Chart patterns can provide valuable information to help traders make more informed decisions when trading stocks and other financial instruments. Chart patterns are graphical representations of the price action of a security over a certain period of time; these patterns can be used to predict future price movement and can help traders identify potential entry and exit points. By recognizing chart patterns and understanding how to utilize them, traders can improve their trading decisions and potentially increase their profits. In this article, we will discuss some of the most common chart patterns and how they can be used to improve trading decisions. We will also cover how to interpret and analyze chart patterns and provide tips on how to recognize them. By the end of this article, you should have a better understanding of chart patterns and how they can be used to make better day trading decisions.

Read Candle Power: The Truth Behind the Candlestick Charts.

What are chart patterns?

A chart pattern is a graphical representation of the price action of a security over a certain period of time. Chart patterns can be used to predict future price movement and can help traders identify potential entry and exit points. Chart patterns are not single events and are not guaranteed to occur as expected every time. Instead, they are the result of two opposing forces: the motivation to buy and the motivation to sell. Chart patterns can help traders identify potential areas of support and resistance, which can be used to inform trading decisions. Chart patterns can be broken down into three basic categories: reversal, continuation, and ending. A reversal chart pattern indicates that the prevailing trend is ending and that a reversal is imminent. A continuation chart pattern indicates that the prevailing trend is expected to continue. An ending chart pattern indicates that the prevailing trend is expected to end. Chart patterns can be further broken down into single- and multi-stage patterns, which we will discuss shortly.

Types of chart patterns

Chart patterns are graphical representations of the price action of a security over a certain period of time. These patterns can be used to predict future price movement and can help traders identify potential entry and exit points. Chart patterns can be broken down into three basic categories: reversal, continuation, and ending. A reversal chart pattern indicates that the prevailing trend is ending and that a reversal is imminent. A continuation chart pattern indicates that the prevailing trend is expected to continue. An ending chart pattern indicates that the prevailing trend is expected to end. Chart patterns can be further broken down into single- and multi-stage patterns, as well as uptrend continuation and downtrend continuation.

How to interpret and analyze chart patterns

Chart patterns can be used to predict future price movement, identify potential entry and exit points, and help traders formulate a trading strategy. There are a few things that traders should keep in mind when interpreting and analyzing chart patterns, including keeping emotions out of the decision-making process, remembering that chart patterns are not guaranteed to occur as expected, and using other technical indicators to confirm the existence of a chart pattern.

Keep emotions out of the decision-making process – When analyzing chart patterns and making trading decisions, it is important to keep your emotions out of the decision-making process. Making rash or emotional decisions based on a chart pattern can lead to poor trading outcomes and can have a negative impact on your trading results. Try to be as objective as possible when analyzing chart patterns and making trading decisions.

Remember that chart patterns are not guaranteed to occur as expected – Remember that chart patterns are not guaranteed to occur as expected. It is important to not get caught up in the hype associated with chart patterns and to not expect them to occur as expected every time. Chart patterns are very useful tools for traders and can be used to inform future trading decisions, but it is important to remember that they are not foolproof.

Use other technical indicators to confirm the existence of a chart pattern – Chart patterns are not single events and do not occur in a single bar. Instead, they are the result of two opposing forces: the motivation to buy and the motivation to sell. It is important to confirm the existence of a chart pattern using other technical indicators such as moving averages, momentum indicators, and price volume.

How to recognize chart patterns

There are several key factors that traders should keep in mind when trying to recognize chart patterns, including the fact that not all chart patterns are confirmed by technical indicators, the importance of keeping emotions out of the decision-making process, and the need to use other technical indicators to confirm the existence of a chart pattern.

Chart patterns are not single events and are not guaranteed to occur as expected every time. Instead, they are the result of two opposing forces: the motivation to buy and the motivation to sell. It is important to remember that all chart patterns are not confirmed by technical indicators, and while they may be a sign of impending price movement, they could also mean nothing at all. Chart patterns are not single events and do not occur in a single bar. Instead, they are the result of two opposing forces: the motivation to buy and the motivation to sell. It is important to confirm the existence of a chart pattern using other technical indicators such as moving averages, momentum indicators, and price volume.

Utilizing chart patterns for improved trading decisions

Chart patterns can be used to predict future price movement, identify potential entry and exit points, and help traders formulate a trading strategy. They can also help traders to determine the potential risk and reward associated with a particular trading strategy. Chart patterns can be used to determine potential risk and reward, but it is important to confirm the existence of a chart pattern using other technical indicators. Chart patterns can be used to determine potential risk and reward associated with a particular trading strategy. Traders can use the price action of a security to determine the risk and reward associated with a particular trading strategy. For example, if an uptrend is currently in progress, you can use the price action of the security to determine the resistance level of the uptrend. Once the security reaches that level, it can be used to determine the risk associated with the uptrend, as well as the potential reward if the uptrend continues.

Tips for recognizing chart patterns

In order to understand how to recognize and utilize chart patterns, you first need to become familiar with the different types of chart patterns. There are a variety of chart patterns and each one can provide different information. There are three main types of chart patterns. These are breakout patterns, reversal patterns, and continuation patterns. Breakout patterns are formed when the price breaks out of a trading range or a longer-term price consolidation through an identifiable price level, such as a support or resistance level.

Reversal patterns are formed when the price breaks out of a trading range or a longer-term price consolidation in the opposite direction. Continuation patterns are formed when the price breaks out of a trading range or a longer-term price consolidation but in the same direction as the existing trend. In order to recognize and utilize chart patterns, you first need to become familiar with the different types of chart patterns.

There are a variety of chart patterns and each one can provide different information. There are three main types of chart patterns. These are breakout patterns, reversal patterns, and continuation patterns. Breakout patterns are formed when the price breaks out of a trading range or a longer-term price consolidation through an identifiable price level, such as a support or resistance level. Reversal patterns are formed when the price breaks out of a trading range or a longer-term price consolidation in the opposite direction. Continuation patterns are formed when the price breaks out of a trading range or a longer-term price consolidation but in the same direction as the existing trend.

The importance of incorporating chart patterns into a trading strategy

Chart patterns can be used to predict future price movement, identify potential entry and exit points, and help traders formulate a trading strategy. Chart patterns can also be used to determine potential risk and reward associated with a particular trading strategy. Chart patterns can be used to inform trading decisions and can be used to help traders determine the potential risk and reward associated with a particular trading strategy. It is important to incorporate chart patterns into a trading strategy because they can be used to help inform future trading decisions and can help traders identify potential areas of support and resistance. Chart patterns can be used to determine potential risk and reward associated with a particular trading strategy. Traders can use the price action of a security to determine the risk and reward associated with a particular trading strategy. For example, if an uptrend is currently in progress, you can use the price action of the security to determine the resistance level of the uptrend. Once the security reaches that level, it can be used to determine the risk associated with the uptrend, as well as the potential reward if the uptrend continues.

Best chart patterns

You can find a list of the best chart patterns below. Each chart pattern can be applied to any financial instrument and market conditions, so it is important to be aware of all of these patterns and how they can be used. This can help you make better trading decisions and improve your trading results.

Head and shoulders

This is arguably the most common chart pattern that is used by traders. When this pattern forms, it indicates that the price is likely to fall. This pattern consists of two lower peaks that are connected by a smaller third peak that represents the “head” – the head and shoulder pattern. The two larger price peaks are referred to as the “shoulders” and the neckline is formed by the average of the two shoulders. This pattern is also referred to as a “reverse head and shoulders” when the price action reverses to the upside after the third peak is formed. When this happens, the pattern becomes a “reverse head and shoulders” and indicates that the price will likely rise.

Double top

This pattern indicates that the price is likely to fall and is considered to be a more reliable indication of a price decline than a single top pattern. This pattern is formed when the price reaches a new high and then drops back down to retest the previous high. A double tops pattern can also be referred to as a “failed breakout”. This happens when the price attempts to break out of a trading range or a longer-term price consolidation but then fails to maintain the breakout and moves back into the original price range.

Double bottom

This pattern predicts that the price is likely to rise and is considered to be a more reliable indication of a price increase than a single bottom pattern. This pattern is formed when the price reaches a new low and then rises back up to retest the previous low. A double bottom pattern can also be referred to as a “failed breakout”. This happens when the price attempts to break out of a trading range or a longer-term price consolidation but then fails to maintain the breakout and moves back into the original price range.

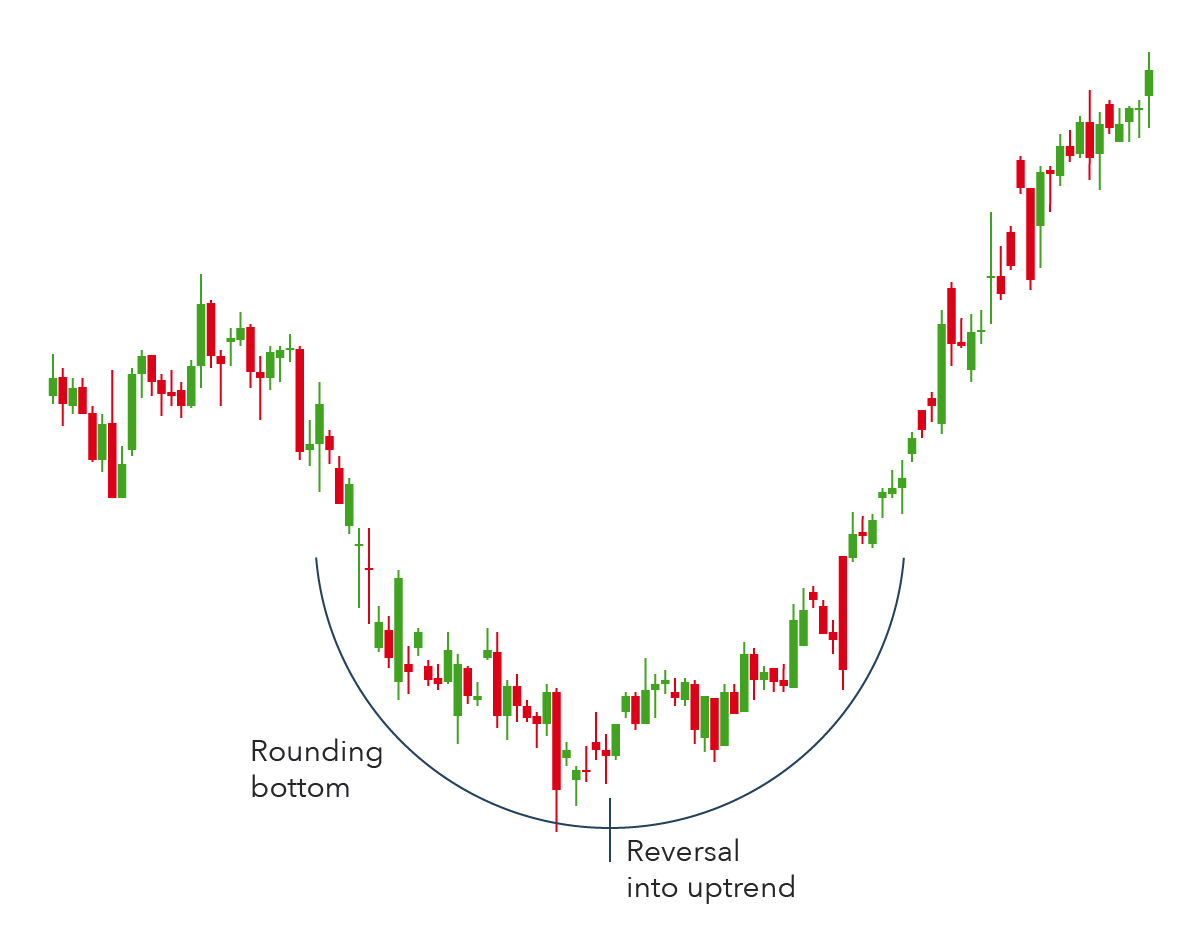

Rounding bottom

This pattern is generally used to predict a short-term price rise but can also be used to predict that the price is likely to fall after the pattern is complete. This pattern is formed when the price of a stock or other financial instrument makes a lower low followed by an increase back to the previous low or the trendline. This pattern is considered to be a short-term reversal pattern that predicts that a short-term price increase is likely.

Cup and handle

This pattern is considered to be a long-term chart pattern that indicates that the price of a stock or other financial instrument is likely to rise. This pattern is formed when the price of a security makes a “bottom” at a lower low followed by a “rally” to form a “cup”. The “handle” is the final movement, which signifies the end of the correction and points to the upside.

Wedges

Wedges occur when the price of a stock or other financial instrument is moving sideways for an extended period of time. The trendlines that form the wedge are known as the contracting and the rising trendlines. The contracting trendline is formed when the security’s price is moving lower and lower, but it’s also moving closer to the other moving average. The rising trendline is when the security’s price is moving higher and higher, but it is also moving closer to the other moving average. When these trendlines meet, a security’s price is likely going to break out of the pattern, potentially moving in the direction of the trendline that was forming during the period of contracting prices.

Pennant or flags

Pennants or flags are very similar to wedges, and they occur when the price of a stock or other financial instrument is moving sideways for an extended period of time. The trendlines that form the pennant or flag are known as the contracting and the rising trendlines. The contracting trendline is formed when the security’s price is moving lower and lower, but it’s also moving closer to the other moving average. The rising trendline is when the security’s price is moving higher and higher, but it is also moving closer to the other moving average. When these trendlines meet, a security’s price is likely going to break out of the pattern, potentially moving in the direction of the trendline that was forming during the period of contracting prices.

Ascending triangle

An ascending triangle occurs when a stock or other financial instrument is trading sideways while the price is rising. The rising trendline in an ascending triangle is formed when the security’s price is moving higher and higher, but it is also moving closer to the other moving average. The contracting trendline is formed when the security’s price is moving lower and lower, but it’s also moving closer to the other moving average. When these trendlines meet, a security’s price is likely going to break out of the pattern, potentially moving in the direction of the trendline that was forming during the period of contracting prices. The breakout of an ascending triangle is usually significant, so traders can look for long entry trades after the triangle breakout.

Descending triangle

A descending triangle occurs when a stock or other financial instrument is trading sideways while the price is falling. The falling trendline in a descending triangle is formed when the security’s price is moving lower and lower, but it’s also moving closer to the other moving average. The contracting trendline is formed when the security’s price is moving higher and higher, but it is also moving closer to the other moving average. When these trendlines meet, a security’s price is likely going to break out of the pattern, potentially moving in the direction of the trendline that was forming during the period of contracting prices. The breakout of a descending triangle is usually significant, so traders should look for short entry trades after the triangle breakout.

Symmetrical triangle

Symmetrical triangles are very similar to other chart patterns, with the main difference being that price action is moving in both directions. A symmetrical triangle is an indecision pattern and is a continuation pattern; it occurs when the price of a stock or other financial instrument is moving sideways while the price is also moving in both directions. The rising and contracting trendlines in a symmetrical triangle are formed when the security’s price is moving higher and higher, but it is also moving closer to the other moving average. The falling and rising trendlines are formed when the security’s price is moving lower and higher, but it is also moving closer to the other moving average. When these trendlines meet, a security’s price is likely going to break out of the pattern, potentially moving in the direction of the trendline that was forming during the period of contracting prices.

Conclusion

Chart patterns can provide valuable information to help traders make more informed decisions when trading stocks and other financial instruments. Chart patterns are graphical representations of the price action of a security over a certain period of time; these patterns can be used to predict future price movement and can help traders identify potential entry and exit points. There are a variety of chart patterns and each one can provide different information. In order to recognize and utilize chart patterns, you first need to become familiar with the different types of chart patterns.