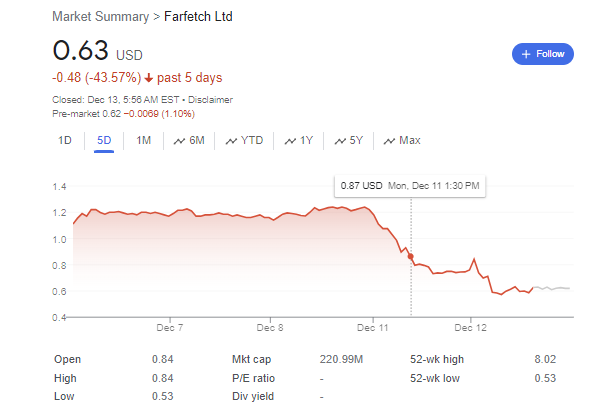

Luxury e-commerce darling Farfetch has hit a major speed bump, with Farfetch stock nosediving 44% in just five days. This freefall follows a brutal blow from Moody’s, which downgraded the company’s credit rating deep into “junk” territory after Richemont, the owner of Cartier, declined to inject more cash.

This dramatic turn of events throws Farfetch’s once-promising trajectory into sharp doubt. What went wrong? Was Richemont’s decision the final nail in the coffin, or are there deeper cracks in Farfetch’s foundation? Buckle up as we delve into the drama, dissecting the reasons behind the stock’s nosedive, the Moody’s downgrade, and what it all means for the future of this luxury e-commerce giant.

Get ready for a story of dwindling liquidity, brand resistance, and a potential debt restructuring that could reshape the landscape of online luxury. Hold onto your hats, folks, because Farfetch’s wild ride is just getting started.

Farfetch has been quite turbulent in the past few weeks

Here’s a breakdown of the recent developments:

Richemont’s pullback:

- Richemont’s decision not to provide further financial support was a major blow to Farfetch. It raised concerns about the company’s financial stability and future prospects, leading investors to sell their shares.

- This resulted in the 44% stock price plunge you mentioned.

Moody’s downgrade:

- Adding to the worries, Moody’s downgraded Farfetch’s credit rating to Caa2, deeper into “junk” territory, on December 12th. This signifies a heightened risk of default on the company’s debt.

- This downgrade further eroded investors’ confidence, potentially making it harder for Farfetch to secure future funding.

Possible implications:

- The combined effect of these events could lead to several challenges for Farfetch:

- Difficulty in securing funding: Lower credit ratings and investor skepticism may make it harder for the company to raise capital for growth or debt repayment.

- Increased borrowing costs: Even if Farfetch manages to secure funding, it will likely come at higher interest rates due to the perceived higher risk.

- Strategic shift: The company might need to re-evaluate its strategy, focusing on cost-cutting, operational efficiency, or exploring alternative revenue streams.

- Impact on the broader market: The struggles of Farfetch could create uncertainty in the online luxury market, potentially impacting other players in the sector.

What to watch out for:

- Farfetch’s response to these challenges will be crucial. Can they implement cost-cutting measures, find new revenue streams, or attract alternative investors?

- The company’s financial performance in the coming quarters will be closely scrutinized by analysts and investors.

- Richemont’s stance will also be interesting to watch. Will they completely abandon Farfetch, or could there be potential for future collaboration or even an acquisition?

It’s important to note that this is a rapidly evolving situation, and the future of Farfetch remains uncertain. However, by keeping track of these key developments and potential implications, we can gain a better understanding of the challenges and opportunities facing the online luxury retailer.

Richemont won’t be providing any further financial assistance to online luxury retailer Farfetch

Richemont, the Swiss luxury conglomerate that owns Cartier, has confirmed they won’t be providing any further financial assistance to online luxury retailer Farfetch. This announcement came in late November 2023 following reports that Farfetch was considering going private.

Here’s a quick breakdown of the situation:

- Richemont invested in Farfetch in 2018, seeing it as a key player in the growing online luxury market.

- Farfetch stock price has significantly declined since then, raising concerns about its financial stability.

- Reports emerged that Farfetch might be considering going private, potentially to avoid the pressures of the public market.

- Richemont has stated that they “definitely have no intention” of putting more money into Farfetch, essentially leaving the company to navigate its own future.

This decision could have several implications:

- Farfetch may struggle to secure funding, potentially hindering its growth and expansion plans.

- The company might need to re-evaluate its strategy, possibly focusing on cost-cutting or finding alternative revenue streams.

- The broader online luxury market could be impacted, with investors potentially becoming more cautious about the sector.

It’s still too early to say definitively what the long-term consequences will be for Farfetch or the luxury market. However, Richemont’s decision not to inject more cash is a significant development worth keeping an eye on.

Farfetch Stock Dip 44% in past 5 days

Farfetch Stock Dip 44% in past 5 days, after Richemont announced that won’t inject more cash in company.

And, we can also find other factors for this drop:

1. Delayed Third-Quarter Results: The primary trigger was the company’s indefinite postponement of its third-quarter earnings report, initially scheduled for that week. This lack of transparency immediately spooked investors, raising concerns about the company’s financial health.

2. Cash Flow Concerns: Reports surfaced that Farfetch was struggling with cash flow and desperately seeking new investors. This further eroded investor confidence, fearing potential insolvency issues if funding wasn’t secured.

3. Lawsuit Against CEO: Adding fuel to the fire, Fashion of Law reported a shareholder lawsuit against Farfetch CEO José Neves, alleging “materially false and misleading statements” about the company’s business and future prospects. This legal action further damaged investor trust and contributed to the sell-off.

4. Overall Market Sentiment: The broader market was also experiencing some volatility at the time, with concerns about inflation and potential recessionary risks. This likely amplified the negative impact on Farfetch stock price.

Moody’s downgraded Farfetch’s credit rating to Caa2 on December 12, 2023, placing it deeper in “junk” territory.

This move comes amid growing concerns about the luxury e-commerce platform’s financial position, including:

- Dwindling liquidity: The company’s cash reserves are shrinking, raising concerns about its ability to meet its financial obligations.

- Potential debt restructuring: Moody’s indicated that Farfetch could face a debt restructuring if its liquidity issues worsen.

- Brand resistance to discounts: Some luxury brands are hesitant to offer significant discounts on their products through Farfetch, limiting its appeal to customers and impacting its profitability.

The downgrade could have several implications for Farfetch:

- Increased borrowing costs: The lower credit rating will make it more expensive for Farfetch to borrow money, potentially hindering its ability to invest in growth initiatives.

- Reduced investor confidence: The downgrade may further erode investor confidence in the company, making it harder to raise capital.

- Potential asset sales: Farfetch may be forced to sell assets, such as its brand incubator New Guards Group, to raise cash.

It’s important to note that the situation is still evolving, and Farfetch is exploring options to address its financial challenges. However, the Moody’s downgrade is a significant signal of concern about the company’s future.

Here are some resources for further information:

- Moody’s announcement: https://ratings.moodys.io/

Read also: