A busy week for earnings reports is on the horizon, with major players like Tesla, Coca-Cola, and Heineken all set to release their Q3 2024 results on Wednesday, October 23rd. Investors will be tuning in to see how these companies have navigated a dynamic global economic landscape marked by inflation, supply chain challenges, and shifting consumer demand. This article provides a preview of what to expect from each company’s earnings call, highlighting key areas of focus and potential discussion topics.

Tesla’s Q3 2024 earnings

Tesla’s Q3 2024 earnings call is scheduled for Wednesday, October 23, 2024, after market close. The company will release its financial results and publish a Q3 2024 Update Letter on its Investor Relations website. The earnings call, conducted by Tesla’s management, will start at 4:30 p.m. Central Time (5:30 p.m. Eastern Time).

Key points:

- Tesla produced 469,796 vehicles in Q3 2024.

- The company delivered 462,890 vehicles during the quarter.

- Analysts project Q3 2024 revenue of approximately $25.34 billion.

- The earnings call will likely cover financial results, business updates, and future outlook.

- Topics such as Optimus, Tesla Semi, and Robotaxi may be discussed.

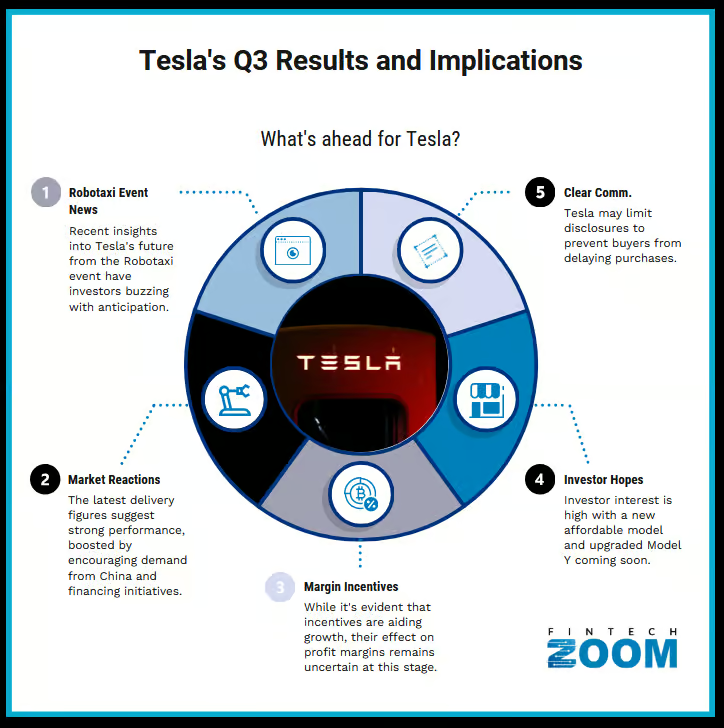

Investors and analysts will be focusing on profit margins, the impact of recent price cuts, progress on autonomous driving technologies, and delivery forecasts for Q4 2024 and full-year 2025.

Matt Britzman, senior equity analyst, Hargreaves Lansdown told to FintechZoom.com

“Tesla comes into next week’s third-quarter results hot off the back of its Robotaxi event, where investors got a glimpse of what the future of Tesla will look like. Markets already know delivery numbers for the quarter were good, with what looks like decent Chinese demand and a push on financing deals helping to deliver a return to growth. It’s unknown how big of an impact those incentives will have on auto margins, but some ongoing softness is expected here.Given the lack of detail at the Robotaxi event, investors will be eager to hear any commentary on both the more affordable model and a refreshed model Y. The irony is that the closer Tesla gets to launching these products, the less likely there will be any chatter about them to avoid buyers delaying purchases. Nevertheless, these are two critical pieces of the puzzle to help drive demand over the next couple of years while work goes on in the background to optimise full self-driving.”

Coca-Cola, Q3 2024 earnings

Coca-Cola Company (NYSE: KO) has scheduled its Q3 2024 earnings call for Wednesday, October 23, 2024, at 8:30 AM EDT. Here are the key details:

- Timing: The earnings release is expected before the market opens on October 23, 2024.

- Access: Investors can access the earnings call via webcast through Coca-Cola’s Investor Relations website.

- Financial documents: The company will likely release the following:

- Earnings Release (PDF)

- 10-Q Filing

- Margin Analysis Schedule

- Transcript (usually available after the call)

- Expected focus areas:

- Global unit case volume growth

- Net revenues and organic revenue growth

- Operating income and margins

- Earnings per share (EPS) performance

- Recent performance context:

In Q2 2024, Coca-Cola reported:- 2% growth in global unit case volume

- 3% growth in net revenues (15% organic revenue growth)

- 10% growth in operating income

- Operating margin of 21.3% (up from 20.1% in the prior year)

- EPS of $0.56 (5% decline) and comparable EPS of $0.84 (7% growth)

- Analyst expectations: While specific Q3 2024 analyst expectations weren’t provided, investors will likely compare results to the previous quarter and year-over-year performance.

- Key topics: The call may cover business updates, future outlook, and progress on strategic initiatives such as sustainability efforts, portfolio transformation, and global market performance.

Investors and analysts can sign up for email alerts on Coca-Cola’s Investor Relations website to receive the latest updates and information regarding the earnings release and call.

Heineken N.V, Q3 2024 earnings

Heineken N.V. has scheduled its Q3 2024 Trading Update for Wednesday, October 23, 2024. Here are the key details:

- Date and Time: October 23, 2024 (specific time not provided, but typically before market open)

- Event Type: Trading Update for Q3 2024

- Access: While not explicitly stated, these updates are usually accessible via Heineken’s investor relations website (www.theheinekencompany.com/investors)

- Context from H1 2024 results:

- Revenue: €17.8 billion, up 2.2%

- Net revenue (beia): €14.8 billion, up 6.0% organically

- Total consolidated volume increased 1.7%

- Net revenue (beia) per hectolitre up 4.3%

- Areas of focus for Q3 update may include:

- Volume and revenue growth trends

- Performance of key markets (e.g., Nigeria, Mexico, Brazil, Vietnam, India)

- Progress on the EverGreen strategy

- Impact of global economic conditions and geopolitical developments

- Updates on productivity and cost-saving initiatives

- Full Year 2024 Outlook (as of H1 2024 report):

- Expected operating profit (beia) growth in the range of low- to high-single-digit

- Anticipation of continued economic volatility in certain markets

- Focus on restoring volume growth through brand investments and innovations

- Currency Impact: As of July 25, 2024, the calculated negative currency translational impact for the full year was estimated at approximately €1,350 million in net revenue (beia)

Investors and analysts can expect Heineken to provide an update on its performance for the third quarter of 2024, potentially including volume trends, revenue growth, and any significant developments affecting the business. The company may also refine its full-year outlook based on the Q3 performance and current market conditions.

Conclusion

With Tesla’s innovative strides in AI and autonomous driving, Coca-Cola’s continued dominance in the beverage industry, and Heineken’s global beer market presence, these earnings calls offer valuable insights into the health of diverse sectors. Investors and analysts will be closely analyzing the results and management commentary to gauge the companies’ performance, strategic direction, and outlook for the remainder of 2024 and beyond.