The US markets today are buzzing with activity as investors closely monitor stock performance and economic indicators. Wall Street’s major indexes, including the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite Index, are experiencing significant movements that have an impact on the overall financial landscape. This real-time snapshot of the US stock markets today provides crucial insights for traders, analysts, and individual investors alike.

As the stock market live updates continue to unfold, several key factors are shaping the trading session. The Dow 30 components, various stock indexes, and commodities such as crude oil are all playing pivotal roles in determining market direction. This comprehensive overview aims to analyze sector performance, highlight notable market movers, and examine the broader economic context influencing US markets today. By delving into these critical aspects, readers can gain a deeper understanding of the current financial climate and make more informed investment decisions.

Major Index Performance

The US markets today are experiencing significant movements across major stock indexes, providing crucial insights for investors and analysts. These indexes serve as key indicators of the overall financial landscape, reflecting the performance of various sectors and companies.

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), often referred to as the Dow 30, is a smaller index consisting of 30 well-established ‘blue-chip’ stocks. This index has a more conservative approach, with weightings based on stock prices rather than market capitalization. Today, the DJIA closed at 42,512.00, showing a gain of 431.63 points or 1.03%. This upward movement suggests a positive sentiment among investors for large, established companies.

S&P 500

The S&P 500, a broader market index, includes roughly the 500 largest U.S. stocks spanning 11 sectors. It assigns weightings based on market capitalization, offering a more comprehensive view of the market’s performance. The S&P 500 closed at 5,792.04, with a gain of 40.91 points or 0.71%. This increase indicates a generally positive trend across a wide range of industries and company sizes.

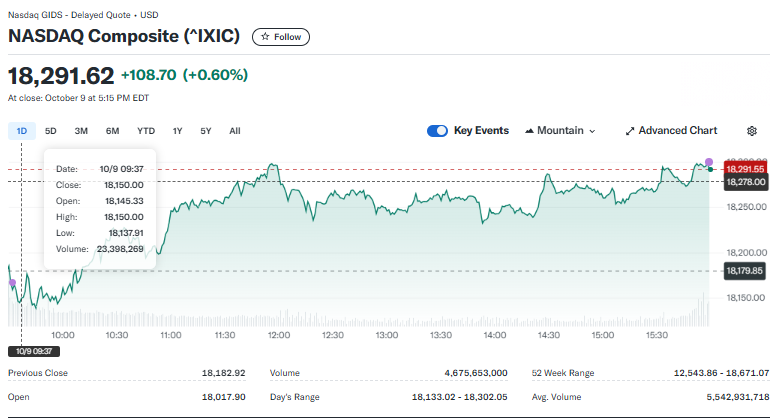

Nasdaq Composite

The Nasdaq Composite, known for its heavy focus on technology and growth companies, includes over 3,000 stocks. It employs market cap weighting, making it a popular benchmark for the tech sector. The Nasdaq closed at 18,291.82, up 108.91 points or 0.60%. While showing gains, the Nasdaq’s performance today suggests a slightly more tempered enthusiasm for tech and growth stocks compared to the other major indexes.

These three indexes generally rise and fall together, but the extent of gains or losses can differ depending on market conditions and economic factors. Today’s performance across all three major indexes points to a positive sentiment in the US markets, with investors showing confidence across various sectors and company sizes.

Key Market Movers

Top Gainers

The US markets today have witnessed significant upward movements in several stocks. Arcadium Lithium plc (ALTM) has emerged as one of the top gainers, with its stock price soaring by an impressive 30.90% to $5.55. This substantial increase has caught the attention of investors and analysts alike, potentially signaling positive developments within the company or its sector.

Another notable performer is MicroCloud Hologram Inc. (HOLO), which has seen a remarkable 26.88% increase in its stock price, reaching $6.57. This surge suggests growing investor confidence in the company’s prospects or potential breakthroughs in its technology.

Astera Labs, Inc. (ALAB) has also made significant strides, with its stock price climbing by 15.60% to $61.22. This considerable gain has placed Astera Labs among the day’s top performers in the US stock markets today.

Top Losers

While some stocks have experienced substantial gains, others have faced downward pressure. Maxeon Solar Technologies, Ltd. (MAXN) has emerged as one of the day’s biggest losers, with its stock price declining by 10.97% to $6.33. This significant drop may be attributed to various factors, including company-specific news or broader market trends affecting the solar energy sector.

AST SpaceMobile, Inc. (ASTS) has also experienced a notable decline, with its stock price falling by 6.57% to $22.61. This decrease has placed AST SpaceMobile among the day’s top losers in the US markets today.

Halozyme Therapeutics, Inc. (HALO) has seen its stock price drop by 6.41% to $50.66, making it another significant decliner in today’s trading session.

Most Active Stocks

NVIDIA Corporation (NVDA) continues to be one of the most actively traded stocks in the US markets today, with a trading volume of 32.581 billion USD. Despite its high activity, NVIDIA’s stock price has seen a slight decrease of 0.18% to $132.65.

Tesla, Inc. (TSLA) is another highly active stock, with a trading volume of 15.924 billion USD. The electric vehicle manufacturer’s stock price has decreased by 1.41% to $241.05, reflecting ongoing market dynamics and investor sentiment.

Palantir Technologies Inc. (PLTR) has also seen significant trading activity, with its stock price increasing by 4.05% to $43.13. This movement has placed Palantir among the day’s most active stocks in the US stock markets today.

Sector Analysis

The US markets today are experiencing diverse movements across various sectors, reflecting the complex dynamics of the economy. In the technology sector, recent performance has been driven by major semiconductor companies, with NVIDIA and Broadcom showing significant gains. The iShares Expanded Tech-Software ETF has reached all-time highs, indicating strong investor confidence in software and cloud stocks. Cybersecurity investments have also seen positive momentum, as evidenced by the Amplify Cybersecurity ETF hitting record levels.

In healthcare, the third-largest industry in the S&P 500 Index, stocks have demonstrated resilience despite market volatility. Through August, the healthcare sector posted a 16.31% gain, slightly underperforming the broader S&P 500. However, the sector’s performance has been marked by significant disparities between winners and losers, creating both opportunities and risks for investors. Companies like Eli Lilly & Co. have seen exceptional growth, while others, such as Pfizer, have faced challenges.

The energy sector has experienced a retreat after a solid start in 2024, with year-to-date gains of less than 4%. Declining oil prices have tempered enthusiasm among investors, although the sector’s performance over the past three to five years remains strong. The US has become more insulated from oil supply challenges as it has transitioned from a net importer to a net exporter of oil.

In the financial sector, recent global shifts have underscored the importance of resilience for companies. The evolving energy mix, the rise of artificial intelligence, and the ongoing energy transition are key factors shaping the industry. Financial institutions are adapting to these changes while also focusing on cybersecurity and talent acquisition in an increasingly digital landscape.

Conclusion

The US stock markets today have shown a dynamic landscape, with major indexes like the Dow Jones, S&P 500, and NASDAQ all posting gains. This upward trend has an influence on various sectors, including technology, healthcare, and energy, each experiencing unique challenges and opportunities. The performance of key market movers and sector-specific developments provide valuable insights to analyze the current financial climate and potential future directions.

To wrap up, the US markets today offer a snapshot of the complex interplay between economic factors, company performance, and investor sentiment. The diverse movements across sectors and individual stocks highlight the need to stay informed and adaptable in the ever-changing financial world. As the markets continue to evolve, these insights serve as a foundation to make informed investment decisions and navigate the dynamic financial landscape.