With the recent hype in the Electric Vehicle industry, the future of the electrification trend seems achievable. Many potential investors want to invest this year.

With government support, EVs might become one of the top investments to watch. With the increase in the distribution of electric vehicles at a healthy pace, EV stocks look promising.

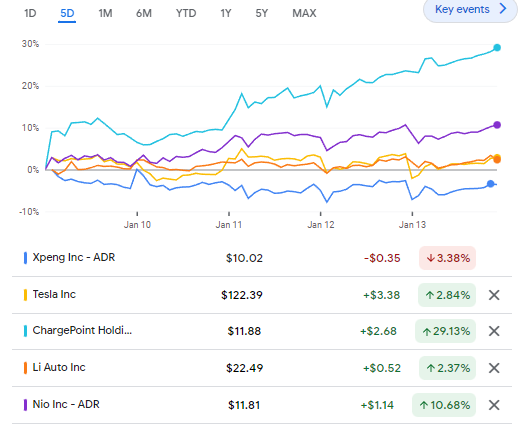

Comparison EV Stocks

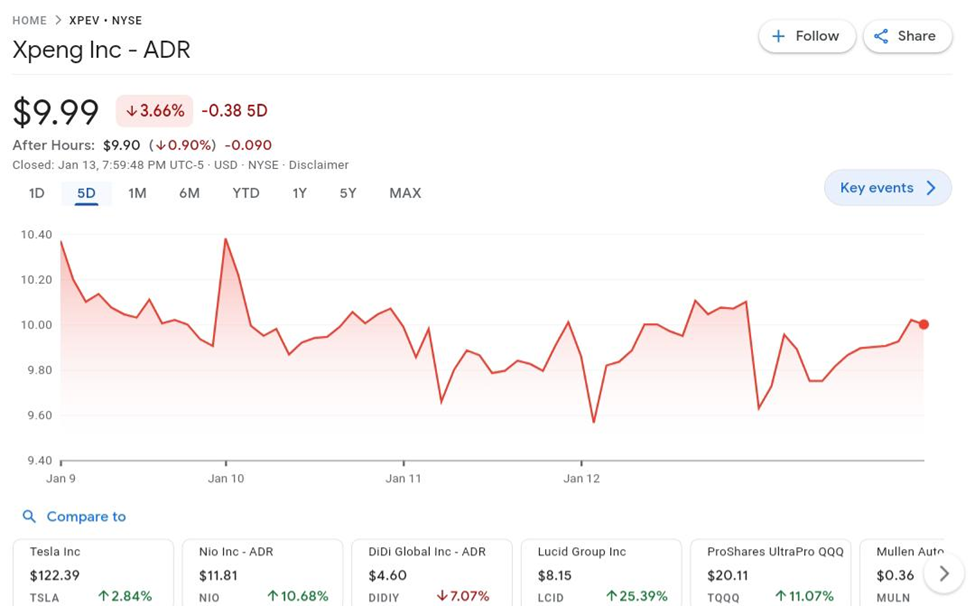

Xpeng Stock (NYSE: XPEV)

Fact 1: Xpeng Stock registered a 3.66% loss in the past five days. The stock started trading at 10.29 at the beginning of the week and closed at 9.99.

Price performance from 09/01/2023 to 13/01/2023 is -0.12 (-1.19%) since 01/06/23.

Period Low: 9.54 +4.72% on 01/11/23

Period High: 10.48 -4.68% on 01/09/23

Period Open: 10.11

Period close: 9.99

Source: https://www.barchart.com/stocks/quotes/XPEV/performance

It was established in 2015 by Xiao Peng He, Heng Xia, and Tao He. This company deals in manufacturing, designing, and developing electric vehicles. Xpeng has its headquarters located in Guangzhou, China.

They create eco-friendly vehicles, such as the sedan (P7) and SUVs (the G3).

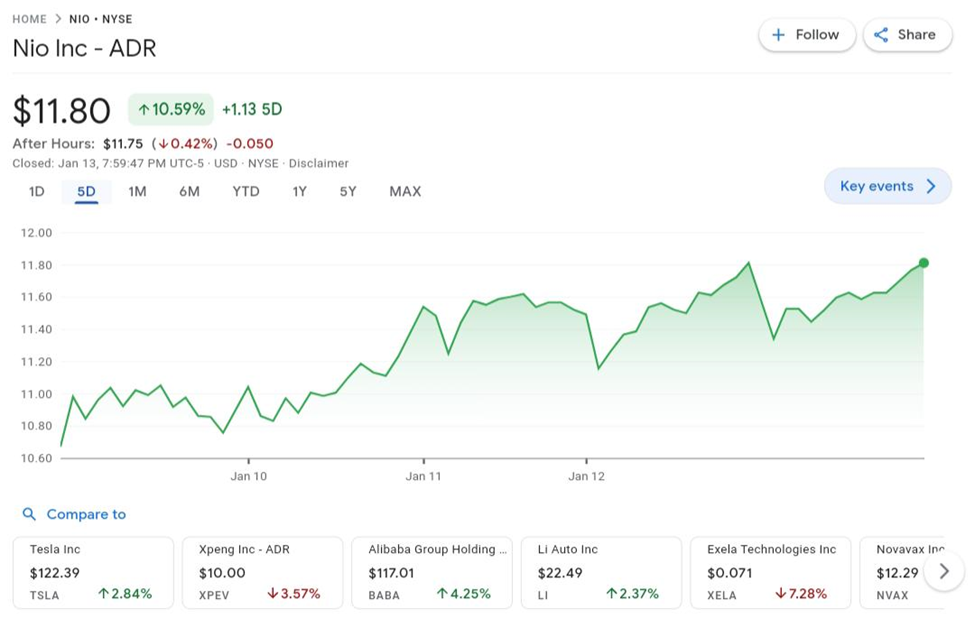

Nio Stock (NYSE: NIO)

Fact 1: On Thursday, NIO Shares were down 0.009% in pre-market trading.

Fact 2: Nio, Inc NIO started trading about 3% lower on Friday. It occurred after the EV giant reported a slash in vehicle prices in the U.S.

Fact 3: Nio increased by +13.79% in the past fivedays. The stock started trading at 10.37 at the beginning of the week andclosed at 11.80.

Price performance from 09/01/2023 to 13/01/2023 is +1.43 (+13.79%) since 01/06/23

Period Low: 10.63 +11.01% on 01/09/23

Period High: 11.81 -0.08% on 01/13/23

Period Open: 10.37

Period close: 11.80

Fact 4: On November 10, 2022, Nio Inc – (NYSE: NIO) announced its earnings result for the last quarter. It reported a $0.36 earnings per share for the last quarter. The company gained $1.83 billion in the last quarter. However, they have negative trailing one-year earnings on can’t of 32.66%, with a negative net margin of 24.94%.

Fact 5: Nio registered about 15,185 monthly annual car deliveries in December, which is about 50.8% for the year. The company produced 122,486 vehicles in 2022, registering an increase of 34% from the previous year. Nio is well prepared and ready to take a full swing of the promising new EV market trend and has had more success this year.

It is a holding company established in November 2014 by Li Bin and Qin Li Hong. The company deals in electric vehicle manufacturing, sale, and design and is headquartered in Jiading, China. They’ve produced several vehicles in the past, including the ES8 7-seater SUV and the EP9 supercar. It offers users access to home charging and other power solutions such as power express valet services, power mobile charging trucks, public charging, and battery swap. It provides other services like battery payment arrangements, service packages, vehicle financing, and license plate registration.

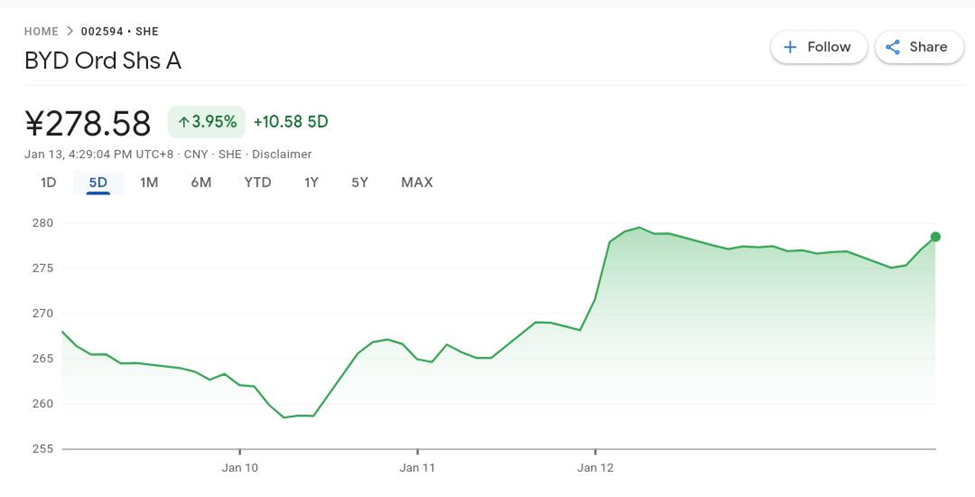

BYD Stock (OTCMKTS: BYDDY)

Fact 1: BYDDF increased by a +12.54%% in the past five days. The stock started trading at 26.3000 at the begging of the week and closed at 29.5980.

Price performance from 09/01/2023 to 13/01/2023 is +3.2980 (+12.54%)

Period Low: 25.7800 +14.81% on 01/09/23

Period High: 29.8500 -0.84% on 01/13/23

Period Open: 26.3000

Period Close: 29.5980

BYD is a well-known name in the electric vehicle industry. This stock is currently named one of the top EV stocks to buy. The stock has a long-term value and should be noticed.

ChargePoint (NYSE: CHPT)

Fact 1: CHPT increased by +29.13% in the past five days. The stock started trading at 9.01 at the beginning of the week and closed at 11.88.

Price performance from 09/01/2023 to 13/01/2023 is +2.87 (+31.85%)

Period Low: 9.18 +29.41% on 01/09/23

Period High: 11.90 -0.17% on 01/13/23

Period Open: 9.01

Period close: 11.88

EVs have become popular with the new rave of cleaner, greener transportation forms. This has had a positive effect on companies such as ChargePoint, which deals with the installation of Charge points for battery-powered cars.

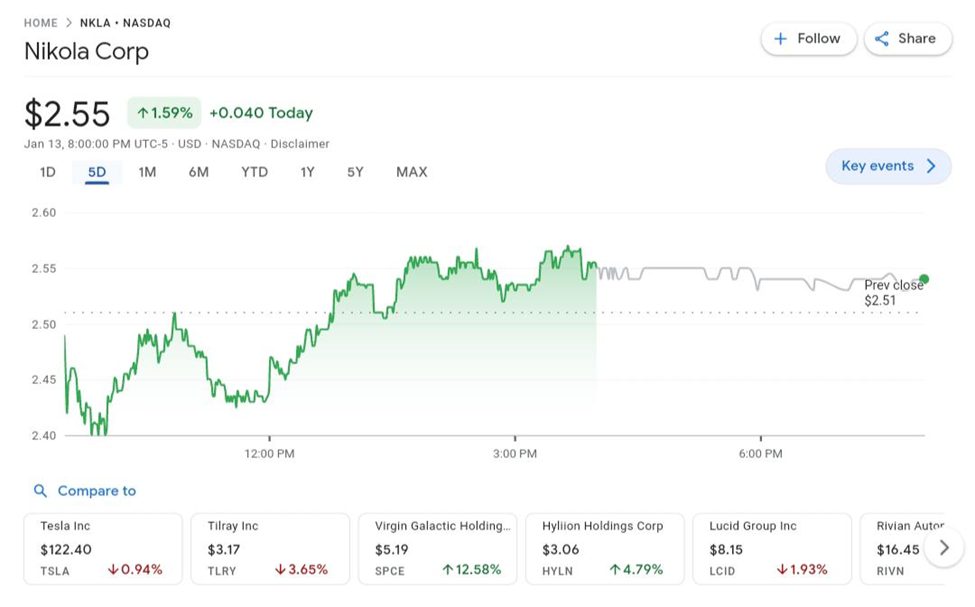

Nikola Stock (NASDAQ: NKLA)

Fact 1: NKLA increased by a +19.72% in the past five days. The stock started trading at 2.13 at the beginning of the week and closed at 2.55.

Price performance from 09/01/2023 to 13/01/2023 is +0.42 (+19.72%).

Period Low: 2.19 +16.44% on 01/10/23

Period High: 2.57 -0.78% on 01/13/23

Period Open: 2.13

Period close: 2.55

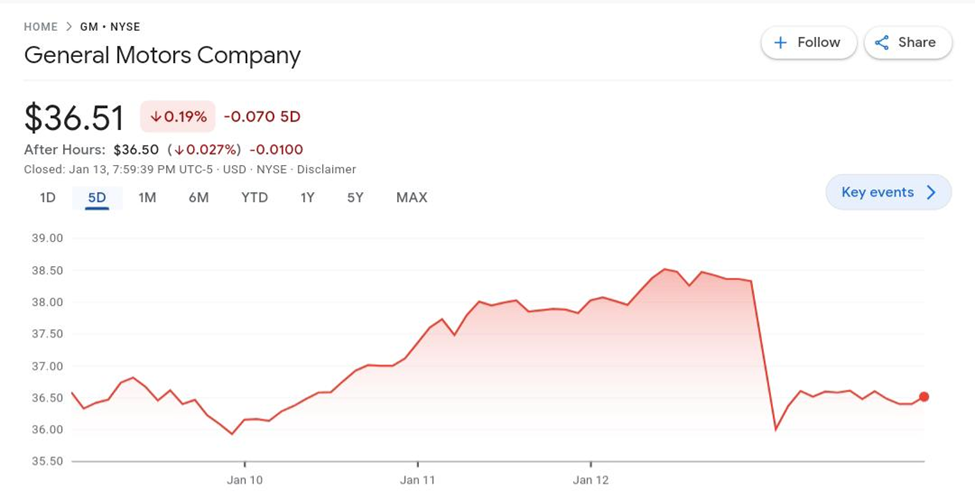

General Motors GM (NYSE: GM)

Fact 1: GM increased by +1.67% in the past five days. The stock started trading at 35.91 at the beginning of the week and closed at 36.51.

Price performance from 09/01/2023 to 13/01/2023 is +0.6 (+1.67%).

Recorded high 38.61 -5.44% on 01/12/23, recorded low 35.81 -1.97% on 01/13/23

Period Open: 35.91

Period Close: 36.51

Fact 2: GM Stock Value increased by 2% from January 9 to January 13, 2023.

In the past five days, the GM Stock was bullish compared to the previous week’s closing price. The stock closed at $36.51 per share, showing an increase of $0.60 per share, or 1.67%; the previous week closed at $35.91.

General Motors has been on a continued streak of success after the recent announcement of recorded sales.

GM recorded sales of over 2.2 million vehicles in 2022 only in the United States. They surpassed Toyota Motors’ 2022 sales, which recorded a sales of 448,854 EV vehicles.

The main factor propelling this stock’s performance is the announcement that GM will join Ford, Google, and others through the Virtual Power Plant Partnership (VP3) to create virtual power plants.

A recent report stated that GM ventures would find FocalPoint to create next-gen GPS.

Also, GM has talked about the future arrival of the 2025 Corvette E-Ray, while their other car products, Cadillac and Andretti Global, are teaming up for a run in the F1 World Championship.

Read Also: Unlock the World of Investing for Kids: The Power of Stocks for Kids!, AMD Stock Increased Today +7.10%. Check Here What we Know, NVIDIA Stock Climbed Today +5.18% at 156.28USD, How a 47% YOY Q4 Production Rise Gave Tesla Stock an 8.8% Boost, Uncovering the Potential of DOMA Stock: Analyzing the Price of Doma Holdings Inc., INDEXDJX: .DJI Is Surging (+0.43%) Ahead of Earnings Season, During the Last Year GME Stock Have Dropped -50.05%. It’s time to Sell? , Discover How to Easily Track the DJIA on Yahoo Finance – An Overview of the Dow Jones Industrial Average!, Stock Price of Li Auto Inc (LI) Rose 8.4% Since Announced Their Vehicle Increase of 50.7% YoY., The TSLA Stock Rollercoaster: Will it Continue To Surge or Take a Dive?, Microsoft Stock Down -27.73% last year, now is looking to invest up to $10 billion in AI, Tesla Stock Increased Today +5.93%, Investing Wisely: How to Buy Bitcoin Stock?, Exploring the Potential of Nasdaq QLGN: A Look at Qualigen Therapeutics Inc Stock, Investing in Penny Stocks on Robinhood: A Comprehensive Guide, An Introduction to Contracts for Difference (CFDs): What Every Investor Needs to Know, The Warning Signs: Why Fintech Startups are Serious Trouble!, A Beginner’s Guide to MACD Indicator: What It Is and How To Use It, Understanding the Risks of Pumps and Dumps: What Investors Need to Know.

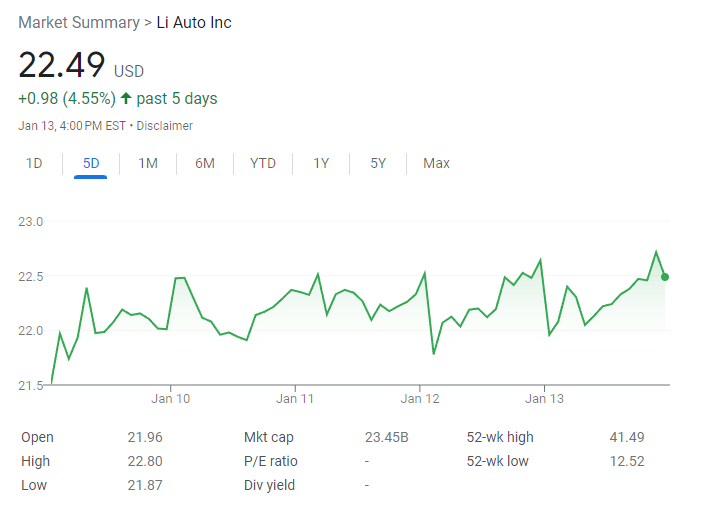

LI Auto Stock (NASDAQ: LI)

LI Auto Stock – Facts:

Fact 1: Li Auto Inc. Shareholder Investigation: On December 9, 2022, Li Auto announced third-quarter operating results. Revenue missed analyst estimates by 2.5%. Earnings per share also missed analyst estimates by 40%. Gross margin was 12.7% in the third quarter of 2022, compared with 23.3% in the third quarter of 2021. Source: https://www.globenewswire.com/news-release/2023/01/07/2584705/0/en/Li-Auto-Inc-Shareholder-Investigation-Submit-Your-Losses-to-Johnson-Fistel.html

Fact 2: LI Auto Stock: 22.49 USD +0.98 (4.55%) past 5 days

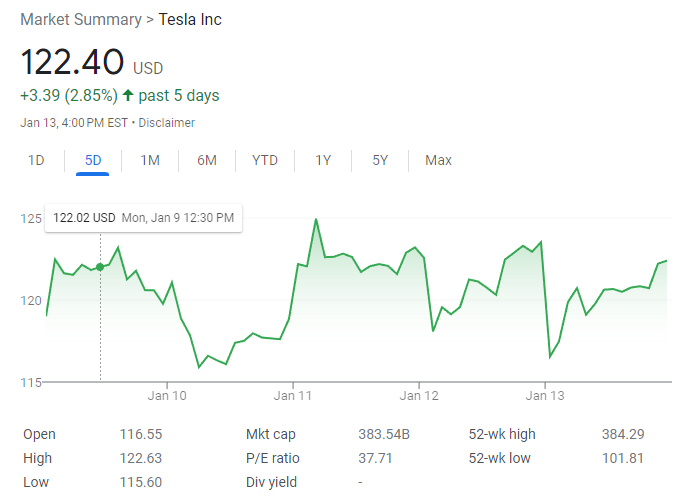

Tesla Stock (NASDAQ: TSLA)

Fact 1: Tesla cuts prices globally by up to 20%. Source: https://www.reuters.com/business/autos-transportation/tesla-cuts-prices-electric-vehicles-us-market-2023-01-13/

Fact 2: Elon Musk is not a popular man in the San Francisco Bay Area. Source: https://www.reuters.com/legal/government/prospective-jurors-dont-like-elon-musk-just-ask-his-own-lawyers-2023-01-13/

Fact 3: Tesla Stock : 122.40 USD +3.39 (2.85%) past 5 days