The Asian markets have been a focal point for global investors, with recent developments shaping the economic landscape across the region. From the bustling streets of Tokyo to the financial hubs of Hong Kong and Shanghai, Asian stock markets are experiencing significant shifts that have an impact on both regional and international economies. The performance of key indices such as the Nikkei 225 and Hang Seng Index provides crucial insights into the health and direction of Asian financial markets.

Today’s update on Asian markets offers a comprehensive look at the factors driving market trends and sector-specific movements. We’ll explore the latest performance of major Asian market indices, delve into the key influences shaping investor sentiment, and analyze emerging patterns across various industries. This overview aims to equip readers with the knowledge to understand the current state of Asian markets and their potential implications for global finance.

Major Asian Market Indices Performance

Asian markets have experienced significant fluctuations recently, with major indices showing varied performance across the region. These movements have an impact on global financial markets and investor sentiment.

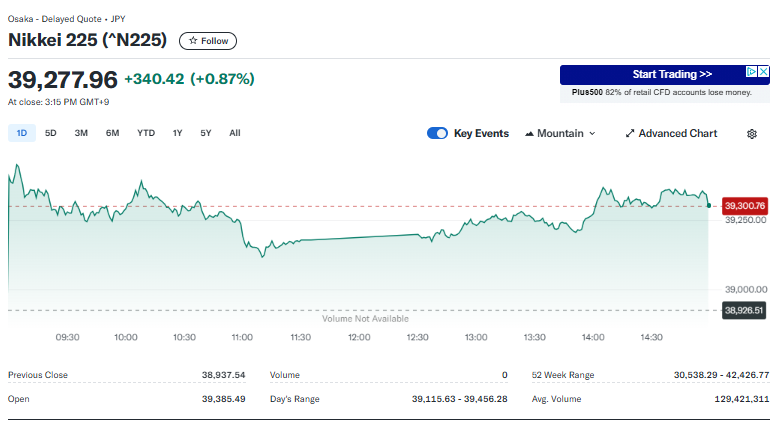

Nikkei 225

The Nikkei 225, Japan’s leading stock index, has shown resilience in recent trading sessions. As of the latest update, the index stands at 39,277.96 points, marking a 0.87% increase. This upward trend has been consistent over the past few days, with Japanese stocks rising for three consecutive sessions. The Nikkei’s performance has an influence on investor confidence in the Asian financial markets, as it represents the health of Japan’s economy, the world’s third-largest.

Hang Seng Index

Hong Kong’s Hang Seng Index has faced challenges recently. The index closed at 20,637.24 points, experiencing a 1.38% decline. This downturn comes after a period of gains, highlighting the volatility in the Hong Kong stock market. Investors are closely monitoring the situation, as concerns about China’s economic stimulus measures have an impact on market sentiment.

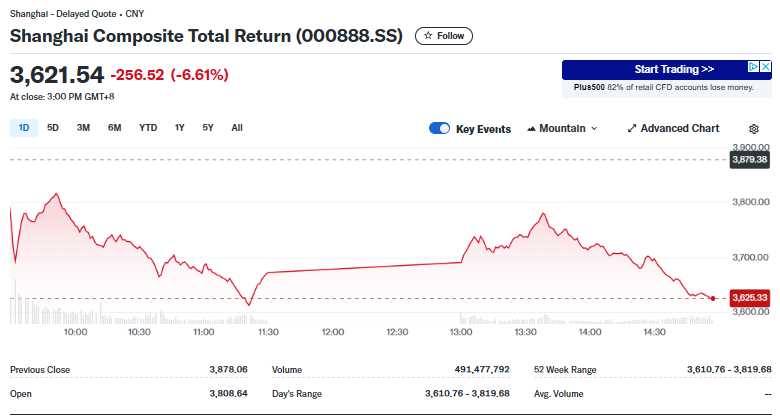

Shanghai Composite

The Shanghai Composite, a key indicator of China’s stock market performance, has shown mixed results. The index currently stands at 3,258.86 points. Recent data suggests that Chinese stocks have faced pressure, with the CSI 300 index experiencing a significant drop. This volatility has an influence on investor confidence in the broader Asian markets.

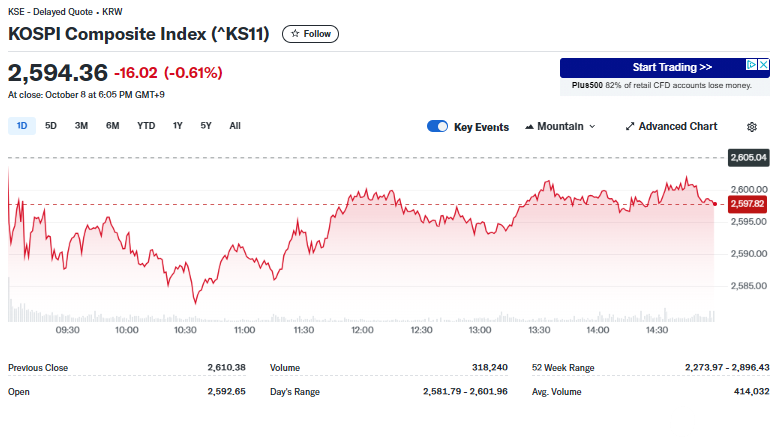

KOSPI

South Korea’s KOSPI Composite Index closed at 2,594.36, recording a 0.61% decrease. The index has faced some challenges, with its year-to-date performance showing a 2.29% decline. However, over the past year, the KOSPI has demonstrated resilience, posting a 7.71% gain. The performance of South Korean stocks has an impact on the overall sentiment in Asian financial markets.

These major Asian market indices provide crucial insights into the region’s economic health and investor sentiment. Their performance has a significant influence on global financial markets, making them essential indicators for investors and analysts alike.

Key Factors Driving Asian Markets

Global Economic Trends

The performance of asian markets is closely tied to global economic trends. The ongoing rivalry between the United States and China has a significant influence on the region’s financial landscape. This competition is particularly evident in Asia, where both countries have historically strong financial and trade connections with other Asian nations. The Chinese Yuan is expected to become a major regional currency in the near future, reflecting China’s growing economic influence.

Global factors, such as the business cycle, uncertainty in economic and monetary policy, and investor sentiment, have an increasing impact on emerging Asian stock markets. The marketization and globalization of these markets have made them more susceptible to external influences. This interconnectedness means that events in developed markets can quickly ripple through Asian financial markets.

Regional Political Developments

Political developments within Asia have a substantial impact on the region’s markets. The rivalry between the United States and China is gradually intensifying, with each country seeking to expand its sphere of influence in economic, financial, and political domains. This competition has led to the creation of various economic forums and trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) and the Indo-Pacific Economic Framework (IPEF).

These political dynamics have an influence on trade relationships and investment flows within the region. For instance, China has replaced the US and Japan as the main trading partner for almost all Asian countries. However, this shift has also exposed these nations to potential vulnerabilities stemming from China’s economic conditions.

Corporate Earnings Reports

Corporate earnings reports play a crucial role in shaping investor sentiment and market performance in Asian financial markets. Recent reports from major companies have highlighted some challenges facing the region. For example, McDonald’s reported its first drop in sales worldwide in 13 quarters, citing weakness in China’s economy. Other companies, including Unilever, Visa, and Aston Martin, have also noted weakness in China, suggesting that demand in the Asian giant is unlikely to reverse while a protracted property downturn and job insecurity weigh on consumers.

Sector-specific Trends and Analysis

Technology Sector

The technology sector in Asian markets has shown significant growth and resilience. Companies like Taiwan Semiconductor Manufacturing Co. Ltd. and Samsung Electronics Co Ltd. are leading the charge, with substantial weights in the Emerging Asia Manufacturing Index.

These firms have a significant influence on the performance of Asian stock markets, particularly in Taiwan and South Korea. The sector has benefited from increased demand for semiconductors and electronic components, driven by the global shift towards digitalization and the rise of emerging technologies.

Financial Services

Asian financial services are experiencing rapid transformations, with digital ecosystems playing a crucial role. The rise of super apps and embedded finance has reshaped consumer interactions with financial institutions.

Banks and insurance companies are innovating to create their own ecosystems, with examples like State Bank of India’s YONO app and DBS in Singapore running marketplaces in various sectors. The sector has seen an increase in digital banking users, with 88% of Asian consumers now actively using digital banking services.

Manufacturing

The manufacturing sector in Asian markets is facing both challenges and opportunities. Countries like Vietnam and Thailand are experiencing moderate growth, supported by favorable trade agreements and infrastructure improvements.

However, Indonesia and Cambodia are grappling with external demand pressures and supply chain challenges. The sector’s performance varies across countries, with Indonesia’s manufacturing PMI at 48.9, indicating contraction, while Vietnam shows growth with a PMI of 52.4.

Consumer Goods

The consumer goods sector in Asian markets is adapting to changing consumption patterns. With the rise of the consuming class in Asia, expected to reach 70% of the total population by 2030, there has been an increase in demand for various consumer products. However, the sector faces challenges due to inflation and changing consumer preferences.

Companies like Uniqlo have been expanding their presence in Asian markets, capitalizing on the growing middle class and increasing disposable incomes.

Conclusion

The Asian markets continue to be a key player in the global financial landscape, with recent developments highlighting both challenges and opportunities. The performance of major indices like the Nikkei 225 and Hang Seng Index reflects the complex interplay of regional and international factors. Global economic trends, political dynamics, and corporate performance have a significant influence on investor sentiment and market movements across the region.

Looking ahead, the Asian markets are likely to remain a focal point for investors worldwide. The ongoing technological advancements, shifts in consumer behavior, and evolving financial services sector present exciting prospects for growth. However, challenges such as geopolitical tensions and economic uncertainties will need to be navigated carefully. As the region continues to adapt and innovate, its role in shaping the global economic landscape is set to become even more crucial in the coming years.