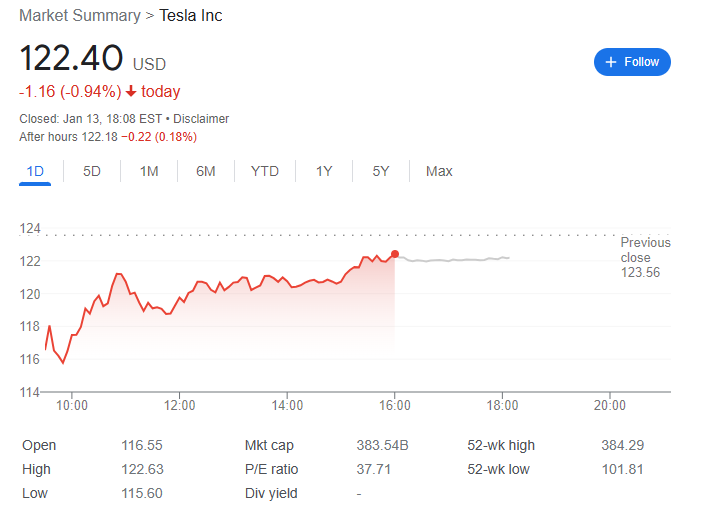

Tesla made significantly reducing prices across the world on their electric cars up to 20%

Tesla stock decreased 0.9% after the company cut the cost of its electric vehicles in the United States and Europe by as much as 20% after missing its delivery targets for 2022.

Tesla is ramping up the competition by decreasing the cost of their products worldwide.

Tesla lowered its prices in various parts of the world, including the US, Europe, the Middle East, and Africa, after having already lowered its prices in Asia the week prior. Many analysts believe that Tesla’s move was meant to challenge both the up-and-coming competitors who have been losing profits and the long-standing car manufacturers that are actively increasing their production of electric cars.

On January 13th, Tesla Inc made headlines by significantly reducing prices across the world on their electric cars, up to 20%, in an effort to remain competitive after failing to meet Wall Street delivery quotas for 2022. This is a shift in their strategy over the last two years when new vehicle orders far exceeded supply. CEO Elon Musk had warned that if they want to keep up their growth, they might need to lower their prices, even if it means sacrificing profits.

The shares dropped 0.9% after initially falling 6.4% on the same day. However, during this week 47% YOY Q4 Production Rise Gave Tesla Stock an 8.8% Boost. Last year, Tesla’s stock was at its worst since its beginning due to slowing growth in China plus Musk’s constant activity on Twitter. Prices have been cut in the US, Europe, Middle East, and Africa, following cuts last week in Asia. This is a direct challenge to smaller rivals that have been struggling financially and to the big car companies that have been increasing production of electric vehicles.

Most Recent Developments

Thomas Hayes, chairman and managing member of Great Hill Capital, remarked that firms are reducing their prices in order to compete. This could make electric vehicles accessible to those who previously could not afford them. U.S. and French customers could take advantage of the discounts offered along with federal tax credits. According to Reuters, Tesla’s top-selling Model 3 sedan and Model Y crossover SUV were marked down by between 6% and 20%.

This means the basic Model Y is now worth $52,990 instead of $65,990. Plus, the US government’s $7,500 tax credit for certain electric vehicle purchases is applicable since January 1st, leading to discounts of more than 30%. Tesla also discounted its Model X luxury crossover SUV and Model S sedan in the US.

A spokesperson for Tesla Germany reported that decreased cost inflation was a contributing factor in reducing prices in its most important European market. In Germany, Tesla cut prices by close to 17% on the Model 3 and the Model Y. The best-selling Model Y is now priced at €44,890, a €9,100 decrease.

Prices were also reduced in Austria, Switzerland and France. French customers buying the Model 3 for €44,990 can receive an additional €5,000 reduction through the government subsidy for EVs with a threshold of €47,000. The price cut also made the five-seat version of the Model Y eligible for the Biden administration tax credit. Analysts at Deutsche Bank estimated that the Model Y, after tax credits, could be $18,000 cheaper than Ford’s Mustang Mach E.

The move is forecasted to increase Tesla’s global deliveries by 12% to 15%, and it shows Elon Musk responding to the increasing competition. The stocks of Tesla’s rivals were heavily affected, with GM and Ford dropping 4.5% and 6%, respectively, and Stellantis and Volkswagen sliding 3.7% and 3.6%, respectively.

A sudden, intense feeling of distress or shock.

Tesla customers and fans were displeased when the company slashed prices following their purchase of a vehicle. Greg Woodfill, who is a Model Y owner from Seattle, was debating whether or not to wait for the US subsidy when he saw a discount of $3,750 in December. Though the Tesla enthusiast had previously owned a Model 3, he chose to purchase the Model Y as he is a fan of their products.

He expressed his disappointment to Reuters on Friday, noting that it was unfair of Tesla to offer discounts to stimulate fourth-quarter sales only to reduce prices even more the following month. In China, owners went as far as protesting at delivery centres, and requesting compensation due to the 6-13.5% price cut. In 2021, the United States and China represented around 75% of total Tesla sales, while Europe is slowly increasing the company’s presence.

Analysts claimed that the price cut in Asia will boost demand, therefore putting pressure on other electric vehicle makers, such as BYD, to follow suit in the largest EV market.

Nikola´s Battery Production to Arizona

Nikola Stock increased +0.040 (1.59%) today, Jan 13. in the day that Nikola said it is moving its Cypress, Calif.- based battery manufacturing making plant to Arizona as part of a cost management plan according to MarketWatch.

The manufacturer of commercial battery-electric vehicles, fuel-cell electric vehicles, and energy solutions said its manufacturing Coolidge, Ariz., plant would now include truck and fuel-cell power module assembly, as well as battery module, pack production and battery-line automation.

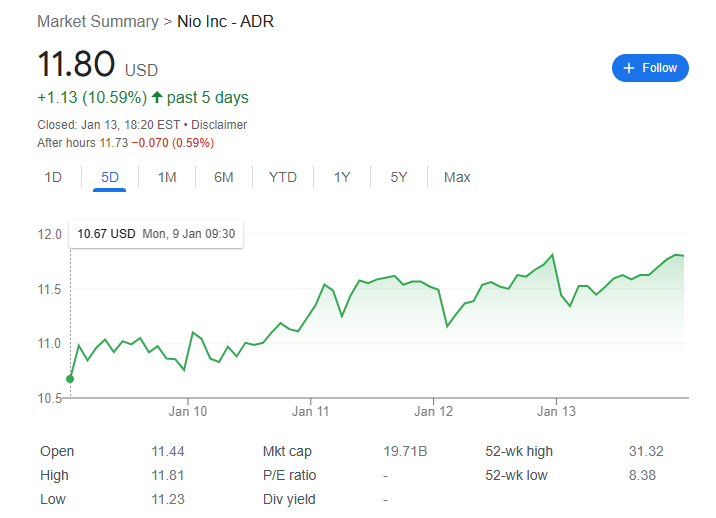

NIO increased +10.59 % this week

NIO Stock jumped +1.13 (10.59%) past 5 days, Jan 13 2023.

Nio, a Chinese manufacturer of electric cars, was highly sought after by investors during the peak of the Covid-19 pandemic. It seems that over-optimism regarding the speed of EV companies’ expansion may have been a factor. Nevertheless, the stock has plummeted by 60% in the last 12 months, prompting many to ponder if it is a sensible investment at present. To ascertain if this is the case, let’s analyze what Nio is currently doing well, alongside the obstacles that lie ahead.

Nio has been doing remarkably well in terms of finance, as it had $7.2 billion in cash and cash equivalents by the end of the third quarter. The company has also been doing an impressive job of expanding vehicle deliveries over the past few years, with a 60% surge to 40,052 in the fourth quarter and a 34% increase to 122,486 for the whole of 2022. Additionally, Nio’s revenue showed a 32% growth to $1.8 billion in the same period.

The company will be releasing its fourth-quarter financial results next month. Furthermore, China, being the world’s biggest car market, has an exceptionally high rate of EV adoption, leading to a 56% share of global passenger EV sales in the first half of 2022, which increased from 48% in the previous year, according to Bloomberg research.