In an unprecedented turn of events, the Dow Jones surged 200 points, reaching a new record amidst the turmoil following an assassination attempt on former President Trump. This significant movement in the Dow Jones today underscores the complex dynamics at play in the global financial markets, where geopolitical incidents can have surprising effects on investor confidence and stock performance. The resilience of the Dow Jones stocks in times of political instability not only highlights the robust nature of financial markets but also raises important questions about the factors that drive market sentiment and valuation.

The article will delve into the backdrop of this dramatic rise, analyzing the immediate market reaction across key indices and evaluating investor sentiments in the wake of the news. Furthermore, it will feature insights and quotes from financial experts, offering a comprehensive understanding of the event’s impact on the Dow Jones and the broader market. By exploring these aspects, readers will gain a clearer picture of how such incidents can influence market trends and investor strategies, providing a valuable perspective on navigating the complexities of investing in today’s unpredictable global landscape.

Background Information

Assassination Attempt on Donald Trump

The recent assassination attempt on former President Donald Trump occurred during a public rally. A bullet, fired by a sniper from a nearby rooftop, grazed Trump’s right ear as he was addressing his supporters. The assailant, identified as 20-year-old Thomas Matthew Crooks, was neutralized within seconds by the Secret Service’s counter-sniper team . The swift response highlights the critical role of security measures at such high-profile events. Following the incident, the FBI took charge of the investigation, focusing on both the shooter and the security protocols in place . This event has drawn attention to the need for stringent security arrangements during public gatherings, especially when they involve high-profile individuals.

Historical Market Reactions

In the wake of the assassination attempt, the Dow Jones experienced a notable surge, climbing 200 points and reaching a new record. This reaction is reflective of historical trends where, despite initial volatility, markets tend to stabilize and often improve following geopolitical disturbances. A review of 40 major historical geopolitical events showed that, on average, markets were higher three months later . This pattern suggests that while immediate market reactions to global events can be turbulent, the long-term impact tends to be less severe, especially in a strong economic environment. This resilience is crucial for investors to understand as it guides their strategies in times of uncertainty.

Market Reaction and Key Indices

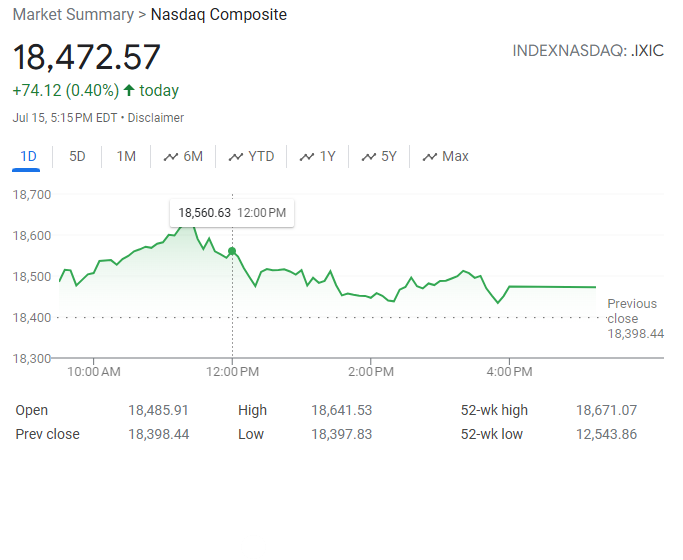

Despite the unsettling event of an assassination attempt on a former president, the U.S. stock market demonstrated remarkable resilience. On the Monday following the incident, both the Dow Jones Industrial Average and the S&P 500 not only recovered but reached new highs, while the tech-heavy Nasdaq also closed up .

Dow Jones Performance

Historically, the Dow Jones Industrial Average has shown a tendency to dip following assassination attempts on political figures. For instance, after the attempt on President Ronald Reagan in 1981, the Dow fell by 1.4%. However, this pattern did not hold in the current scenario, as the Dow finished 0.53% higher on the Monday after the attempt on former President Trump, demonstrating a break from historical patterns where the Dow Jones would typically fall by an average of 1.1% in the first trading day after such incidents .

NASDAQ and S&P 500 Movements

The NASDAQ and S&P 500 indices similarly reflected this unexpected market confidence. Two days post-incident, both indices climbed to new record levels. This rise was supported by various factors including advancements in artificial intelligence and recent progress in controlling inflation, which appear to be significant drivers of stock performance today, overshadowing the immediate impacts of political disturbances .

This unusual market behavior underscores a broader trend of resilience in the face of political challenges, suggesting that investors are possibly becoming more accustomed to navigating through periods of political uncertainty with a focus on long-term investment strategies .

Investor Sentiments

Positive Outlook due to Political Stability

Investor sentiments have been notably buoyant following the assassination attempt on former President Donald Trump, largely due to the perceived political stability his potential re-election in November might bring. Notably, the options market has shown a positive trend, with a surge in demand for bullish call options tied to the Russell 2000 and an exchange-traded fund that tracks the index, suggesting that the rally in small-cap stocks might continue . This optimism is further echoed by the rising likelihood of a Trump victory, which has been seen as a significant tailwind for risk assets like Bitcoin, which also saw a jump in value .

Impact on Specific Stocks (Solar, Bitcoin, Trump Media)

The assassination attempt has had a mixed impact on various sectors. Cryptocurrency, a sector Trump has previously supported, witnessed significant growth, with top crypto stocks like Coinbase Global, Riot Platforms Inc., and Marathon Digital soaring between 5 percent and 8.5 percent . Trump’s own media company, TMTG, saw its stock skyrocket by 33 percent, driven by expectations of his victory and the subsequent increased viewership and advertising revenues for his platform, Truth Social .

Conversely, stocks in sectors like clean energy faced declines, with Invesco Solar ETF and iShares Global Clean Energy ETF experiencing drops. These sectors are perceived to be at a disadvantage with a Republican administration, which historically has not favored aggressive clean energy policies . This sector-specific volatility highlights the nuanced reactions within the market, where political developments can significantly sway investor confidence and stock valuations.

Expert Opinions and Quotes

Insights from Financial Analysts

Financial analysts have provided valuable insights into the potential impact of the new policy on the market. They suggest that while the short-term implications might raise concerns among some investors, the long-term benefits are expected to enhance market performance significantly . According to experts from BofA Global Research, there is no evidence to support the argument that disinflation could be a headwind to the financial health of American companies. They argue that it is demand and economic growth that drive corporate earnings rather than pricing, which has been a lagging indicator with no statistically significant relationship to earnings .

Investor Reactions

Investor reactions to recent events have been mixed. Some express optimism about the long-term benefits of the current economic policies, while others are concerned about the immediate implications. The options market has shown a positive trend, with a surge in demand for bullish call options, suggesting that many investors are betting on the continuation of the rally in small-cap stocks . This sentiment is echoed by the rising likelihood of a Trump victory, seen as a significant tailwind for risk assets like Bitcoin, which also saw a jump in value . Conversely, sectors like clean energy have faced declines, highlighting the nuanced reactions within the market where political developments can significantly sway investor confidence and stock valuations .

Conclusion

The recent surge in the Dow Jones following the assassination attempt on former President Donald Trump highlights the unpredictable nature of financial markets in response to geopolitical events. This remarkable resilience reflects a broader trend where, despite initial volatility, markets have historically tended to stabilize and demonstrate strength over time. Through a detailed exploration of the event’s impact on investor sentiments, stock performances in various sectors, and professional insights, the article has provided a comprehensive understanding of the complex interplay between politics and financial markets.

The significance of these developments extends far beyond immediate market reactions, suggesting that investors are increasingly focusing on long-term strategies and the potential for political stability to influence market trends. As we reflect on these findings, it becomes clear that navigating today’s financial landscapes requires a nuanced understanding of how geopolitical incidents can shape market dynamics. This analysis not only underscores the importance of robust investment strategies but also highlights the need for ongoing research into the factors that drive market sentiment and valuation in an ever-evolving global context.