Stock Market rallied sharply on November 3, 2023, after the Labor Department reported that nonfarm payrolls rose by 150,000 in October, which was 20,000 fewer than expected. This lower-than-expected jobs growth was seen as a sign that the Federal Reserve may be able to slow down its pace of interest rate hikes, which is good for stocks.

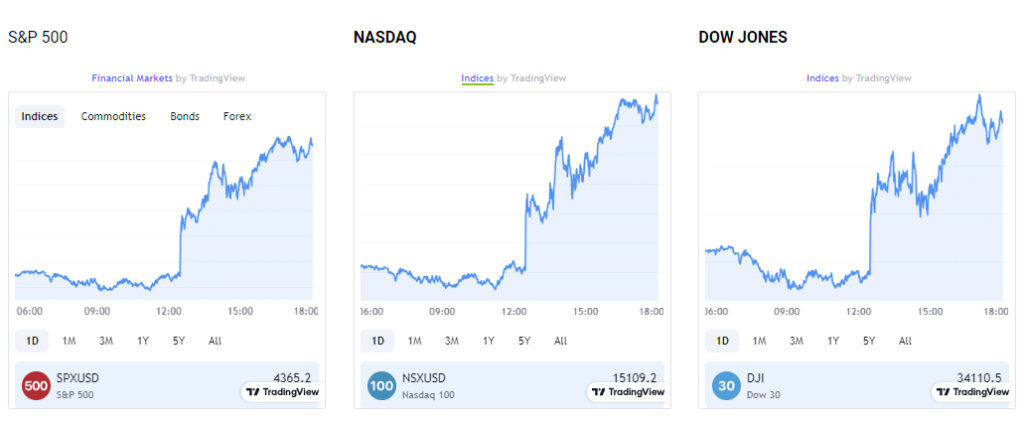

The S&P 500 rose 1.02% on the day, the Dow Jones Industrial Average rose 0.80%, and the Nasdaq Composite rose 1.5%. All three major indexes are now up for the week and the month.

Some of the biggest winners on the day were technology stocks, which have been particularly hard hit by the recent sell-off in stocks. Alphabet (GOOGL), Amazon (AMZN), and Meta (META) all rose more than 2%.

Other sectors that did well on the day included healthcare, financials, and consumer discretionary.

The overall rally in stocks suggests that investors are becoming more optimistic about the economic outlook. The lower-than-expected jobs growth in October could be a sign that the economy is slowing down, but it could also be a sign that the Fed’s rate hikes are having the desired effect of cooling inflation.

Only time will tell how the economy will perform in the coming months, but for now, investors are taking a positive view.

Slowdown in U.S. Job Growth

The U.S. economy added 150,000 jobs in October, less than the 170,000 jobs that economists had expected. The unemployment rate rose to 3.9% from 3.8%, but that was still near a half-century low.

The slowdown in job growth was driven by a number of factors, including the ongoing United Auto Workers strike, which led to a loss of jobs in the manufacturing sector. Other sectors that saw job growth in October included healthcare, government, construction, and social assistance.

The lower-than-expected jobs growth is a sign that the U.S. economy is cooling down. However, the unemployment rate remains near historic lows, and wage growth is still strong. This suggests that the economy is still on solid footing, but that growth is likely to be slower in the coming months.

The Federal Reserve is watching the jobs market closely as it decides whether to raise interest rates again. The Fed is trying to cool inflation without causing a recession. A sharp slowdown in job growth could lead the Fed to pause its rate hikes, but a continued decline in unemployment could lead the Fed to continue raising rates.

Overall, the October jobs report is a mixed bag. It suggests that the economy is slowing down, but that it is still on solid footing. The Fed will need to weigh this data carefully as it decides whether to raise interest rates again.